Content navigation

A strategically significant growth industry meets a country characterised by high quality companies, and an entrepreneurial, educated and large workforce. A recipe for success? We think so.

- IT services has been a core driver of emerging markets (EM) technology performance historically and is a significant opportunity for the future

- Services and solutions required to support increasingly complex IT infrastructure will help drive future growth in the industry

- Artificial intelligence (AI) can further support innovation and growth in IT services

- EM, especially India can fill the labour shortfall for highly-skilled, English-speaking talent in IT services globally

IT services has a strong history of delivering

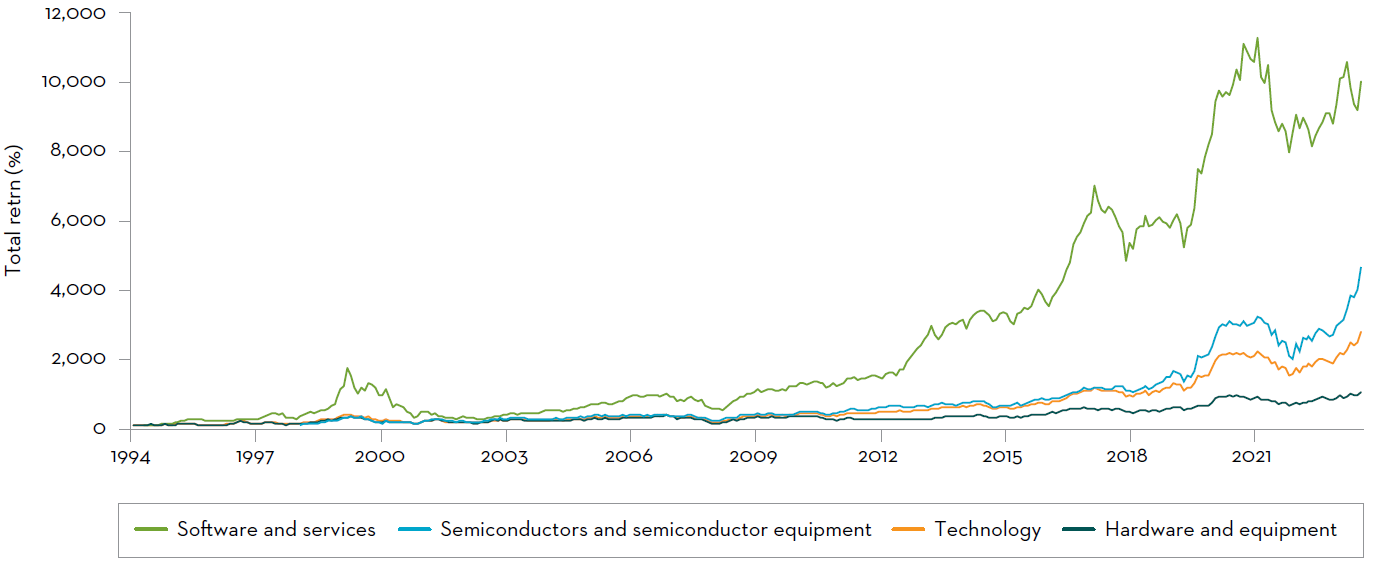

Over the past 30 years, the IT services sector has consistently outperformed the broader sector, thanks to advancements in technology hardware that often result in the need for investment in software and IT services solutions. Additionally, the Indian IT services sector has benefited from the maintenance and development of older IT systems globally.

MSCI Emerging Markets long-term technology sector and industry group performance

Source: FactSet, as at 30 June 2024. Sector and Technology Hardware and Equipment inception 31 December 1994, Software and Services inception 31 March 1995, Semiconductor and Semiconductor Equipment inception 31 December 1998.

