Content navigation

- Martin Currie's UK mid-cap strategy has delivered strong returns over the past 25 years

- The UK mid-cap market is currently undervalued, providing an exceptional opportunity for investors

- Three areas we see opportunities in the UK are:

construction, consumer focused and global industrial stocks

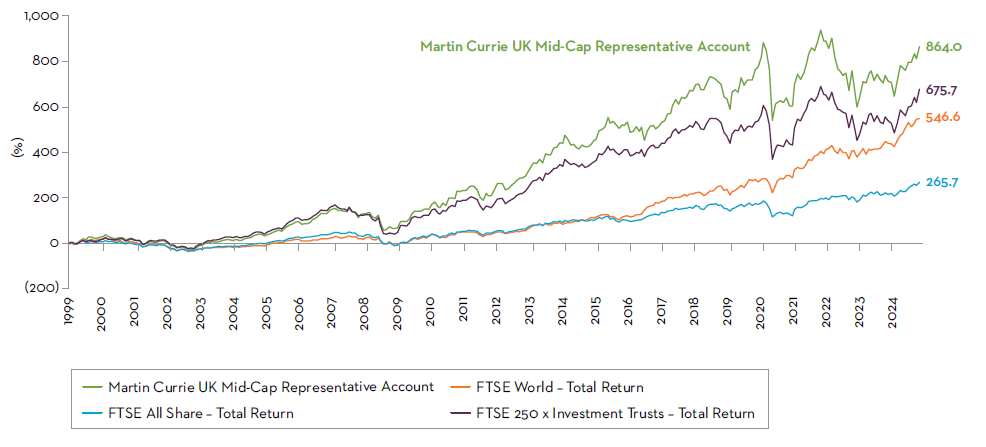

This summer we celebrated the silver anniversary of our UK mid-cap strategy. If you’d invested £1,000 in our strategy at launch, it’d be worth £9,640 today (31 July 2024). Representing an annual return of over 9% for 25 years – not too bad! Even better, it has provided an active return of 24%, ahead of the FTSE 250 ex Investment Trusts, since inception.

Performance: 12 July 1999 to 31 July 2024

Source: Franklin Templeton and Martin Currie as at 31 July 2024.

The UK mid-cap space offers an attractive hunting ground for investors where the companies are large enough to be resilient, yet small enough to be dynamic, adaptive and offer opportunities for growth. This sweet spot in the market offers a diverse array of investment options, especially for active managers looking to add value.

Patient investors have enjoyed a remarkable two and a half decades. But we think things could get even better from here. We may not be able to predict the next 25 years, but we are certainly excited about what’s in store for UK mid-caps in the next 2-5 years!

-

The UK mid-cap space offers an attractive hunting ground for investors where the companies are large enough to be resilient, yet small enough to be dynamic, adaptive and offer opportunities for growth.

Valuations – the elephant in the room

The UK equity market is currently extremely cheap – offering an exceptional opportunity for investors. Low valuations have been a persistent feature of the UK equity market since the outcome of the Brexit vote. However, the tides are turning. The FTSE 250 ex Investment Trusts has returned 18.5% in the 12 months to 31 July 20241.

Positive momentum is building, and the market is slowly beginning to re-rate after almost a decade in the doldrums. The Bank of England has also begun cutting rates, which has historically marked the early stages of a multi-year rally in UK mid-cap stocks.

Private equity firms and corporations with deep pockets have noticed the UK offers quality investments at bargain prices. There were 32 UK transactions of more than £100 million announced in the first half of 20242, which was the second largest, globally, after the US. Of which 14 and c.£36.7 billion of market capitalisation related to FTSE 250 constituents. Ongoing interest in takeover activity will contribute to upward price pressure across the market.

However, upon closer examination, you’ll see the UK equity market offers much more than undervalued stocks. It has an array of companies with excellent fundamentals, about to benefit from strong trends that will help drive returns. Our UK mid-cap portfolio is positioned to benefit from:

Construction and the supply chain – demand pull and Government push

The construction industry has faced a difficult 18-24 months of lower demand and volumes, most recently seen with the collapse of ISG. However, the strongest industry players are well positioned from the recovery on the horizon.

The UK is experiencing easing mortgage costs as interest rates reduce, improving customer confidence, relatively resilient employment levels, and a supportive backdrop for a positive recovery of the construction sector.

