Navigate to section within recording +

0:03:43 Panellist introductions

0:06:23 From a CSIRO perspective, what is the current state of play vs. expectations?

- A global perspective

- Down at the micro level

- BlueScope's natural gas pathway

- Worley and its role in the transition

- Changing the discipline of project delivery

- Worley’s ‘five shifts’

- Learning from collaboration success

- Scope of Telstra's emissions, targets and projects

- The barriers to getting there

- The importance of embracing risk

- The critical enablers – tech is not the limiting factor

- Worley seeing flow of capital shifting towards US

- Telstra's discussions with global telcos

- Early days for BlueScope operational benefits

- Implications on social licence to operate

- The IRA from a scientist point of view

- Telstra's experience with regulated and voluntary projects

- Community engagement and co-development

- Worley's experience with carbon capture

- BlueScope exploring offsets for scope 3 emissions

- Carbon credit market - conflict between priorities and sequencing

- Anna: Need to fundamentally rethink how we do things

- Tom: Opportunities and risks are too great not to

- Sue: We have the smarts to get there but capital is not flowing

- Warren: Generation capacity is there, but need to accelerate pipeline and capital allocation

01:11:30 How do we as investors apply this in an investment strategy

Net Zero in the Real World: The implications for Australian companies, investors and regulators

Hosted by Martin Currie and Franklin Templeton, the Pathway to 2030 Forum was held on 10 October 2023 in Melbourne.

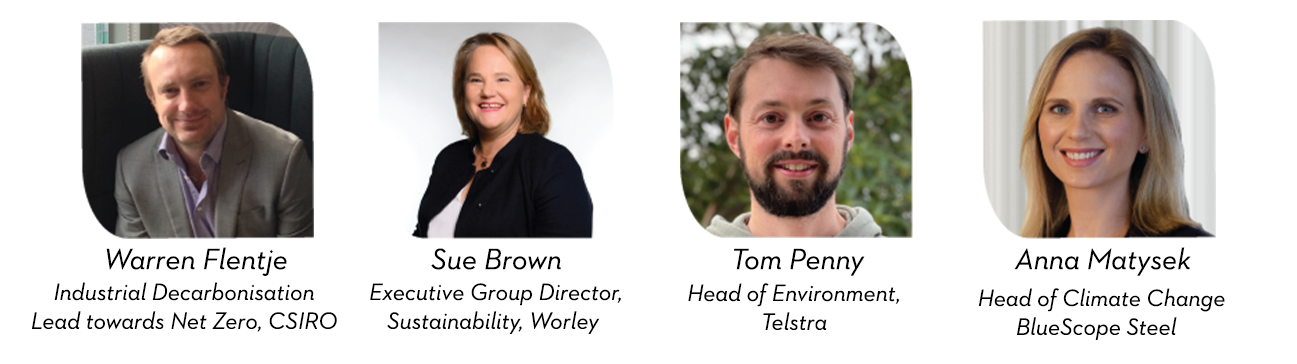

The panel, moderated by Will Baylis, Portfolio Manager for Sustainable Equities at Martin Currie, brought together investors, sustainability experts and leading ASX-listed companies who are at different stages in their energy transition and emissions reduction pathway.

Over the course of 90 minutes, the expert panel discussed how Australia and Australian companies are not short of ambition, skill or technology, but in order to improve the pace of energy transition pipeline fulfilment, we need to think differently about how to get capital flowing.

The panel offered their perspective on the critical elements to achieve this, including the use of transition fuels and carbon offsets, improved collaboration, a shift away from the traditional way of delivering infrastructure projects, and a focus on community and social licence to operate.

To bring this to life for investors, the Martin Currie Australia team also shared how we seek out companies that are thriving or failing on the Net Zero transition, and how we can apply our research and engagements with companies in our investment strategies.

Watch a full recording of the panel session above, and use the nagivation to jump to the relevant section or question.

-

Learn more about Martin Currie Australia, and discover more of our latest insights here.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this recording has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The recording does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this recording and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategies may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this recording has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The recording does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this recording and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategies may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.