Content navigation

What are semiconductors and why do they matter?

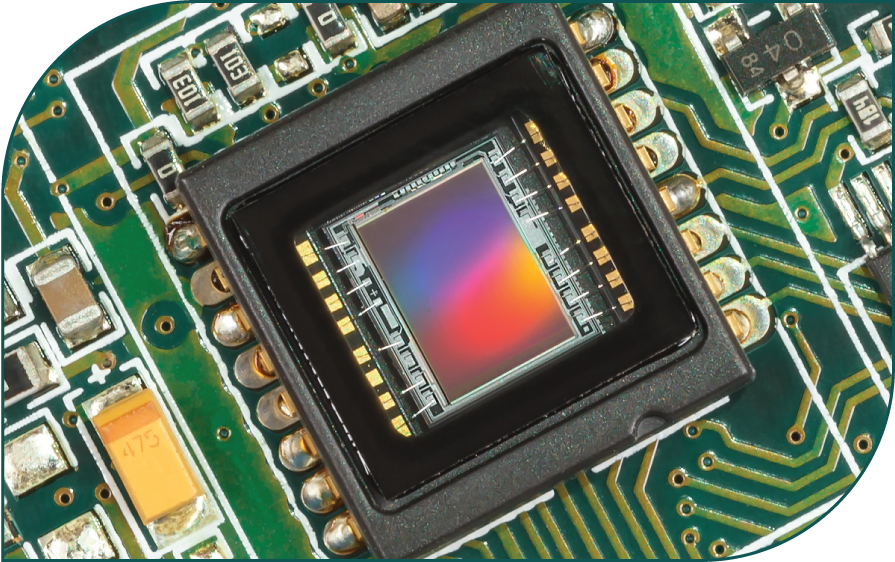

The generic term 'semiconductor' refers to a material which can both conduct electricity (like copper or aluminium) and insulate (like rubber). More commonly when we refer to semiconductors, what we mean is semiconductor devices, or ‘chips’ (microchips).

Chips are created using semiconductor materials, giving the industry its name. They are crucial elements of almost all electronic devices, varying by function and intelligence. The ‘smarter’ the device, the more ‘intelligent’ the chip needs to be, from your mobile phone to your refrigerator or car. As such, semiconductor manufacturers benefit directly from the rise of digitalisation in society provided they invest in their businesses sufficiently to capitalise on that opportunity.

Semiconductors directly enable technological innovation in other industries and will continue to do so as new products are developed, both in emerging markets and the rest of the world. Firms in this industry are hugely concentrated in emerging markets, especially Taiwan and Korea. Companies in these geographies supply customers across the globe with their products for use across many areas such as computing, communications, consumer electronics, automotive and industrial equipment.

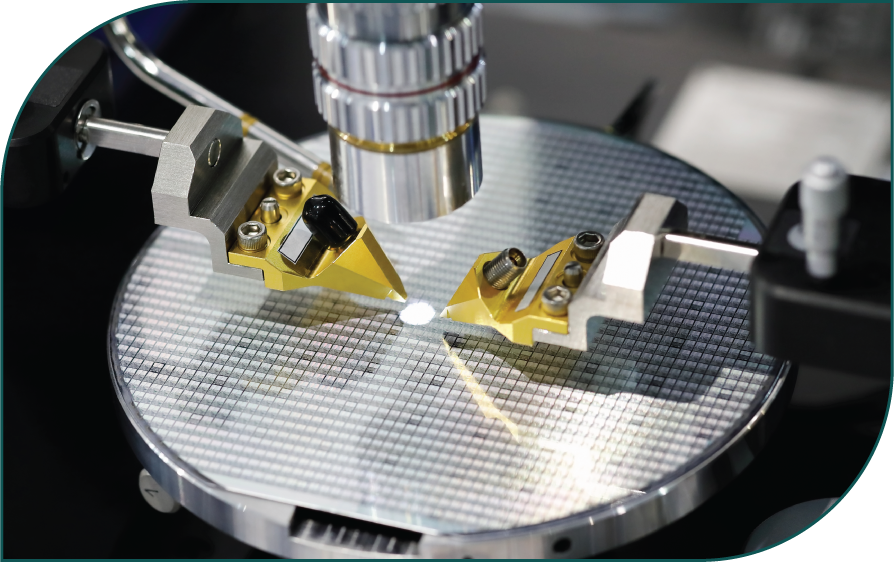

Semiconductor manufacturing process

Semiconductor manufacturing is a critical industry which manufactures integrated circuits – these are sets of electronic circuits on a semiconductor material (or wafer) which is typically made from silicon. The process is highly sophisticated and involves three key steps:

The silicon wafer is created from a cylindrical ingot which is then sliced into discs roughly 1mm thick. The ingot can be a range of diameters including 150mm and 200mm but most commonly it is 300mm. The majority of semiconductor manufacturers outsource wafer production, purchasing them from a specialist wafer manufacturer.

