Content navigation

Key takeaways

- Fourth quarter of 2024 saw negative returns in emerging markets (EM)

- Donald Trump elected as next US president resulting in dovish guidance from the Federal Reserve

- US dollar appreciated, impacting many EM countries

Market overview

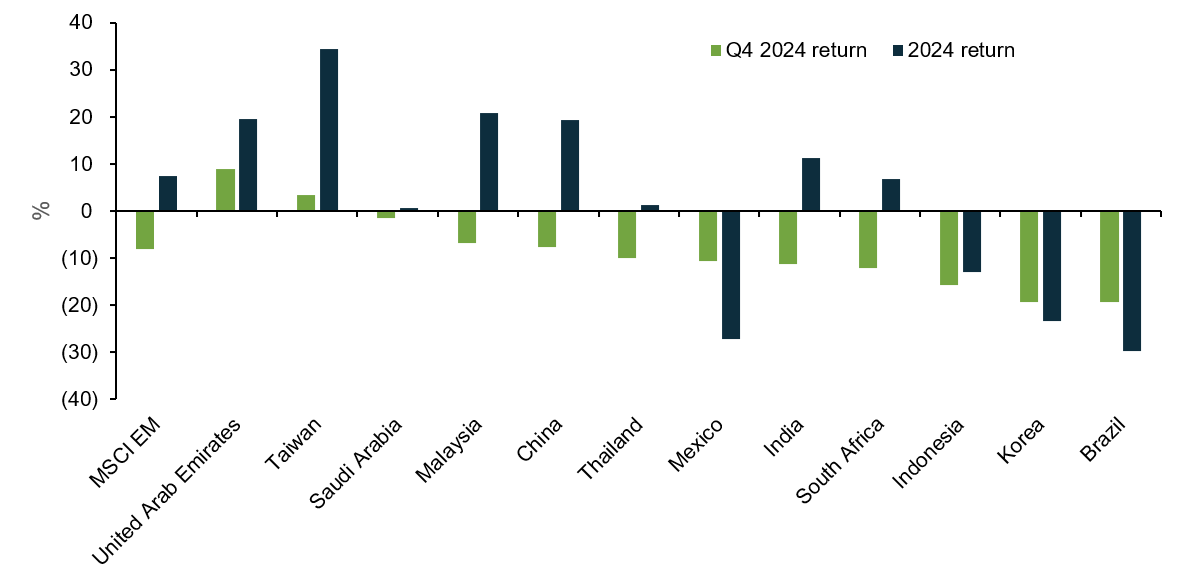

EM performance in the fourth quarter saw challenges, giving back much of the positive performance which had been achieved year-to-date. The asset class was impacted following a series of geopolitical events, starting with the election of Donald Trump as US President in November and followed by incremental uncertainty in the Korean markets with the impeachment of the incumbent President and then the acting President just days later.

EM negatively impacted by foreign currency as well, where a strong appreciation of the US dollar followed the Federal Reserve’s policy pivot in December. Fears of the impact of proposed trade tariffs on US imports from countries such as China cooled the positive momentum which was evident in this market year-to-date.

Korea was the weakest market in the asset class in the quarter. We also saw pronounced weakness in Brazil. This was followed by double digit declines in more interest-rate sensitive markets such as Indonesia, South Africa, and Mexico.

MSCI EM core country performance Q4 2024

Source: FactSet, as at 31 December 2024. Data in US$. Countries with an index weight over 1% shown.

Top ten holdings by active weight

| Stock | Country | Sector | Active(%) |

|---|---|---|---|

| Tencent | China | Communication Services | 3.6 |

| TSMC | Taiwan | Information Technology | 3.4 |

| Samsung Electronics | Korea | Information Technology | 3.1 |

| HDFC Bank | India | Financials | 3.0 |

| ICICI Bank | India | Financials | 2.7 |

| SK Hynix | Korea | Information Technology | 2.4 |

| Titan | India | Consumer Discretionary | 2.2 |

| Globant | United States | Information Technology | 2.0 |

| China Merchants Bank | China | Financials | 2.0 |

| WEG | Brazil | Industrials | 1.7 |

Source: Martin Currie as of 31 December 2024. Data shown is for the Martin Currie Global Emerging Markets representative account. Holdings are subject to change.