-

Even without the added boost from the adoption of AI, IT services present a significant opportunity

A perpetual growth opportunity

With each technology cycle (e.g., PC > internet > cloud), enterprises have become more, not less reliant on IT Services companies because it is not possible for companies nowadays to maintain the requisite expertise in house. Speaking to the IT services companies, they are busy building and developing potential solutions with their clients. IT services firms will also design, develop, and implement AI-driven solutions and workflows for enterprises.

Digital-focused IT service firms are best positioned for growth and success given they operate at the leading edge of technological change, although we should continue to look for new companies that may do so well. It is interesting that some companies not only have a strong record of execution and innovation but have also been investing in AI-driven intellectual property well before the AI hype began.

Even without the added boost from the adoption of AI, IT services present a significant opportunity. The existence of dated IT systems requiring ongoing upgrades, or services and solutions following technology change (such as the move to a cloud infrastructure) are important and ever-present drivers of growth in IT services.

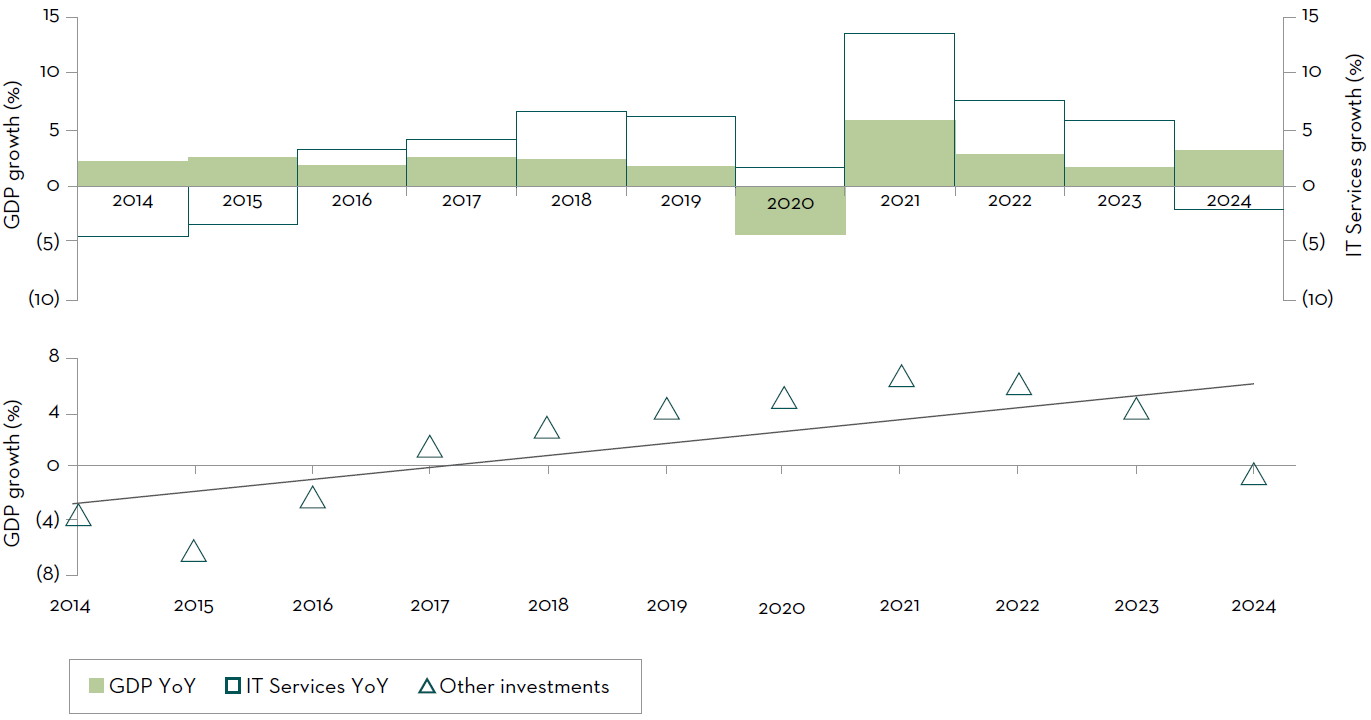

IT services spending is correlated with Gross Domestic Product (GDP) growth, with increases in GDP leading to higher budgets for spending. This does not mean, however, that spending stops when GDP growth is weak. In this type of environment, typically any cost savings made in other areas of a business would be reinvested into IT systems given companies’ dependence on reliable and secure technology.

