Content navigation

Will China join the Emerging Market recovery?

2023 has seen the beginning of a recovery in Emerging Markets (EM) but China continues to lag behind. The MSCI EM ex China has delivered a year-to-date return of 10.0%, while MSCI China is down 11.0% in the same period.1 This compares to MSCI ACWI at 14.7%1 or the S&P 500 at 24.3%2. Generally speaking, fundamentals look healthy and, when combined with extremely compelling valuations, we see great potential in the EM asset class.

We expect positive momentum in 2024 in the broad market through derisking of policy and politics. This, combined with heavily underweight investor positioning, suggests that we will see a dramatic shift in EM.

We are now at a unique turning point where all five points are directionally positive:

-

One of the big positives for EM as a whole is the earnings outlook. Expectations are for positive earnings growth from all industry sectors.

Fundamentals

Here comes the sun – a positive outlook for earnings

One of the big positives for EM as a whole is the earnings outlook. Expectations are for positive earnings growth from all industry sectors. Major index constituents information technology (IT) and consumer discretionary are experiencing positive estimated revisions for 2024 earnings per share (EPS) growth, which should be supportive of the asset class.

In particular, we view IT as a key EM opportunity in 2024 – earnings growth is projected at 65.6% for the calendar year compared to just 16.5% for the sector within the S&P 500.3 After a very strong 2023, US technology stocks may find themselves taking a back seat behind their EM peers’ standout rebound in 2024.

Table 1. Emerging market earnings outlook by sector

| Sector | Index Weight (%) | EPS Growth 2024E (%) |

|---|---|---|

| Financials | 22.5 | 9.8 |

| Information Technology | 21.7 | 65.6 |

| Consumer Discretionary | 12.7 | 10.0 |

| Communication Services | 9.3 | 17.3 |

| Materials | 7.8 | 42.3 |

| Industrials | 6.8 | 19.8 |

| Consumer Staples | 6.0 | 15.1 |

| Energy | 5.1 | 1.9 |

| Health Care | 3.8 | 19.0 |

| Utilities | 2.7 | 241.6 |

| Real Estate | 1.6 | 10.8 |

| MSCI Emerging Markets Index | 100.0 | 26.1 |

Source: FactSet, as of 15 December 2023.

