While Growth and Momentum stocks have driven recent market performance, particularly by stocks in the tech sector, underlying economic indicators tell a different story about the future. We delve into the case for prioritising Value for a pathway beyond the current market conditions.

Style as a driver of global performance

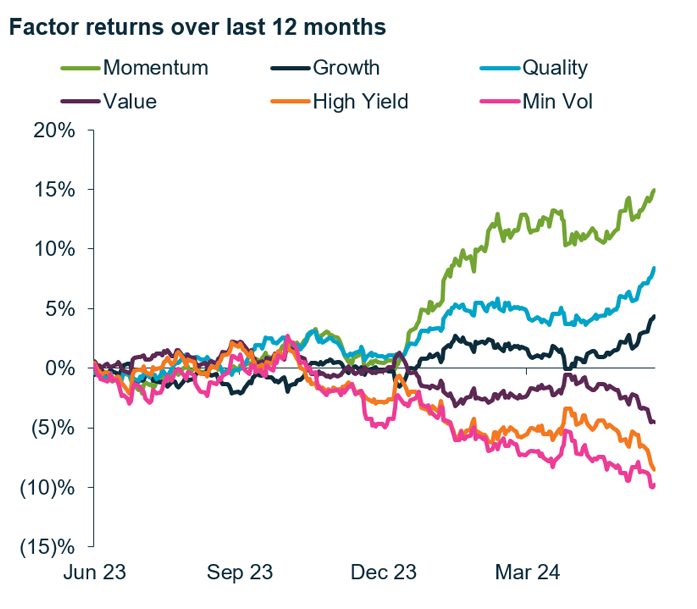

Over the past year, style factors have significantly influenced global market performance. Global equities have generally performed well, with Growth stocks outperforming Value, particularly in the US. Bonds did well but lagged equities.

Within global equities, the Momentum factor has been a major contributor to performance1, experiencing its strongest returns in two decades, largely driven by tech giants like NVIDIA. Price expansion, rather than earnings growth, has been the primary driver, pushing markets to historical peaks.

Disconnect between economic indicators and market performance

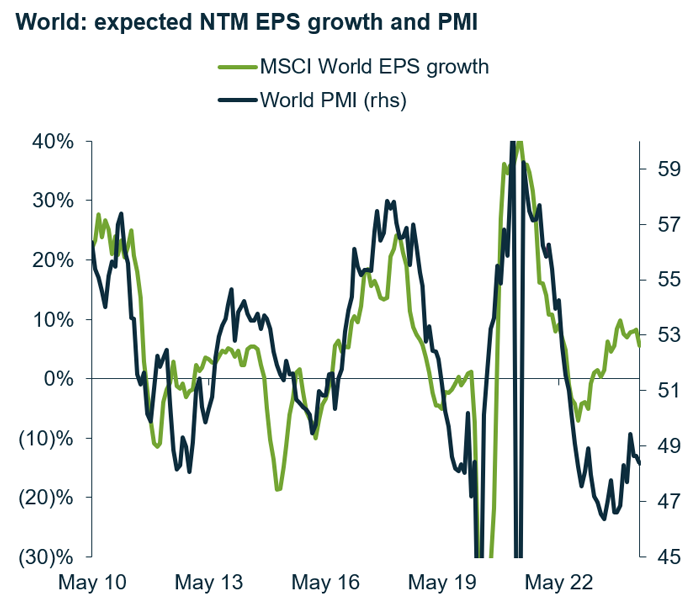

Typically, there is a strong correlation between market PMI levels and expected earnings growth2. However, since March 2023, this relationship has weakened, partly due to the AI hype. Current PMI levels for the US, China, and Australia indicate contraction, contrasting with optimistic earnings growth projections. Everything now looks worse than our pessimistic forecast 12 months ago.

The inverted US yield curve, now more negative than even during the GFC era, signals poor economic prospects, suggesting a delayed impact on GDP growth. Despite anticipated rate cuts, economic pain may persist, as central banks are forced to cut rates in response to underlying problems in the real economy, not simply because they have resolved the inflation issue.

-

Higher inflation rates in Australia suggest at least a lengthy delay to rate cuts if not potential rate hikes.

Challenges for the Australian economy

The old saying, “when the US sneezes, Australia catches a cold,” holds some truth that we should heed. Australia faces pressures from slowing global growth, rising US real rates, and concerns over China's property issues all affecting iron ore prices.

