As part of the Net Zero Asset Managers Initiative (NZAMI), Martin Currie Australia (MCA) is committed to supporting companies in achieving Net Zero greenhouse gas emissions by 2050 or sooner, aligning with efforts to limit global warming to 1.5 degrees Celsius.

To this end, we currently utilise, amongst other tools, the work of the Science Based Targets Initiative (SBTi) in validating investee company SBTs to help assess and guide our investment decisions.

While progress has been steady, achieving Net Zero is a complex process, requiring companies to navigate stringent requirements, evolving technologies, and competing priorities. In this article, we share insights from our recent engagements with ASX-listed companies about SBTs and explore the challenges and opportunities that lie ahead.

Our outreach work on Science Based Target verification

We believe that transparency and proactive engagement are key to achieving our shared objectives. As we work to further align our investment strategies with our sustainability goals, we initiated a focused outreach in November 2024 to large ASX-listed companies to understand their rationale for adopting (or not adopting) verified SBTs or any alternatives.

This company engagement builds on previous surveys on topics such as Modern Slavery (2021) and Biodiversity (2022), and our 2023 Net Zero in the Real World forum. At this forum we brought together investors, sustainability experts and leading ASX-listed companies who are at different stages in their energy transition and emissions reduction pathways.

These interactions continue to shape our investment process and the development of best practice frameworks for investee companies.

The lay of the land for SBTs

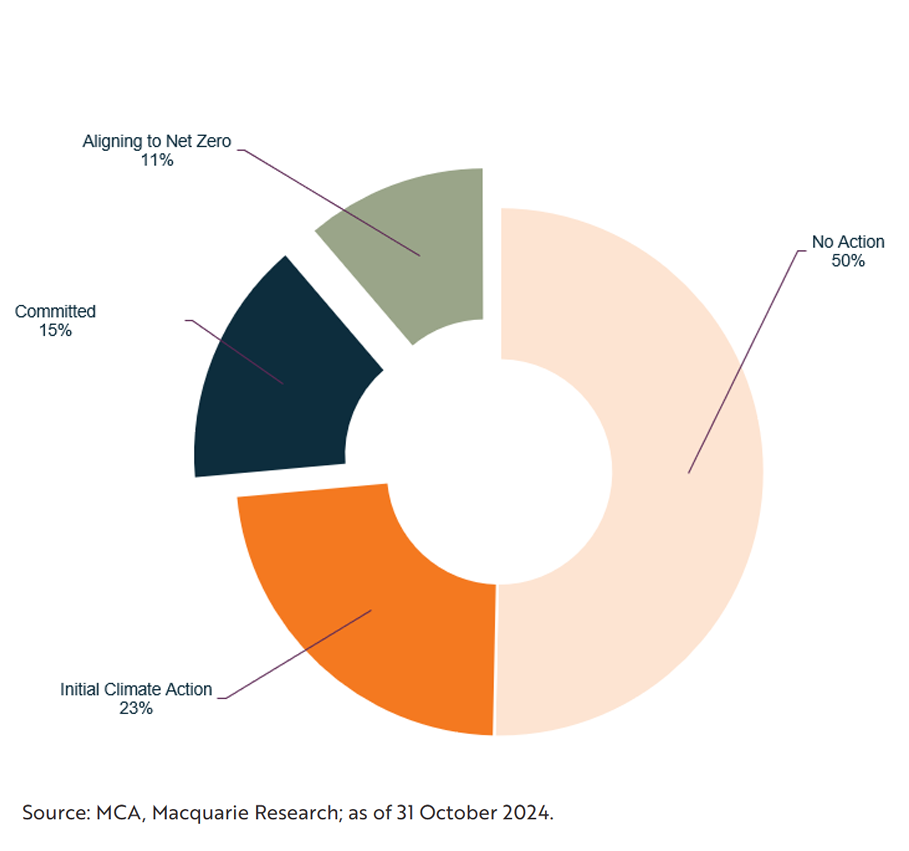

We began tracking SBTs as part of our NZAMI commitment in 2022. Today, based on our proprietary analysis, 11% of S&P/ASX 200 companies by market cap have set a fully verified SBT, and 15% are publicly committed towards achieving one. This means that 73% of the index by market cap still have no firm commitments to achieve SBT verification or are only in the very early stages of taking any climate action.

S&P/ASX 200: SBT status by category

SBT category definitions

SBT Set- Achieving net zero: Emissions performance is at net zero and expected to remain so.

- Aligned to net zero: The company has set an SBT and is on track to meet it.

- Aligning to net zero: The company has set an SBT but is not yet on trajectory to meet it.

Committed:

- Committed: The company has publicly committed to setting an SBT.

Other:

- Initial Climate Action: The company is making efforts to reduce emissions but is currently not committed to, or may be unable to, reach net zero due to technical, social, or economic barriers.

- No Action: The company has not yet made any meaningful efforts to reduce emissions.