Expect IT leadership to continue

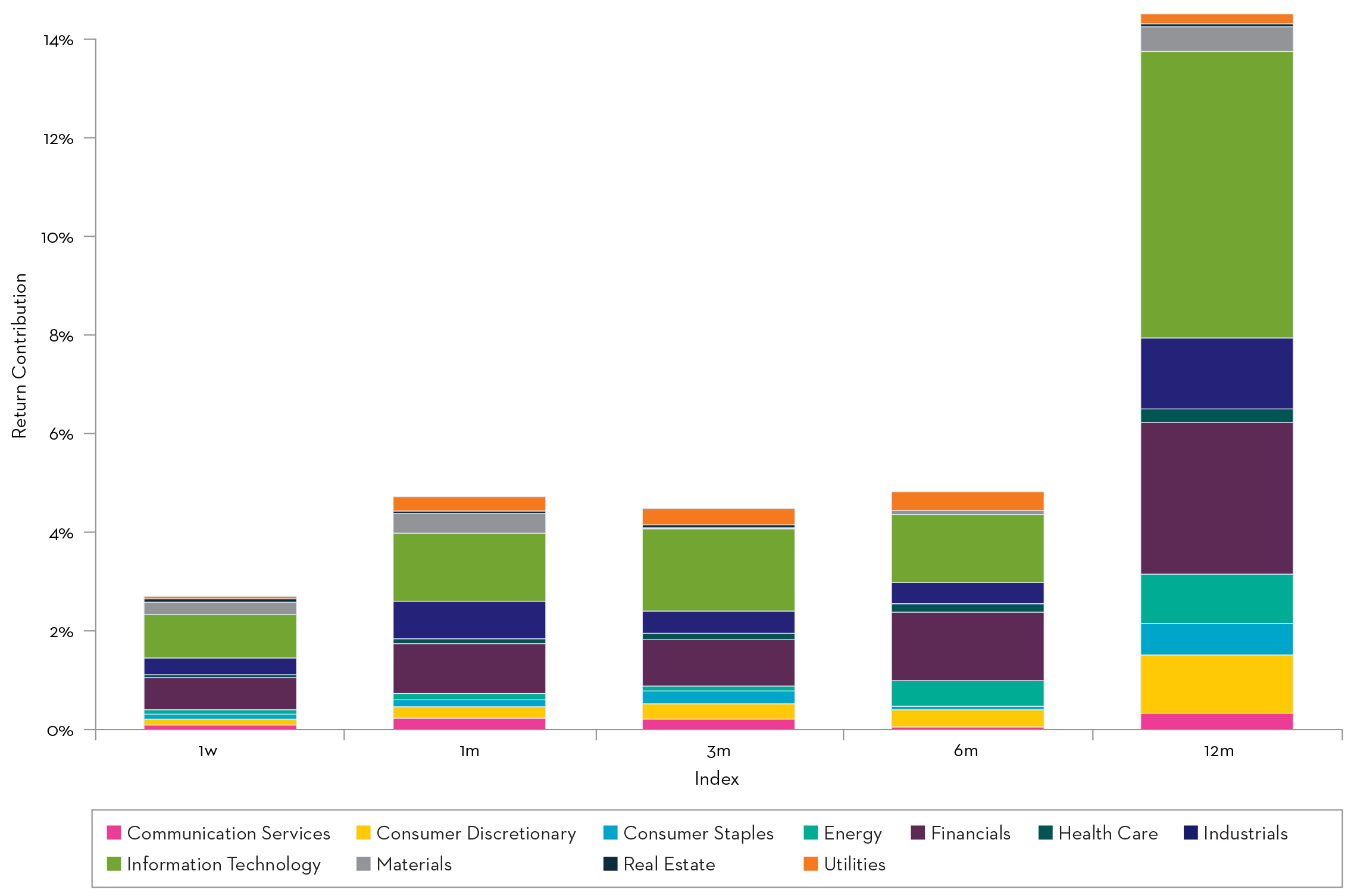

In 2023, we saw a very strong contribution from IT stocks in Asia, namely those from Korea and Taiwan which benefited from a dramatic demand shift relating to artificial intelligence (AI). In the past 12 months, EM technology has returned 16.8% and contributed around 40% to index performance.4 Chart 1 shows the dominance of technology in the region over the last 12 months. We expect this trend to continue in 2024, supported by the sector’s expected earnings rebound.

Chart 1. Sector return contribution of STOXX Emerging Markets 1500 Index

Source: STOXX, December 2023.

Growth vs. Value – what is going on?