Global GDP growth relative to IT Services spending 2014-24e

Source: Gartner, Goldman Sachs Global Investment Research as at 24 June 2024. Americas Technology: IT Services.

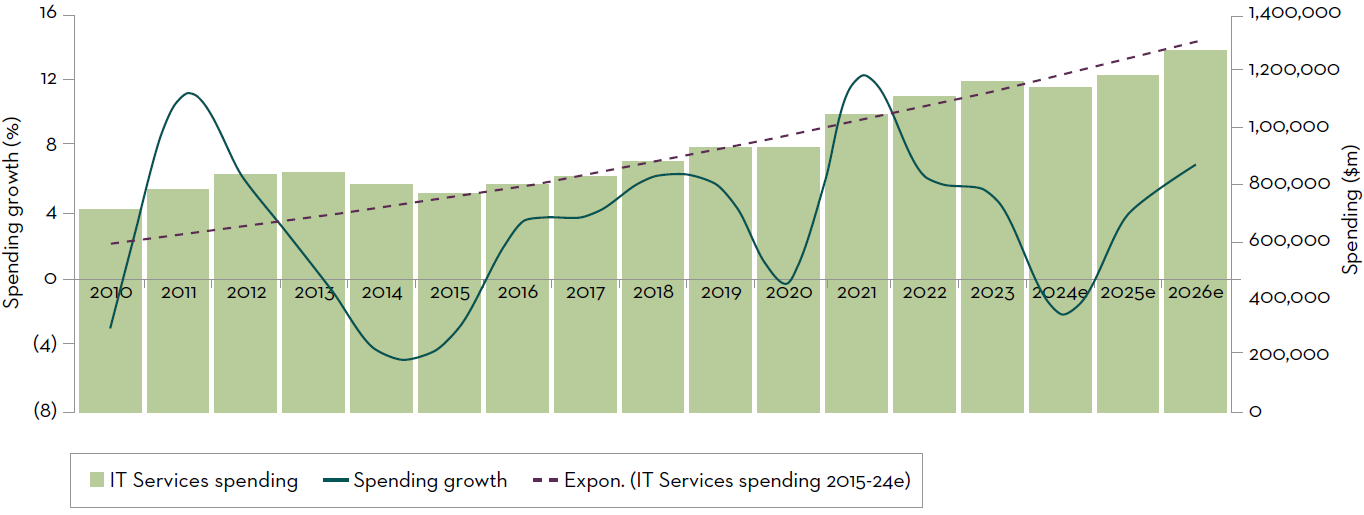

Similarly, spending in IT services has consistently grown in the past 10-15 years and set to continue on an upward trajectory. The need for increased servicing and more complex and tailored solutions for clients’ needs should be supportive of industry growth.

Forecast of IT Services growth (2025-26)

Source: Gartner, Goldman Sachs Global Investment Research as at 24 June 2024. Americas Technology: IT Services.

Artificial intelligence

The first stage beneficiary of AI has been the semiconductor industry, where EM companies such as TSMC and SK Hynix are significant suppliers. As AI use cases become better developed and companies see increasing opportunities to implement AI solutions, we expect the next beneficiaries to be IT infrastructure names. But we also see huge potential for IT services, who will be enabling and implementing AI solutions, to benefit over the long-term.

The positive impact on people in IT services is twofold. Within software services, the minority of developer time is actually spent coding. AI has the potential to reduce both the non-coding time by improving efficiencies, as well as improve productivity in coding, such that the remainder of time can be devoted to understanding rapidly evolving client needs and discussing unique solutions. In addition, as companies start implementing AI, their spending on the solutions and services to maintain it will increase. This should boost growth in the services industry.