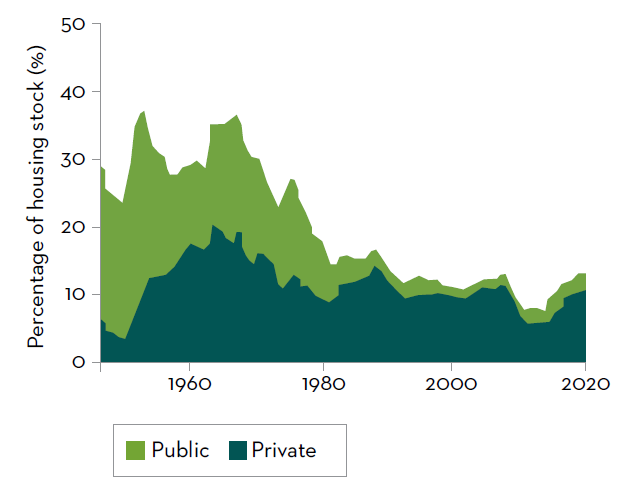

The Labour party have committed to building 1.5 million new homes through an overhaul of the existing system including relaxing planning laws, utilising the “grey belt” and reinstating local housing targets. Their target amounts to 300,000 new homes a year during their parliamentary term, by comparison 176,000 houses were built in 20233.

Gross rates of housebuilding

Source: Centre for Cities and United Nations, Bulletin of Housing and Construction as at February 2023. From 2000 Tenure and housing stock data is from the Office of National Statistics.

Construction company prices had been discounting a recession like environment, and given this didn’t materialise, construction companies have performed well in recent months. While the upside has reduced somewhat, prices have only reverted to historic averages, we continue to see good value in the sector. We are focused on identifying the resilient areas of the supply chain who will be the greatest beneficiaries of a medium term stronger period for the housebuilding sector.

UK housebuilder that is trading at book value as the sector is still at the foothills of recovery.

Manufacturer of sustainable water, climate, and ventilation management solutions for construction. Genuit are helping homes meet the increased environmental requirements of the future.

Distributor of building materials and DIY products, making it a key part of the housebuilder's supply chain.

Logos are property of their respective owners, are used for informational purposes and should not be construed as an endorsement of, or affiliation with, Martin Currie.

-

Upon closer examination, you’ll see the UK equity market offers much more than undervalued stocks.

Consumers’ confidence is growing

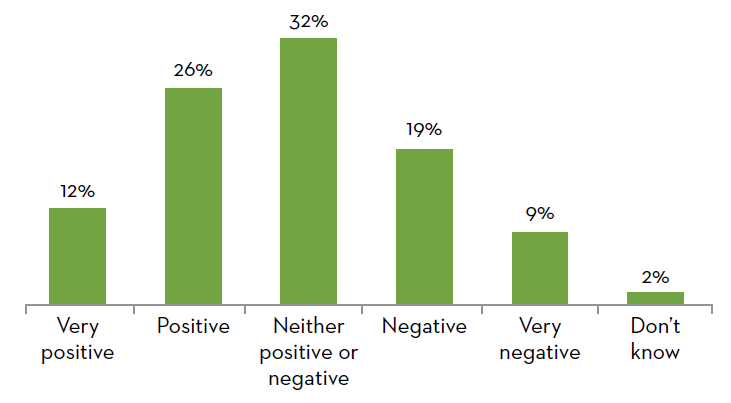

UK consumers are now more likely to rate their economic situation positively than negatively. This is a massive improvement following a period of rampant inflation and a cost-of-living crisis.

Inflation is now within range, real wages are in positive territory and rate cuts have begun; all helping living standards and disposable incomes.

We’re at an inflection point where consumer confidence is ticking up into positive territory, an upwards trend that we anticipate will continue, despite the recent gloomy rhetoric of the incoming government.

UK consumer rating of own economic situation

Source: Statista Consumer Insights Global as at May 2024.

Periods of inflection are the most interesting times to be an investor. It's difficult to predict and trying to time the market can be foolhardy. We focus on when we believe too much pessimism is priced into a stock and look to the long-term value creation the business can achieve. For the last 12-18 months, we’ve seen the steady drip feed of positive economic data, which contrasts so starkly with the negative market sentiment. We are ready and waiting for the resurgence of the UK consumer.