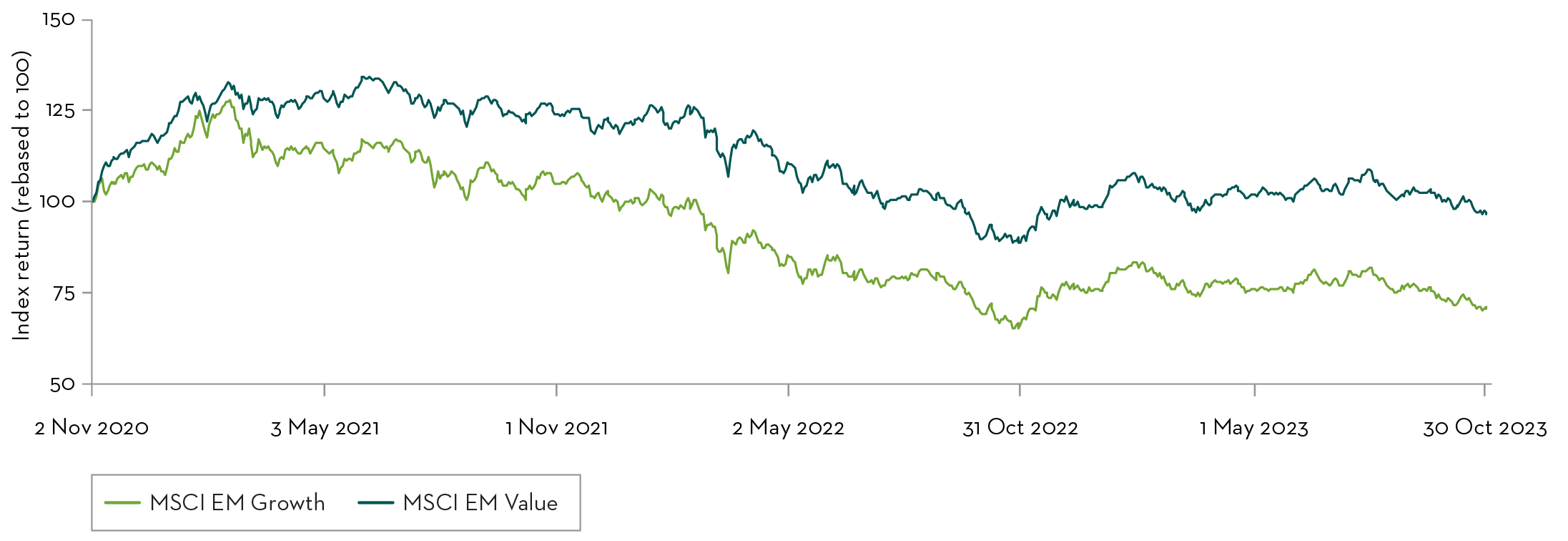

One recent development is the increasing probability of slower economic growth coming out of the US. In this environment, growth stocks have been outperforming in the US as investors are willing to pay a “growth premium”. However, in EM growth stocks have lagged value stocks. In fact, value has now outperformed growth in EM for three consecutive years.5 We believe this has created attractive valuations for EM growth stocks heading into 2024.

Chart 2. Value has outperformed growth for three consecutive years

Source: MSCI, 31 October 2023.

One hypothesis for the underperformance of growth stocks is their broad ownership by dedicated EM and global investors. Growth stocks in EM have been long-term structural winners and constitute the majority of the “mega caps” in the MSCI Emerging Market index.

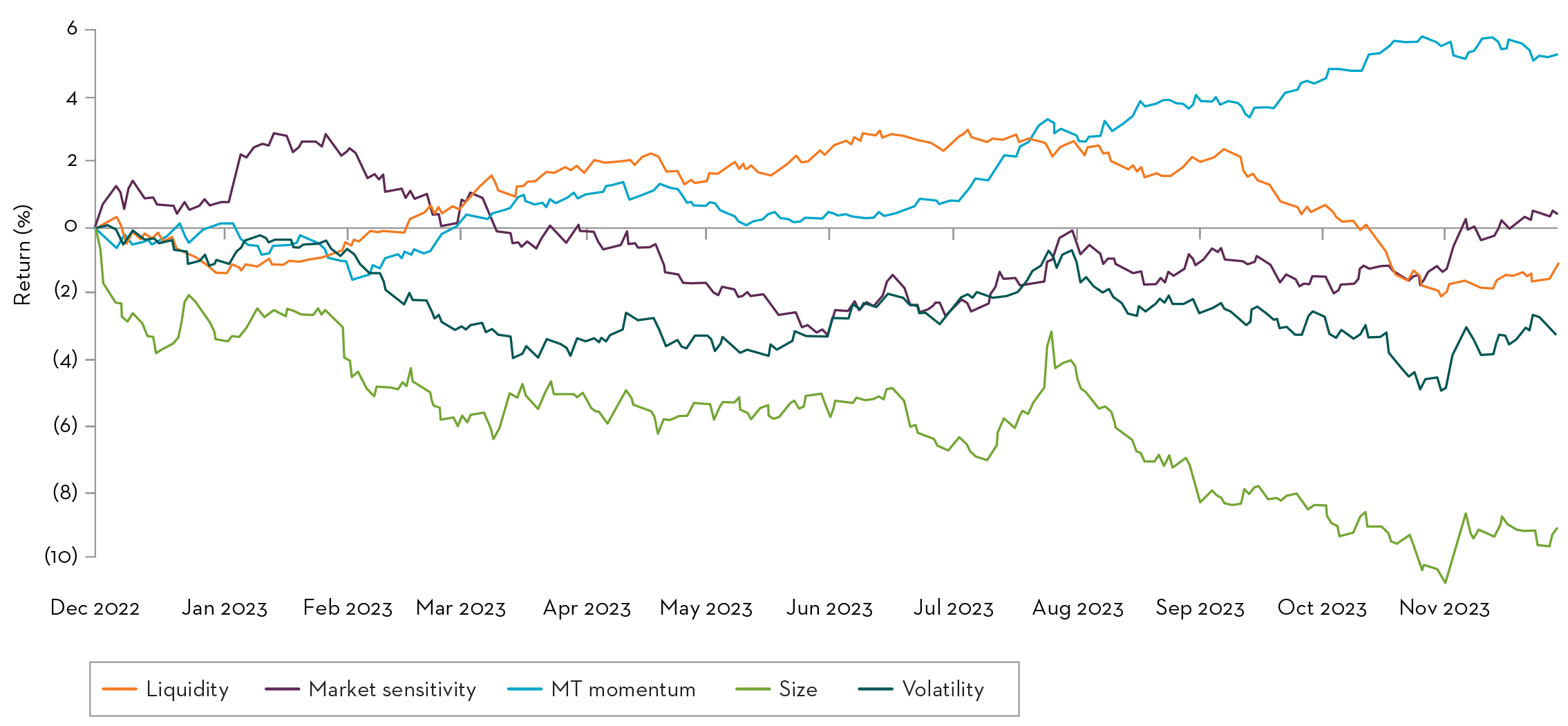

Below we highlight the impact of the growth underperformance by using a related metric: market cap. When the index is decomposed into factors, size shows the most material negative performance in the past 12 months (chart 3).