Artificial intelligence

The first stage beneficiary of AI has been the semiconductor industry, where EM companies are significant suppliers. As AI use cases become better developed and companies see increasing opportunities to implement AI solutions, we expect the next beneficiaries to be IT infrastructure names. But we also see huge potential for IT services, who will be enabling and implementing AI solutions, to benefit over the long-term.

The positive impact on people in IT services is twofold. Within software services, the minority of developer time is actually spent coding. AI has the potential to reduce both the non-coding time by improving efficiencies, as well as improve productivity in coding, such that the remainder of time can be devoted to understanding rapidly evolving client needs and discussing unique solutions. In addition, as companies start implementing AI, their spending on the solutions and services to maintain it will increase. This should boost growth in the services industry.

EM software engineers can close the labour shortfall

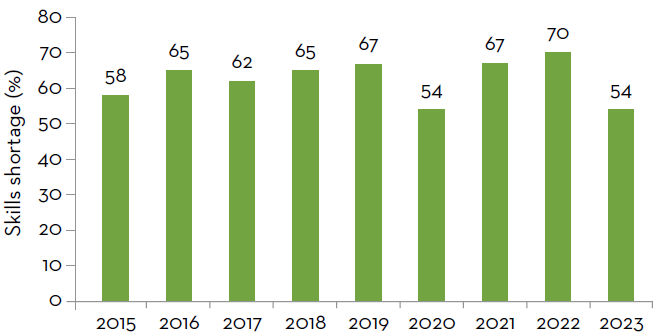

A lack of software engineers in developed markets is a catalyst for IT outsourcing. Technology talent is cheaper in developing markets but more importantly, countries like India not only have engineering talent at low relative cost but they also have an existing, vast IT services ecosystem.

There is a clear shortfall in the demand for developers and the supply. This impacts companies’ abilities to adapt and change in an increasingly complex technological landscape. Crucially, a key opportunity is driven by the US, where the forecast shortfall increases from 63% in 2024 to 73% in 20301.

Technology organisations experiencing skills shortage worldwide 2017-2023

Source: Statista, Nash Squared and Cionet as at November 2023

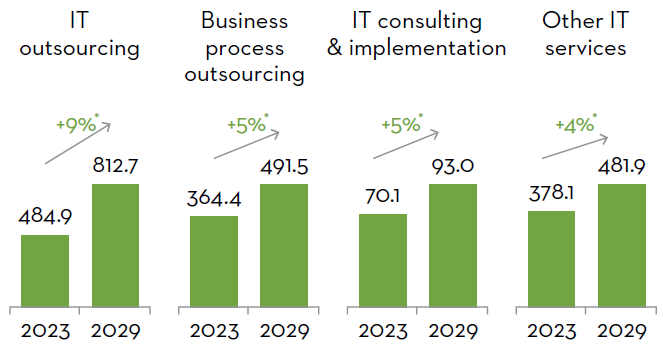

Forecast growth in IT services sub-industries 2023-2029

Source: Statista Market Insights as at August 2024, p.10. *Compound annual growth rate.

This employment shortfall can be addressed through outsourcing. Indeed, this is the area of IT services which is forecast to see the highest growth in the current decade.

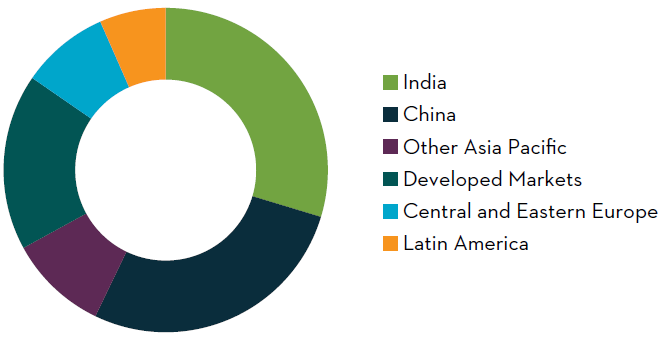

EM countries have some of the highest graduation rates for students studying science, technology, engineering and mathematics (STEM) subjects. This has created a highly skilled and well-populated workforce which can address the shortfall in developers through outsourcing. Importantly, India’s established IT services ecosystem is a key area of potential growth for these reasons but also because of language accessibility – the demand for English-speaking talent is high in a global context and India has this.