The chips are created in batches on the silicon wafer, with multiple chips being manufactured at the same time at a minute scale with thousands of automated steps.

An integrated circuit (IC) is a single semiconductor (semi) chip which has other components all integrated. These may include diodes, resistors, transistors or inductors, for example. ICs help to support complex circuits.

Chips are created in batches on the wafer. The factory in which this takes place is called a fabrication plant, or fab. There are high barriers to entry with costs of building and operating a fab reaching tens of billions of dollars.

-

The largest semiconductor firms by sales are reliant on emerging market companies; although the top ten includes several developed market companies, most of these are fabless and rely heavily or exclusively on emerging market companies for their chips.

Semiconductor industry

The semiconductor industry has two main business models: either the company designs and manufactures its own chips, or it designs them and then outsources their manufacture. Companies operating the former operating model are called integrated device manufacturers (IDMs). Those operating the latter model are called fabless semiconductor companies, outsourcing the manufacturing of their designs to foundries. The majority of companies rely heavily on foundries for their chips.

The split of these types of companies across the industry varies depending on the type of chips designed and produced. For example, those focusing on memory are mainly IDMs, including Samsung Electronics, SK Hynix and Micron. The IDM model provides an advantage because by designing and producing the chips themselves, the companies have more control over the whole process.

There has been a shift in recent decades with chip manufacturing whereby it has become more concentrated in Asia and less common in the US, reflecting the prevalence of the foundry-fabless model over IDMs. Currently it is estimated that 12-13% of chip manufacturing is domestic US, having been >30% in the 1990s1. Of the ten major US semiconductor companies, only two have in-house chip manufacturing capability (Texas Instruments and Intel), with the others needing to outsource it to a foundry.

- Five of the top 10, Intel, Qualcomm, Broadcom, MediaTek and Nvidia, use either TSMC or Samsung Electronics' foundry services.

- Three are US IDMs: Intel, Micron and Texas Instruments.

- Three are emerging market companies themselves: Samsung Electronics, TSMC and SK Hynix.

The largest semiconductor firms by sales are reliant on emerging market companies; although the top ten includes several developed market companies, most of these are fabless and rely heavily or exclusively on emerging market companies for their chips.

Top 15 semiconductor companies worldwide market capitalisation

(at December 2022 in billion US dollars)

![]()

Source: FactSet at 30 May 2024. Using market capitalisation denoted in billion US dollars, based on publicly traded companies and Factset industry classification of these companies as Semiconductor companies with the following definition "This industry group consists of companies engaged in the manufacturing of integrated circuits for electronic applications."

The shape of the industry today

The semiconductor industry has historically been quite cyclical, driven by industry, macro factors and product cycles. Cyclicality has reduced in recent years as companies invest more in technology and as the manufacture of chips gets increasingly complex. This has increased the barriers to entry, alongside addressing cyclicality.

- Inventory cycles: driven by supply and demand of semiconductor inventory.

- Macro factors: sales are correlated with GDP, meaning that the health of the economy can be a key driver of the semiconductor cycle.

- Product cycles: these are the cycles of the end markets which use semiconductors. Their product cycles may be wholly different from macro cycles or driven by specific trends in, for example, autos, the Internet of Things (IoT) or smartphones.

There is a mismatch in the industry between suppliers of the technology and those companies using it. It takes time for the companies to adjust their supply to meet demand, given the production timeline, which creates both up and down cycle.

- Down cycle: this is where inventory has been over-built and so companies respond by reducing excess levels through under-shipping their end demand. This leads to depleted inventory and helps build up chip demand again.

- Up cycle: as demand builds up again, companies work to rebuild their inventory levels at a higher rate than end demand in order to catch up with it.

The industry is currently experiencing a down cycle and is at the point where there are concerns over the build-up of inventory levels and over demand in end markets. This led to some profit-taking in recent months, with valuations being lowered as much as 30% in some cases. However, we believe this correction is to be expected given the cyclical nature of the industry.

The long-term opportunity which is presented by this industry remains a key area in which we have conviction. As enablers of advances in technology, semiconductor firms benefit directly from the rise of digitalisation and innovation in society. The reliance of the global industry on emerging market companies also make semiconductors highly attractive for emerging markets-focused investors.

There does remain an element of geopolitical risk which impacts the industry as a whole. This is largely driven by recent moves by US authorities regarding technology and encouraging domestic US production, including through subsidies. The aim of this is to reduce reliance on certain geographies and to stimulate domestic growth and innovation. The semiconductor industry is one component of this broader drive. For now, the focus area of risk is a small part of the overall emerging market technology sector (specifically, high-powered computing) and we have confidence that companies within the sector will be able to successfully navigate the resulting headwinds.

Sources

1Source: Morgan Stanley Research, ‘Clash of the Chips: TSMC, Samsung, and Intel’, May 2022.

Important Information

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document.

Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.