We have witnessed simultaneously the asset class experiencing significant outflows (which we will address later) and a sizeable price correction in widely-held, large cap names.

Chart 3. Market-based style factor performance for STOXX EM 1500 Index – year to date

Source: STOXX, December 2023.

What is Value in EM?

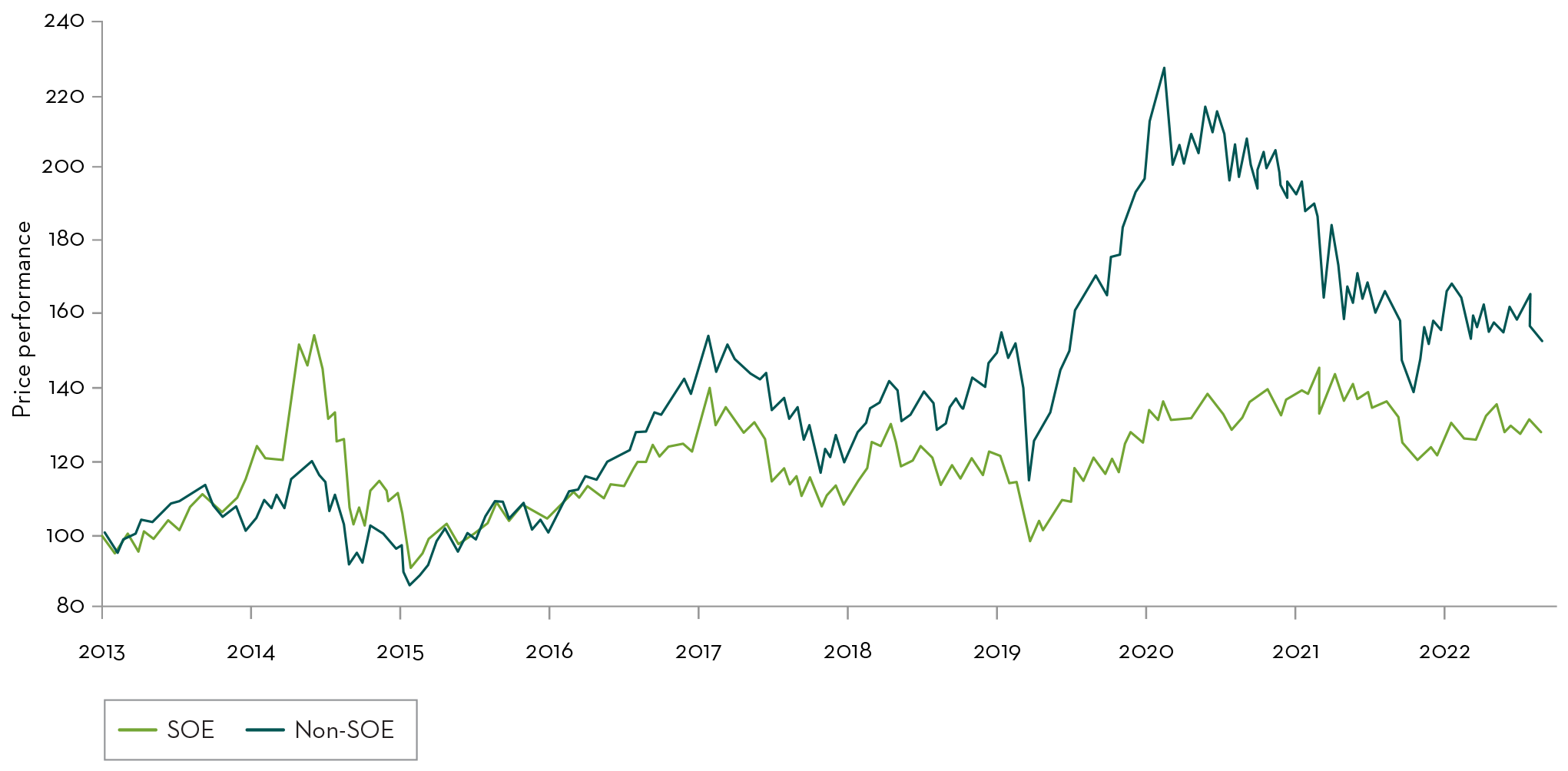

Value stocks in EM are predominently energy, utilities, resources, and financials. State-owned enterprises (SOEs) are over-represented in these key sectors where they are anywhere from 85% to 50% of listed market cap.6

They are also historically strategic sectors where government involvement is signficiant. In the value-led rally of the past three years, we’ve seen SOEs have more defensive performance as they have been long-term secular underperformers, as shown below.

