Content navigation

As the Olympic flame approaches Paris, you’ll be interested to know there is a correlation between Olympic Gold medals won and the stock market performance of a country.

Many of you will remember the London 2012 Olympics, a record year for Team GB! We took home 67 medals, 29 of which shimmered with Gold, whilst the FTSE 250 (ex-investment Trust) returned a remarkable 28.7% over the year, compared to the FTSE All World’s 12% return1.

As a Yorkshire based investment team, we must add that if Yorkshire were on its own we would’ve come 12th in the 2012 Olympics!

Of course, this relationship is not actually true. What does a country’s Olympic performance all mean for the future of its equity market? Quite frankly, nothing.

In a world full of data, there is such temptation to cherry pick, draw connections, find relationships and patterns where they often just don’t exist. We could draw out a tedious link, create a narrative for such a phenomenon, talking about national morale, pride and celebrations.

And, yes, this may be partially true. For example, we may well see a short-term bump in a country’s hospitality profits, as a country celebrates. But it’s unlikely to be anything structural in the years ahead. We shouldn’t create casual links between two things, just because a spurious pattern or a good story exists.

As we move back into reality, sadly, the things that tend to matter aren’t as glamourous as Olympic success.

But UK equities do benefit from the podium finishing qualities of falling inflation, interest rate cuts and a stable political backdrop.

-

UK equities do benefit from the podium finishing medal winning qualities of falling inflation, interest rate cuts and a stable political backdrop.

So sticking with Gold(s)*, the Bank of England (BOE) is critical in the UK economy, utilising its monetary policy tools to meet its objective of maintaining monetary and financial stability.

*The Bank of England are responsible for the UK’s gold reserve. Now, what did I say about creating tedious links where they don’t exist…?

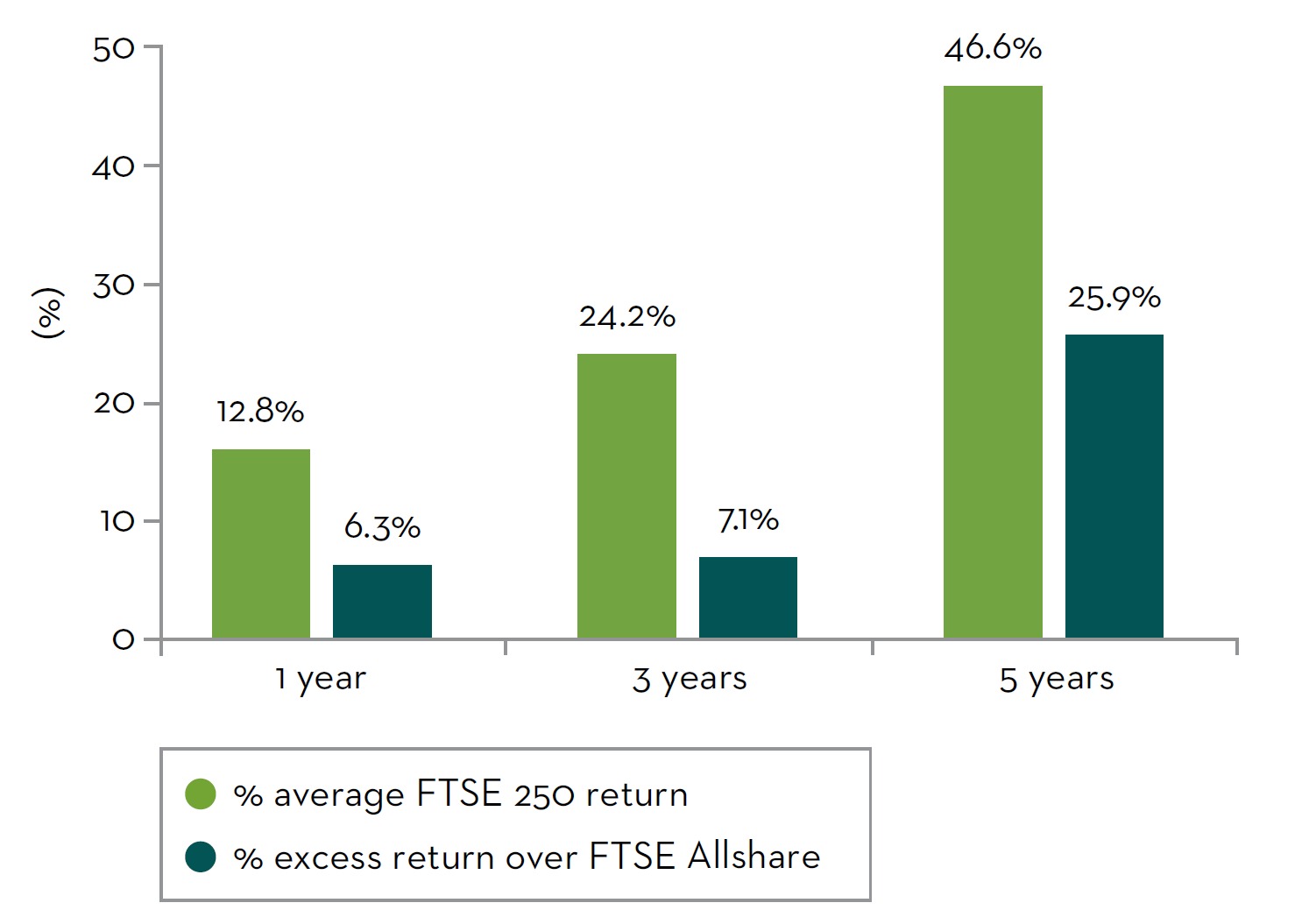

It’s less shimmery than a medal, but let’s talk about central bank rate cuts. Particularly, the historic link between BOE rate cuts and a multi-year period of outperformance for mid-cap stocks.

Looking at data over the last 30 years, the asset class tends to outperform the broader market following cuts over one, three and five-year periods.

FTSE 250 returns after UK Interest rate cuts (%)

Source: Martin Currie and Bloomberg as of 31 May 2024. Data is month end index for the month when UK interest rates were first cut. Date range analysed is 1990- 2024 (seven rate cut periods).

Here, the correlation makes sense as rate cuts are a stimulant to growth in an economy and disproportionately benefit the more domestically focused parts of the market, notably mid-cap stocks. This is a relationship that isn’t by chance, rather is one backed by reason, and we anticipate it will repeat itself.

The BOE is anticipated to begin cutting rates in the second half of the year. UK equity markets have already started to recover, with a buoyant nine months behind us. Yet it appears we are not long off the starting blocks. Rate cuts are combined with a new stable political backdrop, rapidly falling inflation and backed by an economy that is primed to rebound.

Moreover, the last nine month’s returns are from historic lows with UK equity valuations remain depressed on any long-term metric. History would suggest mid-cap stocks can continue to punch above their weight in the years to come. Now is certainly a good time to take a second look at the opportunity in front of us.

We would like to wish team GB good luck for the 2024 Paris Olympics (but we also know it’s not needed for excellent years ahead for the UK stock market!)

Sources

1Morningstar as at 31 December 2021.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document.

Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.

Copyright © 2024 Franklin Templeton. All rights reserved. Investment Products: NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE