Content navigation

Key takeaways

- First quarter of 2024 had positive returns in emerging markets (EM).

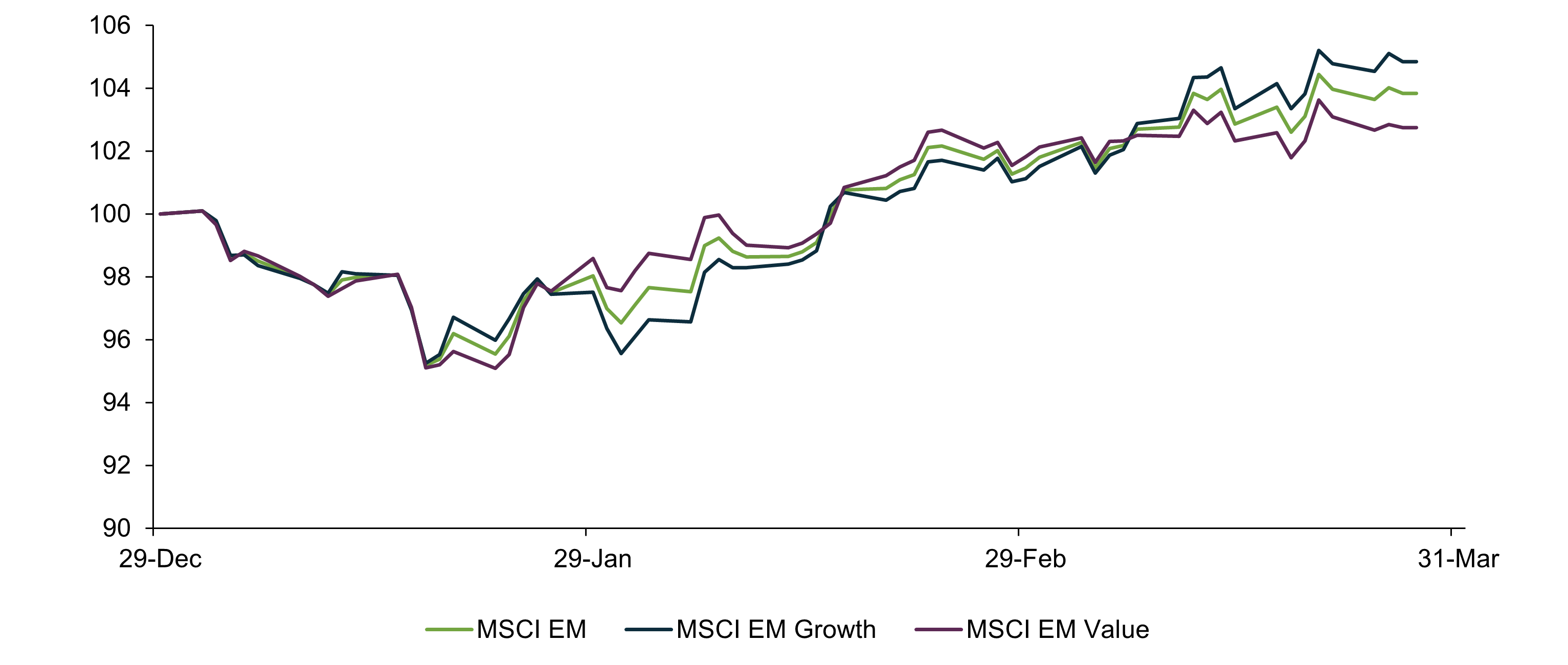

- No clear style leadership during the quarter with Value, Growth and Core styles largely aligned.

- January marked a turning point where the market began to reward earnings delivery, especially in China.

- Technology stocks were drivers of asset class return.

Market Overview

EM performance in the first quarter was a story of two halves. The first part saw a continuation of some of the themes of last year with style and flows being the predominant factor driving returns. There was a turning point in January as we saw Value, Growth and Core styles performing positively and in alignment. In this latter period, the market began to recognise company fundamentals and this is what we believe has driven the turnaround in EM, especially China.

In China, the macro backdrop looks to be more positive and suggests a shift in the market. Equity support programmes from the government, fiscal stimulus, property market measures, and pro-private enterprise meetings between the Chinese government and US technology company CEOs are all likely to be supportive of the Chinese stock market. While throughout most of 2023, earnings delivery was not recognised by the market, this year we have seen the market begin to reward positive earnings delivery.

Technology, especially semiconductors, continued to show strength as we entered 2024. Names linked to artificial intelligence (AI) performed well and strong earnings supported the broader industry.

Total return of Core, Growth and Value segments of EM in Q1 2024

Source: FactSet as at 28 March 2024. Data in US$.

Portfolio Discussion

Indian equities were strong during the quarter, led by mid and small cap companies. Our holdings are typically at the larger end of the cap spectrum and so India’s strength actually detracted from performance, despite our overweight to the country. Fundamentals remain compelling and we have high conviction that our holdings are best-in-class companies. A mid cap recovery is a typical lead indicator of the broader market and we believe this presents strong upside opportunities as large caps close the valuation gap.

Our overweight to technology names was beneficial for portfolio performance during the first quarter. Key markets such as Korea and Taiwan showed strong outperformance relative to the benchmark owing to our large active weights in semiconductor foundry and memory companies TSMC and SK Hynix. Not holding real estate companies was also beneficial for the portfolio given the sector’s continued challenges in EM.

Industry heavyweights in the financial sector suffered setbacks due to stock-specific factors, driving relative underperformance for the strategy. While HDFC Bank’s earnings were met with a lukewarm reception, AIA’s guidance on share buybacks also caused concern about the company’s capital management and growth strategy.

Portfolio Activity

We added two companies to our clients’ portfolios:

Shenzhen Mindray Bio-Medical Electronics. Mindray is China’s largest medical services company, with high growth and profitability. It has diversified revenues, including around 40% of revenues from outside of China. Despite current headwinds in the Chinese market, Mindray is showing good long-term fundamentals and double-digit earnings growth.

Mercadolibre. The company offers unique access to the Latin American eCommerce and digital financial services markets. It is one of the most attractive compounders in Latin America and has a strong growth outlook with expanding margins.

We exited one company:

Ping An Bank. The Chinese bank is our financial most vulnerable to significant earnings downgrades and will likely deliver much lower return-on-equity than we previously forecast. Falling interest rates, mortgage repricing, de-risking in unsecured retail lending, weak company and consumer risk appetites, and pressure on fee pools from risk appetite and regulatory price cuts will be unsupportive of company performance and fundamentals. Although we think it will still be profitable, we no longer have conviction that the company will be among profit leaders in Chinese banks.

Important Information

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.