Given their size and yield, Australia's big four trading banks hold significant importance in the portfolios of equity investors, whether they seek total return or income objectives.

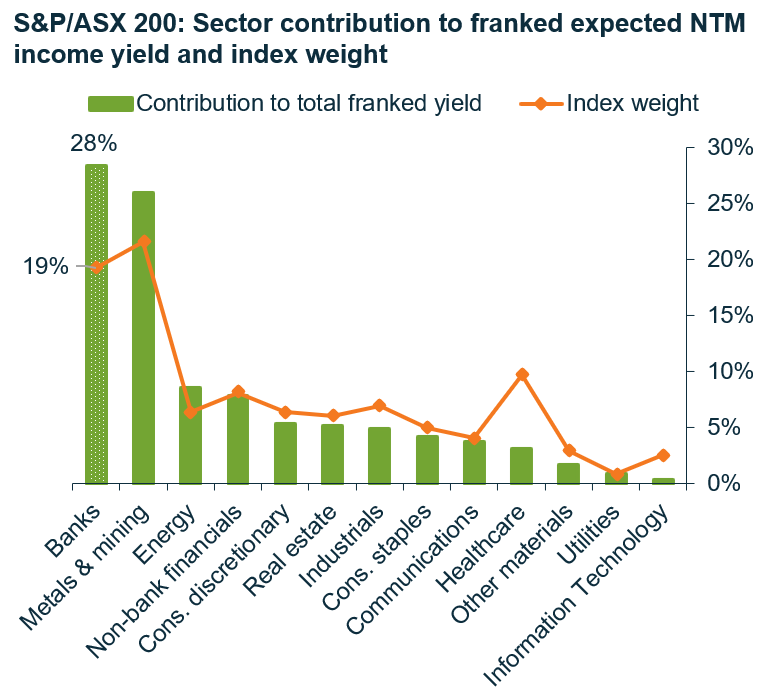

At the end of June 2023, the banks sector accounted for 19% of the S&P ASX 200 Index market cap, and 28% of the broker consensus forecasts for franked dividends over the next twelve months from the same index.1

space

With widespread expectations of a slowing domestic economy and much-publicised concerns over the capacity of borrowers to navigate the transition from low fixed-rate mortgages, we have taken stock of our views on the banks.

We have undertaken a comprehensive analysis of the sector, examining performance differences, and the impact of changing funding costs and margins on bank earnings and prospective dividends. At a macro level we have modelled lower household savings rates and lower house prices.

As a result of this work, we have adjusted our forward expectations for each bank’s relative valuation and re-evaluated our proprietary assessments of their ability to sustainably pay dividends at current levels.

Benchmarking shows CBA as outlier

Traditionally, the big four banks’ share prices and active returns have shown a strong co-movement with each other. Residual differences in ratings or valuations between the banks should then be justifiable through differences in return metrics like return on risk-weighted assets (RORWA) or earnings growth.

Over the last decade, there has been a meaningful decoupling of Commonwealth Bank of Australia’s (CBA) total shareholder return from its peer group, primarily due to its higher trading multiple. There is far more modest evidence, however, of CBA delivering sustainably differentiated operating metrics compared to the other big four. To us, it is difficult to make the case that a valuation difference is truly supported for CBA.

Funding costs to normalise…

Our analysis indicates that as funding costs normalise to pre-‘low rate’ era levels, the embedding of larger mortgage discounts that all banks have offered customers will come home to roost. With deposit margins now a headwind, the only realistic method for banks to repair their net interest margins (NIMs) will be by limiting the pass-on benefits to customers when a rate-cutting cycle commences. In a persistent or sticky inflation environment, it may take a while for banks to implement this strategy, increasing the risk of lower NIMs persisting.

…but inferior margins

Lower NIMs will lead to reduced revenues, which we believe will be even lower than the consensus estimates for the next three to five years. This, in turn, will result in a higher-than-expected cash earnings shortfall compared to our earlier expectations and consensus.

Lower savings likely to reduce customer demand for credit

So, if the outlook for bank margins appears challenged, are there opportunities for offsetting growth in credit to compensate? Our approach also used proprietary analysis of household income data to include an assessment of credit serviceability from a system-wide perspective, and house price forecast scenarios.

After Australian households saved approximately A$100 billion above normal levels in 2021 and 2022, savings rates have normalised, and people are now increasingly using their savings to cover their growing mortgage and essential living costs. Interest payments are on track to rise 119% in FY 2023 and another 33% in FY 2024. Rising interest payments and a potential decline in house prices pose risks to consumption expenditure more broadly and may crimp households’ demand for more debt.

Constrained supply of finance flags caution for house prices

These conditions set the backdrop for a potentially sharp correction in the supply of credit for housing. Following a significant surge in house prices during the low-rate Covid era supported by increased borrowing and active buyers less sensitive to rates, house prices began to correct on the initial raising of mortgage rates. Prices have since rebounded in 2023, with market economist now abandoning predictions of price declines due to factors like stronger immigration, high-end buyers, and tight supply. Our model relies more on the capacity to access and service debt, and highlights risks in the availability of funds for purchasing property. The fundamentals around lending policies, mortgage rates, term deposit rates, and living costs all point to a higher risk of substantial declines in credit availability translating to lower prices.

It remains to be seen if a lack of housing stock and other influences such as immigration prevail, but the resilience of higher inflation and indications of easing loan approvals (net of re-finance) all point to the potential for a deeper correction in house prices, further contributing to the revenue squeeze for banks.

Given their size and yield, Australia's big four trading banks hold significant importance in the portfolios of equity investors, whether they seek total return or income objectives.

Portfolio implications

Bank earnings risks are skewed to the downside, and we feel that CBA in particular appears overvalued.

For portfolios focused on total return, we believe that inferior NIMs and rising potential loan losses support underweighting the banks sector vs. the S&P/ASX 200 Index.

Investors seeking an income stream that is resilient to macroeconomic volatility should be cautious of protecting against downside income risk. Saying this, our proprietary estimates of the resilience of dividends for the big four banks remain attractive, and largely in-keeping with broker consensus forecasts for franked dividend yields for the next twelve months. We are comfortable with retaining bank exposures for their income generating ability, however, our focus on downside income risk means that this is at a significant underweight relative to a yield-weighted view of the index.

Click to display all sources >>

1 Source: Martin Currie Australia, FactSet. As of 30 June 2023.

Big four banks: Commonwealth Bank of Australia (CBA), Westpac Banking Corporation (WBC), ANZ Group Holdings (ANZ) and National Australia Bank NAB)).

The Expected next 12 Months (NTM) Income is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days. Assumes zero percent tax rate and full franking benefits realised in tax return.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.