Chart 4. SOE vs. non-SOE price performance in EM – 10 years

Source: J.P. Morgan research (Refiniv Eikon Datastream, Bloomberg, J.P. Morgan, 29 November 2023).

Valuation

Emerging market valuations are discounted relative to developed markets

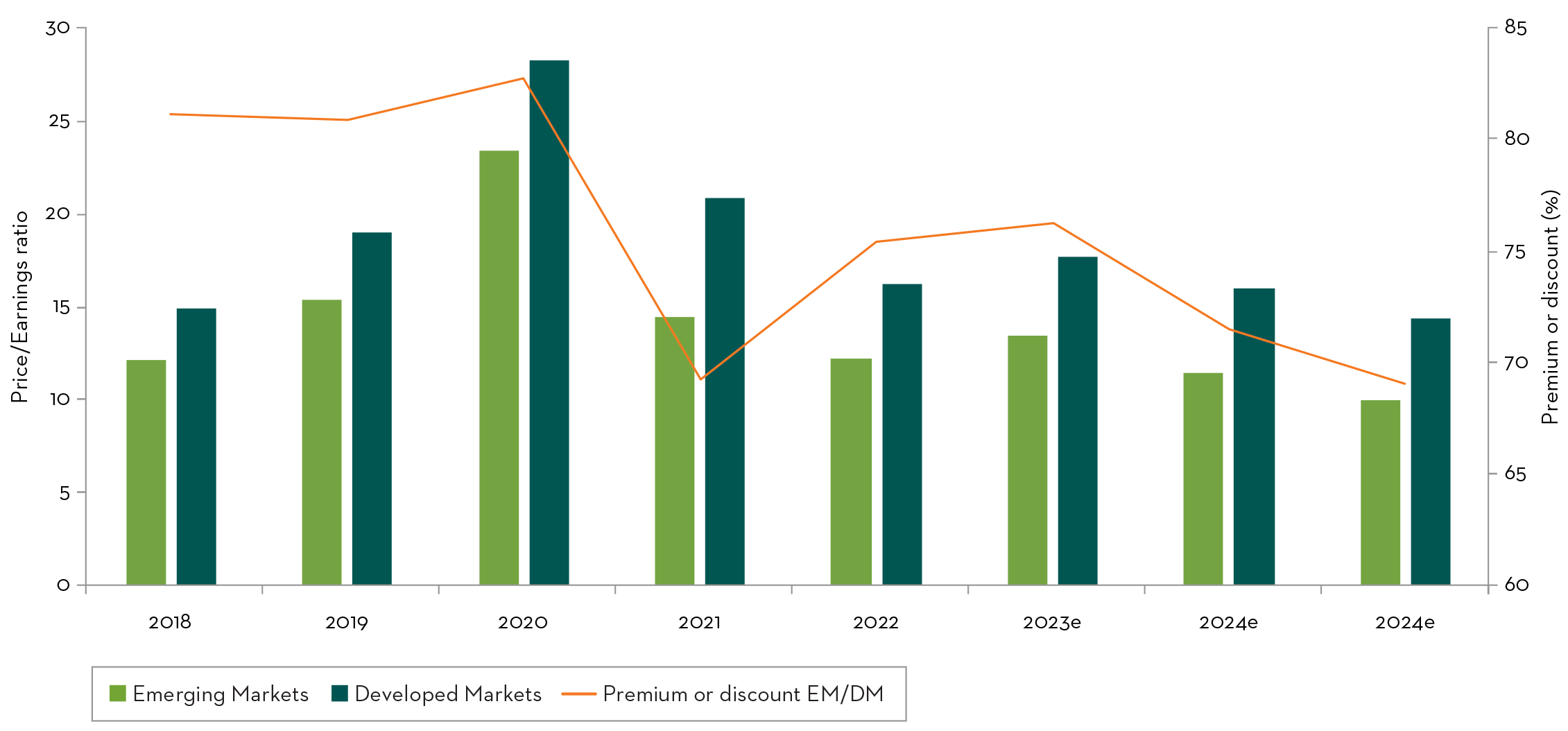

Typically, EM trades at a discount to developed markets (DM). This can be seen in valuation history over the past five years in the chart below. However the recent derisking of EM assets has pushed valuations even lower, such that EM is now trading at a discount relative to its own history versus DM.