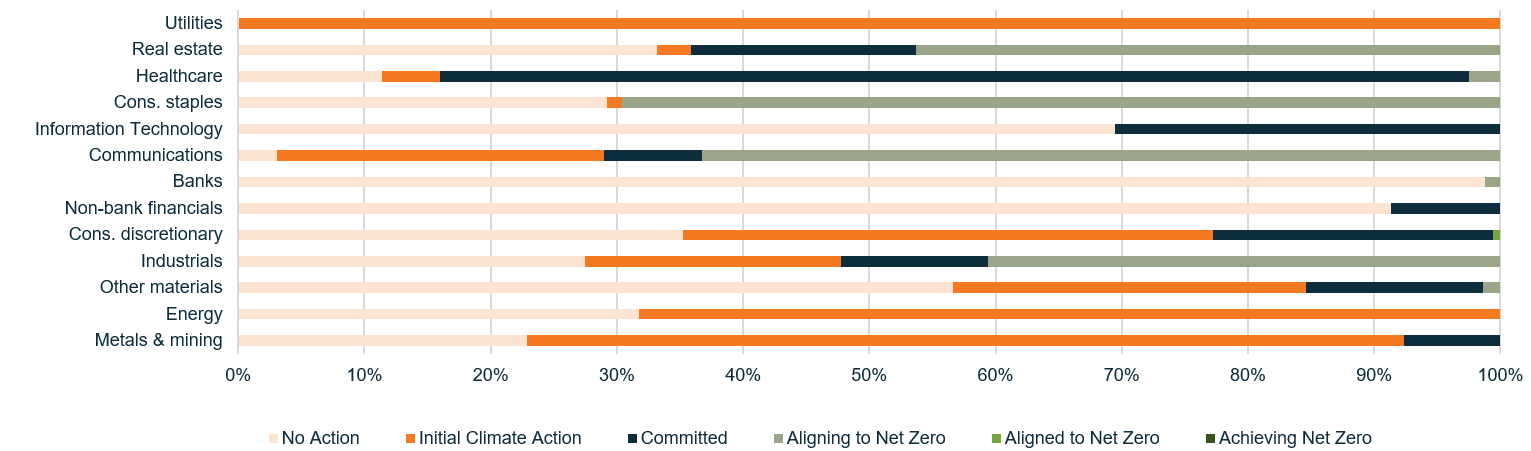

On a sector-by-sector basis, companies in the real estate, consumer staples, communications and industrials sectors have progressed the most with verification, while healthcare companies are largely committed to the process. Unsurprisingly, utilities, metals & mining, and energy are the laggards.

S&P/ASX 200: SBT status by sector

Source: MCA, Macquarie Research; as of 31 October 2024.

Survey identified key issues for SBT adoption

Since we began tracking SBTs, we have seen improvements in the verification statistics for S&P/ASX 200 companies, improving from 15% of the market committed or verified in July 2022 to today’s 26% as mentioned above.

However, in consolidating the company responses to our specific questions, we have been surprised by the results. Instead of embracing SBTs, we found that many companies are choosing not to pursue an independent verification or are even dialling back on their original commitments.

The reasons for this were multi-faceted:

1. Regulatory compliance on carbon emissions takes precedence

Demands upon companies to provide more transparency on climate and emissions, from regulatory agencies, industry bodies and investors, have accelerated over the last 10 years.

This year, the Government has established new mandatory Australia Sustainability Reporting Standards for large Australian businesses, which includes climate-related disclosures, with ASIC responsible for administering the reporting requirements under the Corporations Act.

With a short implementation timeline, companies have told us that they are focussing their initial efforts on ensuring compliance with the Corporations Act, which doesn’t require external validation. Many are considering revisiting other Net Zero frameworks and benchmarks including SBTi verification in the future.

2. Stringent SBTi requirements

SBTi verification is aligned to a 1.5-degree scenario and requires the ability to measure Scope 3 emissions and an ongoing recalibration of targets. Many companies are still struggling with Scope 3 emissions, but this should change with the ramp up of mandatory reporting in Australia.

Companies in ‘Hard to abate’ industries are sharing that it is extremely difficult to commit to a 1.5-degree pathway based on current technology pathways. The lack of progress in green hydrogen is notable in this regard and is a global phenomenon. SBTi excludes companies with over 5% of revenue from fossil fuel assets, irrespective of use case (coal for steelmaking vs. coal for energy generation).

Many companies have also noted that business complexity, i.e. conglomerate structures, make it difficult to align.

Furthermore, setting carbon reduction targets is a material issue, and companies and Boards rightly hold themselves to very high standards when making these commitments. Without a reasonable basis supported by evidence, they are finding it hard to make such commitments.

The substantial cost of transition is also another factor given the post-Covid inflationary environment that we all operate within. For many companies, ESG issues may well take a back seat should the economy weaken and unemployment rise, with social issues already ranking above climate for many Australians. The Australian Energy Market Operator (AEMO) is also pointing to acute shortages of base load power in coming years, and companies that can readily access renewable energy are in a much stronger position to be able to meet Net Zero targets.