We are focused on identifying the quality run, domestically focused businesses that should benefit from an uptick in disposable incomes. Some examples:

UK food producer specialising in premium, fresh, and added-value meat products. Cranswick are set to benefit from increased volumes as real incomes increase.

Leading UK home furnishings retailer offering bedding, curtains, furniture, and home decor. Dunelm will benefit from an uptick in housing activity.

The high street favourite! Greggs will continue to benefit from the growth of on-the-go convenience items through increased demand for its expanding menu which is being served at all times of the day.

Logos are property of their respective owners, are used for informational purposes and should not be construed as an endorsement of, or affiliation with, Martin Currie.

Opportunities in specialist global industrials

The industrial sector is a broad church, covering areas such as aerospace and defence, engineering and machinery and transport and logistics. Many UK mid-cap industrials hold world-leading positions, and often operate in niche areas of expertise, with differentiated products and services. Yet they are trading at valuations well below their international peers.

Economic growth is on the up. After a shallow recession late in 2023, we’ve seen two quarters of positive economic growth in the UK, beating expectations. Gross Domestic Product (GDP) is currently growing at 0.6%4, and is anticipated to be growing at 1.7% by 20265, which is just behind the US and Canada, and just ahead of France and Germany. Industrials benefit when global activity is on the rise.

Many industrials have faced supply chain problems, due to global trade routes disruption, and an inventory build-up through the Covid years. This was reversed through the subsequent period of de-stocking in a bid to manage the surplus. Supply chain improvements have been needed. Ongoing domestic investment is also becoming more prevalent as companies look to reshore or nearshore to get a tighter grip on their supply chain*. This is another driver of demand.

In response, many well-run industrials have been implementing changes that ensure they can better manage costs and meet demand, all of which is beneficial to their bottom line. Operational improvements, combined with moving to an expansionary stage of the economic cycle, means quality industrials are primed to fare well.

Given the breadth of companies in this sector, the team are focused on identifying companies that will outperform the broader industrials sector through being exposed to sub-sectors that are expected to offer a higher rate of growth.

We outline three examples of such holdings that we are hopeful will deliver outsized returns to the wider sector:

Leading global provider of heat treatment and specialist thermal processing services which help to improve properties and extend the life of key metallic components. Bodycote is an early cycle operationally geared recovery play expected to benefit from the wider economic recovery.

Leading engineering and technology company focused on the defence and security markets principally in the UK, US and Australia. In a world of increasing geopolitical instability, demand for the sophisticated products and services it provides is growing. As a result there is increasing pressure for all NATO countries to meet the 2% GDP target for defence spend and in fact some are now seeking to exceed this with the UK having committed to raise defence spending to 2.5% by 20306.

Global leading manufacturer of industrial flow control equipment. Rotork’s products are used to electrify flow control processes in hydrogen, carbon capture, storage and battery production giving it a key role in the energy transition. The UK has pledged to be net zero by 2050, with interim targets of a 68% reduction in emissions, compared to 1990, by 2030 and 78% by 2035. Similar targets exist around the world.

Logos are property of their respective owners, are used for informational purposes and should not be construed as an endorsement of, or affiliation with, Martin Currie.

25 years past, and many exciting years to go

Investing during times of change is exciting! The UK has moved from experiencing rapid inflation with concerns of stagnation, to an economy in recovery with growth taking off. This backdrop is a big positive for a range of industries and companies but is not yet captured in valuations.

With 25 years of experience in the thriving UK mid-cap equity market, we've learned to recognise critical turning points. We believe in investing in quality companies ahead of these changes and are confident and patient enough to wait for the market to catch up. We couldn’t be more excited about the prospects for UK mid-caps, particularly those in our portfolio, over the next 2-5 years.

As we celebrate our 25-year anniversary, we are thrilled about the investment opportunities ahead in the coming years. However, given the vibrancy of mid-cap companies, we have no doubt the next 25 years look bright too!

Sources

1Source: Franklin Templeton and Martin Currie as at 31 July 2024.

2Source: Peel Hunt as at 2 July 2024.

3Source: Office for National Statistics as at 24 April 2024.

4Source: Office for National Statistics as at July 2024.

5Source: International Monetary Fund and World Economic Outlook database as at April 2024

6Source: GOV.UK as at 23 April 2024.

**Reshore = To move a business or part of a business that was based in a different country back to its original country. Nearshore = Involves shifting your company’s business operation to a nearby country.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.