Software engineer graduates by region

Source: OCED data and courtesy J.P. Morgan Chase & Co., Copyright as at 6 June 2024. IT & BPO Services. p33.

India’s role in the industry’s future success

The IT services industry in India has played a significant role in enhancing the country's global competitiveness, innovation, and reputation, as well as creating employment opportunities, social benefits, and digital inclusion for millions of Indians. But India has progressed beyond being simply a provider of low-cost labour and basic outsourced IT functions; the industry has diversified its service offerings, from basic software development and maintenance to complex and high-value services such as cloud computing, AI, data analytics, digital transformation, and cybersecurity. IT services firms will be crucial in delivering AI solutions for their clients, in addition to the ongoing public cloud migration by corporations.

In the past five years, India has witnessed a growing trend of foreign IT companies establishing their operations in the country, attracted by its large talent pool, low-cost advantage, favourable business environment, and strategic location. These not only provide IT services and solutions to their global clients, but also engage in research and development, innovation, and digital transformation initiatives, contributing to the growth and diversification of the Indian IT industry.

Our recent visit to IT companies in India revealed the opportunity for further growth and diversification in the Indian market, due to the increased demand for digital solutions and services amid and following the pandemic. We visited two portfolio companies in their Indian offices. Both companies are capitalising on this opportunity by setting up and expanding their operations in India, using the country's talent, cost, and location advantages

These are examples of how foreign IT companies are tapping into the potential of the Indian market, while also contributing to its growth and development. By establishing their operations in India, they are providing employment and skill development opportunities to the local talent and enhancing the competitiveness and innovation of the Indian IT industry. They are also creating positive social and environmental impacts in the country, through their initiatives and practices. As India emerges as a global leader in the digital economy4 , foreign IT companies such as Globant and EPAM will play a vital role in shaping and transforming its future.

India’s role in the industry’s future success

The IT services industry in India has played a significant role in enhancing the country's global competitiveness, innovation, and reputation, as well as creating employment opportunities, social benefits, and digital inclusion for millions of Indians. But India has progressed beyond being simply a provider of low-cost labour and basic outsourced IT functions; the industry has diversified its service offerings, from basic software development and maintenance to complex and high-value services such as cloud computing, AI, data analytics, digital transformation, and cybersecurity. IT services firms will be crucial in delivering AI solutions for their clients, in addition to the ongoing public cloud migration by corporations.

In the past five years, India has witnessed a growing trend of foreign IT companies establishing their operations in the country, attracted by its large talent pool, low-cost advantage, favourable business environment, and strategic location. These not only provide IT services and solutions to their global clients, but also engage in research and development, innovation, and digital transformation initiatives, contributing to the growth and diversification of the Indian IT industry.

Our recent visit to IT companies in India revealed the opportunity for further growth and diversification in the Indian market, due to the increased demand for digital solutions and services amid and following the pandemic. We visited two portfolio companies in their Indian offices. Both companies are capitalising on this opportunity by setting up and expanding their operations in India, using the country's talent, cost, and location advantages.

Globant

Globant, a South American IT company, has been operating in India since 2016 and has over 2,500 employees across four cities. Globant's Indian operations deliver innovative solutions in areas such as AI, cloud, cybersecurity, gaming, and e-commerce, for clients in various sectors. Globant is also developing its own products, such as StarMeUp and Augmented Coding.