Meeting a linear reduction in emissions was also referred to by many survey respondents as a ‘theoretical target’ and therefore they didn’t see it as applicable in the real world.

3. Sector and Australian specific challenges

Given the Australian market’s resource-heavy composition, many non-resource companies are questioning if there really is a requirement of gaining SBTi validation when these large emitters are not. SBTi verification has not been widely adopted in the mineral resource sector in Australia, with Fortescue being the only significant large company signatory.

4. Alternative industry frameworks

Many companies cited that there are alternatives to SBTi-based verification that are more relevant for their industries, including the Australian government’s voluntary Climate Active Carbon Neutral Certification and the UN’s Net Zero Banking Alliance guidelines. In the property space, alternative verifications include NABERS Energy ratings, Global Real Estate Sustainability Benchmark (GRESB) scores and the World Green Building Council’s Net Zero Carbon Buildings Commitment.

That said, we also heard the alternatives that some companies have identified are currently in their early stages of being like-for-like replacements. For example, the Climate Active Carbon Neutral Certification standard emphasises transparency and public reporting but does not consider climate science-aligned reduction levels and allows a heavy reliance on offsets. We have seen companies such as Telstra move away from this offset approach, making the decision to move funds away from the purchase of carbon credits in favour of investing directly in decarbonisation projects that will directly reduce their carbon footprint overall.

SBTi is also currently in the process of developing the Financial Institutions Net-Zero (FINZ) standard, and some companies we contacted in the financial sector are waiting on this before moving forward to avoid an incomplete view of transition.

Emerging trends

What these comments highlight to us is that a single-minded pursuit of perfection (1.5 degrees) may perversely be hindering independent verification. We suspect more companies will look to align with an organisation like SBTi if a below 2-degree scenario was the gateway as opposed to 1.5 degrees.

Companies also noted that their Net Zero targets are already more ambitious than SBTs, and therefore SBTi participation would not drive further emissions reductions beyond their voluntary commitment.

Another emerging theme that we are hearing is community objections and social implications from building wind farms in regional communities, and how this will impact the rollout of the renewable energy infrastructure required to facilitate the emission reduction targets. This also may be impacting the desire to lock in verified targets.

The rise of protectionist policies and economic competition, as seen in recent US political trends, could shift global focus away from climate action, potentially influencing corporate priorities. The US election of Donald Trump on a large popular vote also demonstrates this social trend, and we anticipate further pushback on ESG topics.

What's next?

The SBTi sets a high bar for climate action, and while our goal of achieving verified SBTs for 100% of portfolio holdings by 2040 may be too ambitious, we remain committed to driving progress, albeit at a slower pace than the linear trajectory of our Funds suggests.

Our research and analysis results suggest that achieving Net Zero requires a balanced approach — combining ambition with adaptability towards verified and non-verified targets — to encourage broader industry participation and meaningful action.

By engaging with companies transparently and supporting pathways that balance ambition with practicality, MCA remains committed to playing a pivotal role in a more sustainable, low-carbon future.

Discover more about Martin Currie Australia

-

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here.

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here. -

Click here to meet the Co-Portfolio Managers of the Martin Currie Australia Sustainable Equity strategy, Will Baylis and Naomi Bant.

Discover more about Martin Currie Australia

-

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here.

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here. -

Click here to meet the Co-Portfolio Managers of the Martin Currie Australia Sustainable Equity strategy, Will Baylis and Naomi Bant.

Important information

This publication is issued for information purposes only and does not constitute investment or financial product advice. It expresses no views as to the suitability of the services or other matters described in this document as to the individual circumstances, objectives, financial situation, or needs of any recipient. You should assess whether the information is appropriate for you and consider obtaining independent taxation, legal, financial or other professional advice before making an investment decision.

Neither MCA, Franklin Templeton Australia, nor any other company within the Franklin Templeton group guarantees the performance of any Fund, nor do they provide any guarantee in respect of the repayment of your capital.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, or a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable. It is not known whether the stocks mentioned will feature in any future portfolios managed by MCA. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier, and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.

- Income strategy charges are deducted from capital. Because of this, the level of income may be higher but the growth potential of the capital value of the investment may be reduced.

Important information

This publication is issued for information purposes only and does not constitute investment or financial product advice. It expresses no views as to the suitability of the services or other matters described in this document as to the individual circumstances, objectives, financial situation, or needs of any recipient. You should assess whether the information is appropriate for you and consider obtaining independent taxation, legal, financial or other professional advice before making an investment decision.

Neither MCA, Franklin Templeton Australia, nor any other company within the Franklin Templeton group guarantees the performance of any Fund, nor do they provide any guarantee in respect of the repayment of your capital.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, or a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable. It is not known whether the stocks mentioned will feature in any future portfolios managed by MCA. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier, and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.

- Income strategy charges are deducted from capital. Because of this, the level of income may be higher but the growth potential of the capital value of the investment may be reduced.