Examining consensus estimates for 2023-2025 suggests that this trend is set to continue, making it an opportune time to add to EM allocations.

Chart 5. Valuation of EM is increasingly attractive relative to developed markets

Source: FactSet, December 2023. EM represented by MSCI Emerging Markets Index. DM represented by MSCI World Index. December 2023, 2024 and 2025 Price/Earnings data are consensus estimates.

Positioning

How are global investors allocated to emerging markets?

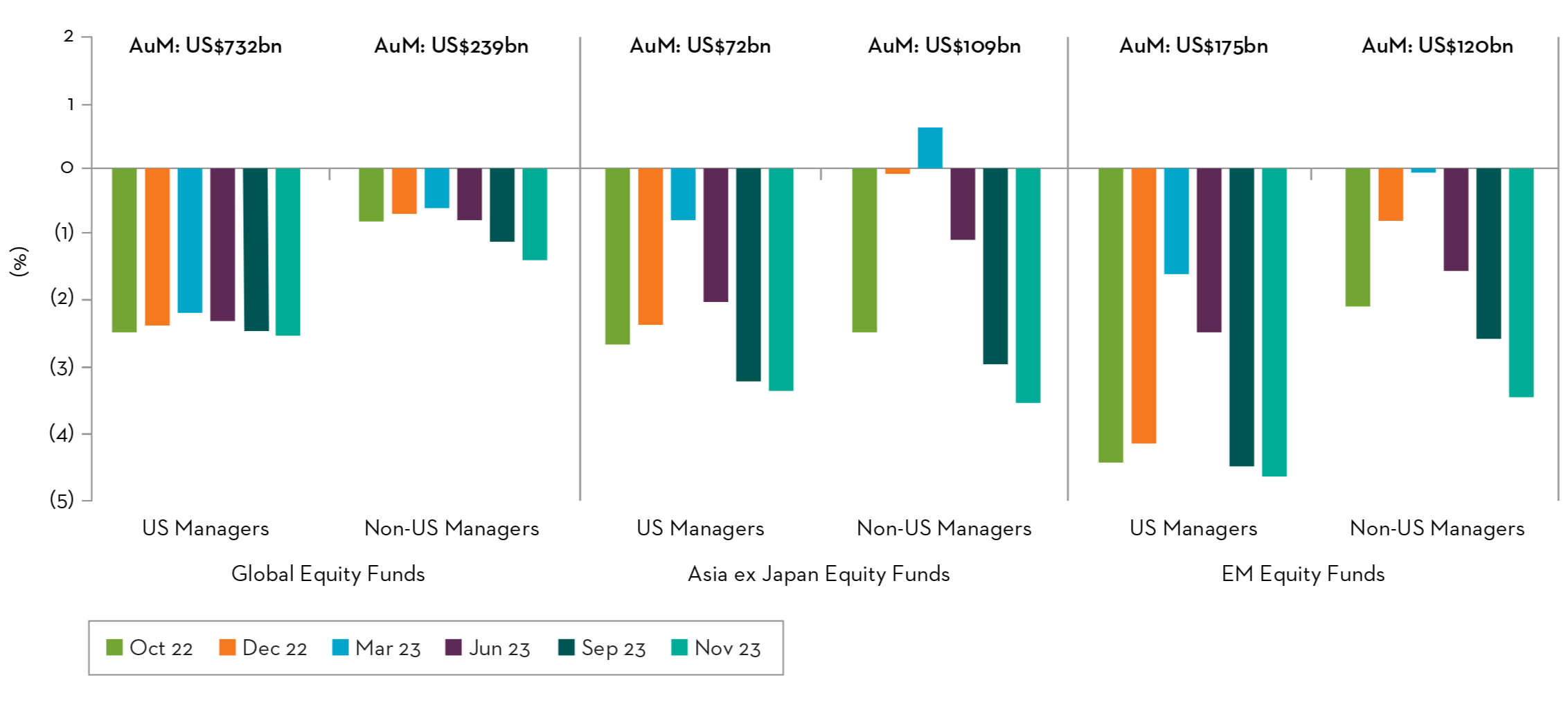

When we look at allocations to EM there are two major dislocations in place.

- There is a significant underweight to the EM asset class for global investors. Their allocation is 5.7%. If we were to see a mean reversion to the 20-year average of 8.4%, we would see inflows of approximately US$673bn – nearly 48% of all current EM assets.7

- There is another dislocation within the EM class itself: China’s endemic underweight across all asset allocator buckets. Across all three key buckets (Global, Asia ex. Japan, and EM equities), funds are underweight China anywhere from 1.5% to 4.5%.8 If investors were to revert to neutral positioning, this would represent nearly US$40bn of inflows.