Portfolio discussion

Industrials and Information Technology (IT) were the most additive sectors, driven by a combination of stock selection and asset allocation. Continued strength in IT names despite a slowdown in Q3 was evident, supporting several of our holdings which were among the top contributors to performance in this period. Energy and Financials were the most detractive sectors. The former was largely driven by stock-specific factors: Cosan was impacted by weakness in the Brazilian markets and sentiment was also weaker following higher interest rates due to its financial asset structure. The company is restructuring its assets to improve capital efficiency and decrease leverage.

Financials companies had mixed performance, with some contributing strongly and some detracting. The most detractive were Shinhan Financial Group, which was negatively impacted because of its high foreign ownership and the perceived risk to the ‘Value Up’ programme that was part of the outgoing Korean President’s agenda, and AIA Group, which is part way through its approved buyback programme which may have impacted short-term performance of the stock.

Reflections on 2024

For most of the year, EM was among the best performing asset classes - driven positively by IT stocks and China, which rallied following coordinated stimulus announcements. However, in the fourth quarter, EM faced headwinds coinciding with the election of Donald Trump and subsequent market reactions. This was compounded by political uncertainty in Korea.

The dispersion of returns across countries within the MSCI Emerging Markets Index was wide with approximately 60% difference between the top performing market (Taiwan, up 34%) and the worst performing market (Brazil, down 30%).

From a sector perspective, we generated positive attribution in relative performance in Consumer discretionary stocks and Industrials. This was primarily a result of strength coming out of names related to the stimulus package announced by the Chinese government in September. On the downside, while several IT stocks contributed to performance (most notably TSMC), overall the sector detracted with particular impact from Samsung Electronics. The company had delays in getting certified as a high bandwidth memory supplier to Nvidia. Since then, we have gotten additional colour that approval is imminent, and the company has entered into a sizable 10 billion KRW buyback - the first since the 2015 - 2017 period.

We continue to be positive on our stocks and believe we are positioned well for an all-weather EM environment.

Portfolio activity

We added two companies to our clients’ portfolios in the fourth quarter:

MakeMyTrip: Travel consumption is relatively nascent in India and MakeMyTrip have established themselves as the leading online travel platform. Rising disposable incomes and easing supply bottlenecks will help the company to scale and benefit from significant operating leverage over the next decade and beyond.

BYD: BYD has risen to a position of leadership in the Chinese car market by unlocking mass market demand for electric cars. Although it faces fierce competition, it should see continued volume growth as scale efficiency, regulation, and consumer preference favour manufacturers of battery and hybrid-power cars. It has an attractive entry-level valuation for a company with such strong potential to grow in China and beyond.

We exited two companies:

Asian Paints: The company faces a period of lower growth compared to history and increased uncertainty on margins as they fend off the entry of Grasim into the industry. Whilst the strong market positioning, strength of brand and long-term growth potential of the industry remain positive, the near-term softness and uncertainty coupled with the high valuation are an opportunity cost especially compared to the other higher conviction/higher growth Indian stocks we hold.

Samsung SDI: Our conviction in the outlook for Korean battery manufacturers has waned, most specifically for Samsung SDI due to US market uncertainty, disappointing profitability and an EU market slowdown. While we expect higher growth in 2025, we prefer positioning ourselves in BYD (new purchase, see above).

Outlook

We firmly believe that the long-term investment outlook for EM remains robust, and we maintain strong confidence in our portfolio holdings. The market persistently undervalues high-quality, sustainable growth companies, and we are convinced that, despite the recent, prolonged style rotation, investing in these companies will yield positive results in the long term.

Looking ahead, we are particularly excited by the powerful synergy of technology adoption, urbanisation, and services-sector growth prevalent in EM. We anticipate that our highly selective, stock-focused strategy will thrive by identifying companies with high returns on equity, operating in structurally growing sectors. Furthermore, the current environment - with its regulatory pressures, human conflicts, and ever-evolving macroeconomic landscape - highlights the importance of focusing on strong sustainability and governance characteristics, and sustainable growth as critical factors in determining which companies will remain relevant and lead the way in the long run.

As we progress into 2025, we think the key drivers of EM returns, and thus the biggest opportunities, will be technology, India and China. Technology companies in EM are core to the global adoption of Artificial Intelligence (AI), and the longer-term structural growth opportunity of EM IT is broader across the whole ecosystem. This should place them well to succeed in the next 12 months and beyond. Similarly, India has had an interesting 2024 and we think that as the market returns to recognising fundamentals in share prices, there may be a market correction which benefits high quality, sustainable growth companies. Finally, as the largest country in the asset class, China will continue to play a key role in the shape of EM and we believe its recovery has only just begun.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia: This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.