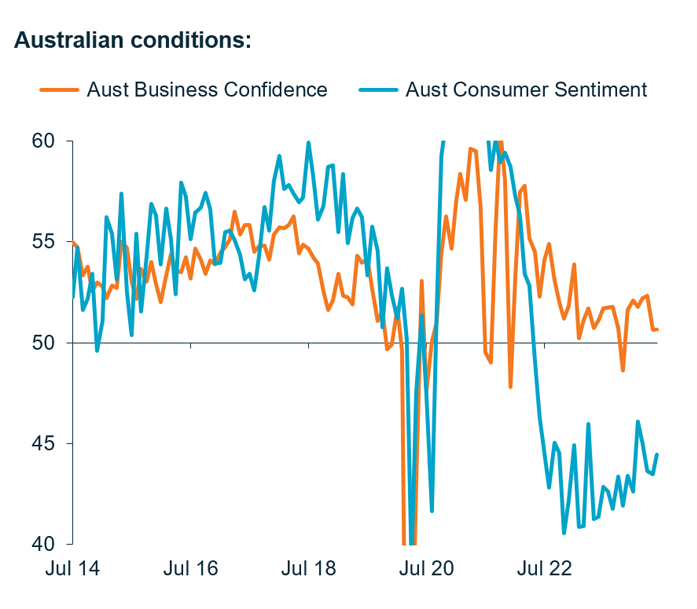

Australian profit margins are under strain due to high business and finance costs. Weaker business and consumer confidence indices further indicate corporate concerns about contraction in household budgets and falling profit margins3. Additionally, higher inflation rates in Australia suggest at least a lengthy delay to rate cuts.

A bubble-like market environment with concentration risk at extremes

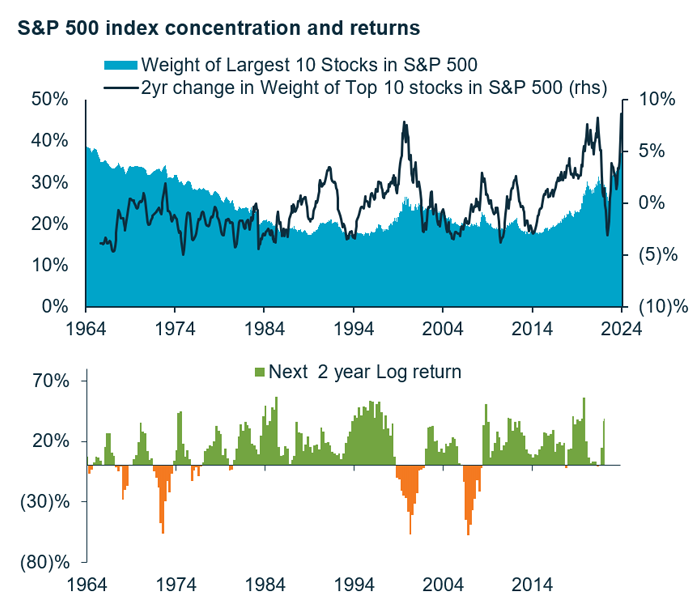

There is growing concern about distorted market prices driven by AI hype and large-cap stocks, reminiscent of the Tech Bubble. The Momentum leadership, particularly from the "Magnificent Seven" and large cap market concentration, has created market exuberance. US market P/E multiples suggest unrealistic assumptions about sustained high profit margins and return on equity.

Analysing the S&P 500 since 19644 reveals a correlation between high index concentration in the top 10 stocks, and changes in the level of index concentration leading to poor market performance. Increased concentration often precedes market downturns, highlighting risks associated with Momentum and US stocks.