Chart 6. Overweight/underweight China positioning for asset allocators

Source: “Position of Active Long-Only Managers in China/HK”, Morgan Stanley, 5 December 2023.

Our EM positioning

Within EM itself, the MSCI index allocations are heavily weighted towards financials, IT and consumer discretionary sectors, which together account for over 50% of the index. We remain overweight in IT, to benefit from the earnings rebound especially within the semiconductor segment, and steady growth in IT services. We are also overweight in Indian consumer discretionary names to benefit from the continued buoyant conditions in the Indian economy.

Politics

Key EM elections in 2024

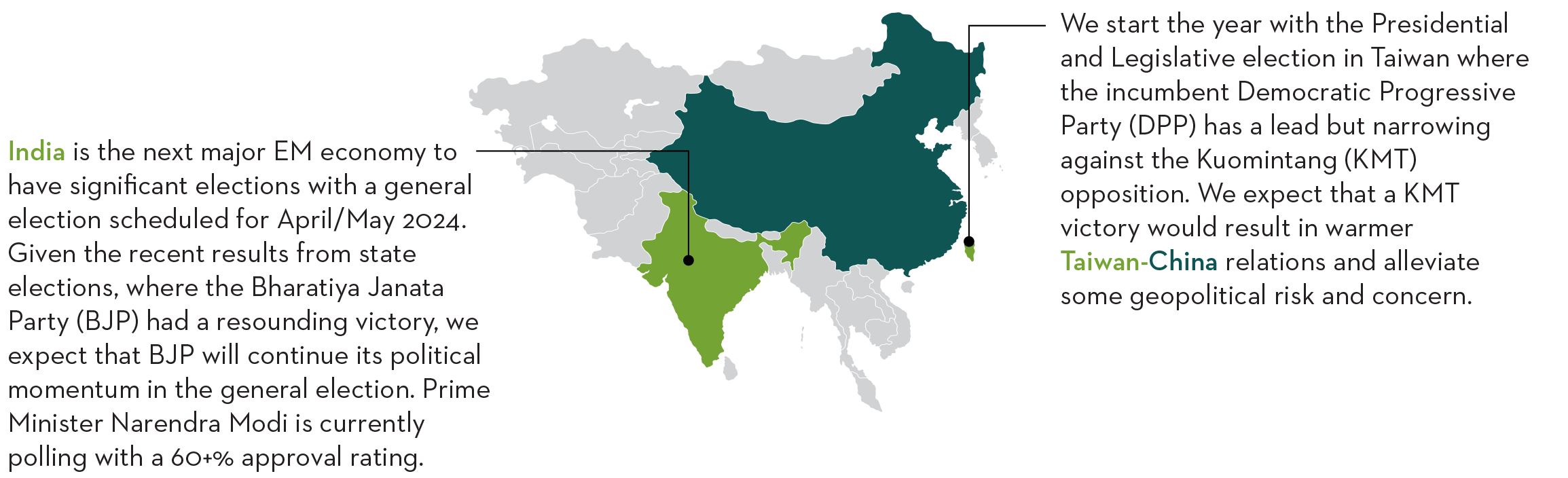

For most EM markets (ex-China) we anticipate that elections will be a source of stability. Electoral disruptions are unlikely with the exception of a few markets such as South Africa where the African National Congress is under pressure.

According to HSBC, elections in eight of the world's ten most polpulous countries will take place in 2024.9 These elections alone are estimated to cover over a third of the world’s population.10 Most of the elections in emerging markets will be in the first half of the year: Taiwan, Indonesia, Turkey, South Korea, India, South Africa, Mexico.

Policy

Our outlook on inflation and rates in EM

Rate cuts across the board

Policy rates will be more accomodative in EM in 2024. Inflation numbers are rolling over and the consumer price index (CPI) continues to be benign. In addition, EM economies have been more disciplined in the post-Covid era with superior monetary and fiscal discipline. From a big picture perspective, most if not all of the emerging economies will undertake some form of policy rate cuts. We highlight those of major economies in the table below.

One market where inflation is a non-issue is China. China has seen flat to negative price trends at both the consumer price and producer price level for the last 12+ months.