Globant has a strong culture of diversity, inclusion, and sustainability, which reflects its global values and vision. Globant hosted an International Women's Day event in March 2021, where company representatives interacted with female entrepreneurs and leaders from different fields. Globant also has a fun and creative work environment, where employees can enjoy facilities such as a bowling alley, a drum kit, and a truck meeting room. Globant aims to foster collaboration, innovation, and engagement among its employees, while also ensuring their wellbeing and happiness.

An important signpost for the recovery of IT services as part of the IT business cycle is software engineer headcount additions – Globant has guided in 2024 for increases here in anticipation of a stronger end-market.

EPAM

EPAM, an Eastern European IT company, has been operating in India since 2015 and has over 8,000 employees across six cities. The company is actively investing in India’s talent market as an area for future growth and it is on track to become their largest delivery location by the end of 2024.2 EPAM's Indian operations deliver highquality and scalable solutions in areas such as cloud, data, digital platform, and enterprise application, for clients in various sectors.

EPAM is also developing its own products and platforms, such as TelescopeAI and EPAM Cloud Orchestrator. EPAM has a culture of excellence, agility, and innovation, which reflects its global standards and reputation. EPAM has been recognised as one of the best companies to work for in India by the Great Place to Work Institute3, and one of the fastest-growing IT services companies in the world by Forbes4.

EPAM also has a strong focus on learning and development, offering its employees training, certification, and mentorship opportunities. EPAM also has a social responsibility agenda, supporting initiatives such as STEM5 education, diversity and inclusion, and environmental sustainability.

A recipe for success?

We think that emerging market companies will play a crucial role in the AI-driven technology cycle and that this will drive growth in all parts of the industry including semiconductors, infrastructure and IT services. The impact of increasing AI demand has already been felt in semiconductors and is beginning to bear fruit in infrastructure companies. We believe that the largest unrealised opportunity lies within IT services as companies will have greater need and dependency on more complex and tailored solutions to service their new AI-enabled infrastructure. India’s resources of talent, cost benefit and location will help it continue to play a crucial role in the success of the services industry. We are very excited for this opportunity to be realised, across not only domestic best-of-breed Indian companies but also the many foreign companies with growing Indian operations.

A recipe for success?

We think that emerging market companies will play a crucial role in the AI-driven technology cycle and that this will drive growth in all parts of the industry including semiconductors, infrastructure and IT services. The impact of increasing AI demand has already been felt in semiconductors and is beginning to bear fruit in infrastructure companies. We believe that the largest unrealised opportunity lies within IT services as companies will have greater need and dependency on more complex and tailored solutions to service their new AI-enabled infrastructure. India’s resources of talent, cost benefit and location will help it continue to play a crucial role in the success of the services industry. We are very excited for this opportunity to be realised, across not only domestic best-of-breed Indian companies but also the many foreign companies with growing Indian operations.

Sources

1Source: Courtesy J.P. Morgan Chase & Co., Copyright as at 6 June 2024. IT & BPO Services. p32.

2Source: Arkadiy Dobkin, CEO, EPAM. EPAM results call as at 8 August 2024.

3Source: EPAM as at 11 January 2023. https://www.epam.com/about/newsroom/press-releases/2023/epam-recognized-as-a-best-place-to-work-across-the-world

4Source: Great Place To Work as at 2022. Certified December 2021 – December 2022. https://www.greatplacetowork.in/great/company/epam-systems-india-pvt-ltd#:~:text=Place%20 To%20Work-,EPAM%20Systems%20India%20Pvt%20Ltd%20is%20a%20Great%20Place%20to,and%20recognizing%20Great%20Workplace%20Cultures

5Source: EPAM as at 11 November 2020. https://www.epam.com/about/newsroom/press-releases/2020/epam-makes-fortunes-100-fastest-growing-companies-list#:~:text=As%20a%20 recognized%20market%20leader,company%20on%20Fortune's%20100%20Fastest%2D

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be

issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee

of future results or investment advice. There can be no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document.

Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future

performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style. Holdings are subject to change.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

All investments involve risk including the potential for loss.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.