Significant potential for undervalued Value stocks

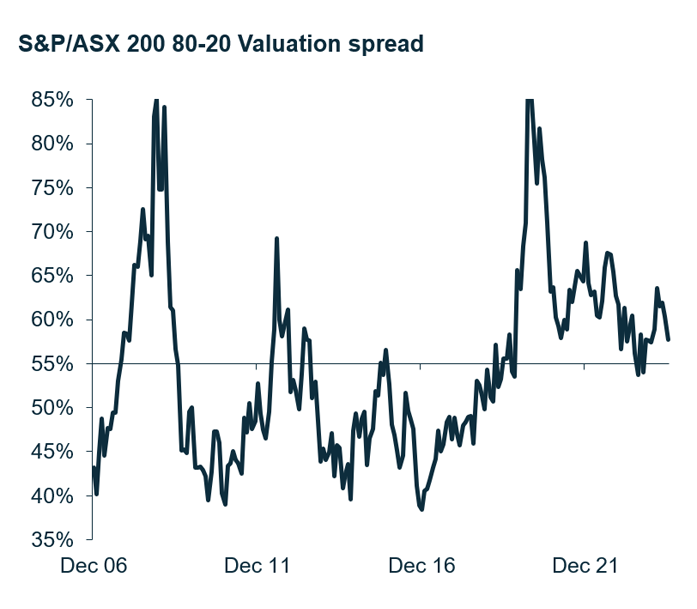

Our analysis of the macro story paints the picture of things at extremes, including Valuation dispersions. The market's preference for Growth and Momentum has widened valuation gaps, making Growth stocks more expensive and Value stocks cheaper than normal.

Our analysis of Australian stocks using factors and our investment team’s proprietary Valuations shows extreme valuation spreads between high and low Momentum and Growth stocks, while Value and Quality stocks remain severely undervalued. This means you are paying much more for Momentum and Growth versus Value and Quality stocks than normal.

The 80-20 spread, which measures dispersion between the cheapest and most expensive parts of the Australian market, is wider than average5. These conditions suggest a potential outperformance of Value stocks as extremes unwind to more normal levels of dispersion.

Importance of Value balance in Multi-Asset positioning

For investors in multi-asset strategies, appropriate asset allocation is crucial for future returns in the current investment landscape. It is crucial to adopt a balanced approach and position for the eventuality that the Momentum bubble will burst.

Our Martin Currie Australia Diversified Growth strategy has a neutral asset allocation of 70% growth assets and 30% in their defensive counterparts, with asset selection driven by our overarching Value philosophy.

We are currently relatively neutral on our growth / defensive mix6.

- Within our defensive positioning, we are close to neutral on our mix between Australian and Global bonds.

- However, within our growth exposure, our views on the Momentum bubble encourage us to be more weighted towards Real Assets (such as real estate, utilities and infrastructure), and underweight Australia and Global equities.

- We like both Australian and Global Real Assets given that interest rates are closer to peak cycle and that they are priced at a significant discount.

- Within Australia equities, our largest weight is toward our Value Equity portfolio.

Defensive, quality potential in Value portfolios

As contrarian Value investors, our Martin Currie Australia Value Equity portfolio is more distinct from the index than ever, and our high active share reflects our conviction in our stock ideas.

It is common for our portfolio to have higher sensitivity to market movement; however, we are finding greater Value upside opportunities among the more defensive, higher quality companies. We are therefore maintaining our portfolio beta at its lowest ever ratio outside of the lead-up to the GFC, allowing better Valuation potential but with less risk than normal.

Our portfolio currently resembles a barbell with undervalued defensive names that can weather economic downturns, and stocks that can grow despite resilient inflation. Preferred names include7:

- Insurers QBE Insurance Group and Medibank Private,

- Defensive stocks like Telstra Group and Aurizon Holdings with resilient earnings and good pricing power,

- Stocks facilitating energy distribution such as Worley and Ventia Services Group.

- AGL Energy, where the energy transition is creating a shortage of electricity production.

- Flight Centre Travel Group, where the market is undervaluing cost efficiencies and margin leadership.

- We are avoiding consumer discretionary stocks impacted by contraction in household budgets.

The Time for Value Investing

The timing of style cycles is difficult to predict, but we believe that current conditions favour Value investing, either as a stand-alone equity allocation, or in driving broader multi-asset portfolio weights. Value-style stocks are cheap, while Growth stocks remain overpriced. As valuation spreads narrow, Value style strategies offer a strong starting point.

Sources

Past performance is not a guide to future returns.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

Source: Martin Currie Australia, FactSet, MSCI; as of June 2024.

1 MSCI World Factor Index returns vs. MSCI World (USD)

2 Expected next 12 Months (NTM) data is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days.

3 NAB business conditions, ANZ-Roy Morgan Consumer confidence

4 Based on U.S. Research Returns Data from the Kenneth R. French Data Library

5 80-20: spread between the MCA proprietary Valuation of the 80th percentile stock and the 20th percentile stock

6 Based on a representative Martin Currie Australia Diversified Growth account

7 Based on a representative Martin Currie Australia Value Equity account vs. the S&P/ASX 200.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.