Table 2. Rate cut outlook for major EM economies

| Sector | Weighting in MSCI EM | Central Bank rate | CPI | Likely to cut rates |

|---|---|---|---|---|

| China | 30% | 4.4% | (0.2%) | |

| India | 16% | 6.5% | 4.9% | |

| Taiwan | 15% | 1.9% | 3.1% | |

| Korea | 12% | 3.5% | 3.3% | |

| Brazil | 5% | 12.3% | 4.8% | |

| Saudi Arabia | 4% | 6.0% | 1.6% | |

| South Africa | 3% | 8.3% | 5.9% | |

| Mexico | 2% | 11.3% | 4.3% |

Source: Bloomberg and “Global Inflation and Central Bank Monitor”, Morgan Stanley, 27 November 2023.

The topping out of developed market bond yields has the potential to turn the tide with regards to investors’ style preference and in their DM/EM allocation. As we glimpse ahead an end to US interest rate rises, this could also provide a boost to EM from a weaker dollar.

China: late out of the gate in 2023, upside in 2024?

China has seen subdued growth recently despite compelling valuations and a wealth of attractive bottom-up stock opportunities. There are three key focus areas for policy changes:

- Pro-equity market measures

- Fiscal deficit expansion and stimulus

- Property market stimulus

Since August of 2023 we have seen significant pro-growth policies focused on equity markets such as stamp tax duty cuts and the intervention of Huijin (a key government agency) in the purchase of large cap bank stocks.

There is incremental upside to fiscal stimulus in China as well – this should support broad economic growth.

We exect continued momentum in property market stimulus and the capacity of local government financing. We expect the People’s bank of China to continue to cut rates and the reserve requirement ratio (RRR) as well.

These measures are expected to help economic activity and improve consumer sentiment.

India: growth is delivering – earnings to drive upside in 2024

India is forecast to deliver its third year of >6.0% Real Gross Domestic Product (GDP) growth.11 There are three key focus areas for policy in India:

- Benign inflation should lead to rate cuts starting in 2H24

- Continued government spending

- Private enterprise expansion

The outlook for inflation in 2024 is positive. India’s inflation assumptions are predicated on ~$80-85 brent assumptions, and at current levels of ~$70/barrel, the inflation outlook is even more supportive for looser monetary policy.12 Currently core inflation is at a 4-year low13 and this gives the Reserve Bank of India further motivation to cut rates starting in the second half of next year.

In the last three years, government spending has been a signficiant driver of GDP growth. The government has doubled capital expenditure to 3.3% of GDP in the past three years.14 In the run up to national elections in Spring 2024, we expect that the spending backdrop will be supportive of continued growth.

Private enterprises in India are extremely healthy. For example, manufacturing companies have leverage ratios that are their lowest in 16 years. Bank balance sheets are extremely well capitalised and are positioned for continued credit expansion into the corporate/enterprise system.15

The stars are aligned for 2024

We are at a unique juncture as we enter 2024, where all five points of fundamentals, valuation, positioning, politics and policy are in positive alignment. This is a powerful combination and we believe it places EM companies and countries in a strong position.

They are set to benefit from strong earnings growth, attractive valuation, a supportive fiscal and political environment and the prospect of a potential normalisation in global/EM asset allocations. We are excited as we enter 2024 to see how companies and the market respond to this favourable environment.

Sources

1Source: MSCI, as of 30 November 2023. Net total return in US$.

2Source: FactSet, as of 15 December 2023. Net total return in US$.

3Source: FactSet, as of 15 December 2023. Earnings growth measured by earnings per share growth consensus estimates for the calendar year 2024.

4Source: FactSet and Martin Currie, as of 30 November 2023. Contribution to index performance (%) calculated as sector contribution divided by the absolute sum of sector contributions.

5Source: See our recent article “Emerging Market Growth has the Quality to Perform” for further information.

6Source: “2024 Year Ahead- Emerging Markets Equity Strategy”, J.P. Morgan, 29 November 2023.

7Source: “2024 Year Ahead- Emerging Markets Equity Strategy”, J.P. Morgan, 29 November 2023.

8Source: “Position of Active Long-Only Managers in China/HK”, Morgan Stanley, 5 December 2023.

9Source: “EM Election Guide 2024”, HSBC, 4 December 2023, and broker communications.

10Source: “World Economic Outlook 2024”, IMF, October 2023.

11Source: “India 2024 Outlook - Port of calm in a ‘Higher for Longer’ world”, Goldman Sachs, 14 November 2023. Real GDP year-on-year growth of 6.7% in F22, 6.4% in F23(E), and ~6.0-6.3% for F24(E).

12Source: Bloomberg and “India 2024 Outlook”, Goldman Sachs.

13Source: Statista and IMF, October 2023.

14Source: “India 2024 Outlook”, Goldman Sachs. 3.3% of GDP in FY 2024.

15Source: “India 2024 Outlook”, Goldman Sachs.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.