Content navigation

Over the last week we have seen elections in India and Mexico, with surprising results. On one side, India’s Narendra Modi and the Bharatiya Janata Party (BJP) saw its majority unexpectedly cut. In Mexico, leftist Claudia Sheinbaum unexpectedly won a substantial majority.

India

The 2024 Indian election is arguably the largest democratic exercise in the world. The country’s electoral commission estimates that in 2024 there are 968 million registered voters1. The elections for 18th Lok Sabha, the lower house, took place from 19 April to 1 June in seven phases covering 543 constituencies.

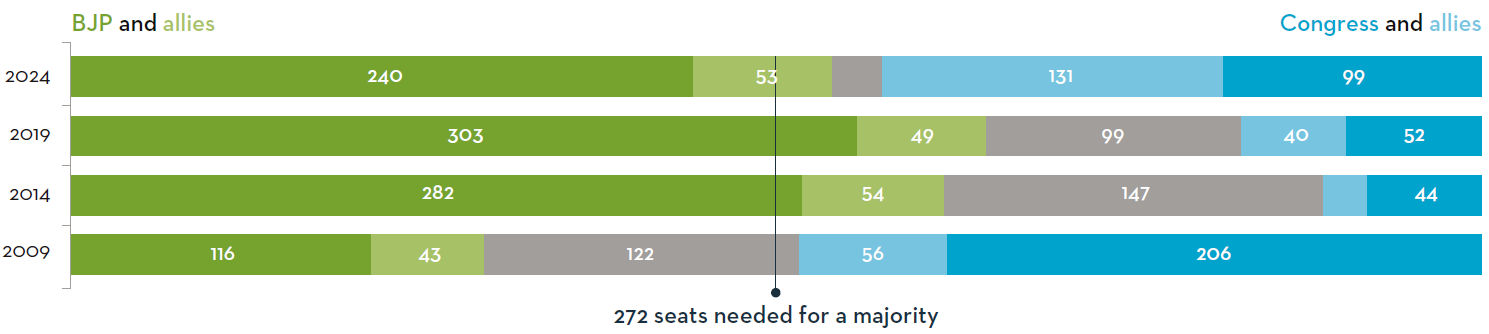

The BJP led by Prime Minister Narendra Modi was expected to maintain a majority on its own. This has been shaken up by an unexpectedly strong result for the opposition Indian National Congress (Congress Party). Modi is now dependent on his coalition partners of the National Democratic Alliance (NDA) and potentially faces making concessions to coalition partners.

![]()

Expectation: The BJP maintains a majority

The exit polling implied that Modi’s BJP alliance (with NDA) would have between 360-400 seats in the Lok Sabha (lower house). This implied that BJP itself would win 272+ seats to maintain a clear majority from the 543 seats.

By maintaining a clear majority, BJP would not need to make any material concessions to its coalition partners going forward.

![]()

Result: Modi dependent on collation partners

The BJP failed to win the required 272 seats to form a majority government on its own. They had to depend on their NDA coalition partners to maintain their majority. Modi’s collation partners have backed him as Prime Minister for a third term.

The market reacted negatively to the result of a reduced Modi majority with a US$400 billion rout, and overseas investors selling a record US$1.4 billion shares2.

Implications: Growth to continue regardless

Modi’s historic reforms are benefitting growth today. In 2018, India was 8% of MSCI Emerging Market index; at end of 2023 it was 18%3. We expect that growth will continue in India, GDP is forecasted to grow at an average of 6.5% annually over the next five years4. High-quality Indian businesses have the potential to accelerate their growth and compound returns, the two-year forecast Earning Per Share (EPS) for the MSCI India is 16%5. Politics will not disrupt the country’s strong growth outlook.

Mexico

Mexico went to the polls on 2 June to elect their next President. For the first time in history, the election was between two female candidates. Claudia Scheinbaum of the ruling Moreno Party (National Regeneration Movement) is close to incumbent President Andrés Manuel López Obrador (known as AMLO). Scheinbaum’s platform was focused on continuing AMLO’s policies of inclusive economic growth and sustainable development. Her opponent, Xóchitl Gálvez of the National Action Party (PAN), is known for her advocacy on indigenous rights and technological innovation with her platform had a focus on governance reform.

Contrary to expectations, Scheinbaum and the Moreno party won by a significant margin. This gives them the ability to pass significant reforms. After losses on both the domestic stock market and a sell-off of the peso6, the market will now be focused on gaining confidence around potential reforms and the drivers of fiscal growth.

![]()

Expectation: Scheinbaum to win by a ‘simple majority’

A week ahead of the election, polls suggested that Scheinbaum and the Moreno Party would win the election by a midteens margin over second-runner, Galvez, in terms of the popular vote.

Furthermore, the market expected that the Moreno Party would win only a simple majority in the congress, around 52-53%. In Mexico you need a two-thirds majority, known as a “Qualified Majority”, to pass significant constitutional reforms.

![]()

Result: Scheinbaum wins a ‘Qualified Majority’

The preliminary results by the election authority of Mexico showed Scheinbaum and the Morena party delivered a 30% margin in the Presidential election. This is equivalent to nearly ~38million people.

More importantly, the Morena party won a qualified majority in the house and is set to potentially deliver a qualified majority in the Senate. Of the nine state governor elections, the Morena party won seven, including control of the allimportant Mexico City Governorship.

Implications: Growth to continue regardless

Many constitutional reforms have been discussed ranging from changes to the autonomous agencies in Mexico to the appointment of the Supreme Court. Most believe that Scheinbaum will continue pro-economy, poverty reduction policies such as continued increases in the minimum wage. Economic policy will be a key focal point going forward.

Both the market and the Mexican peso fell sharply over fears of ability of the Sheinbaum administration’s ability to implement potentially market unfriendly policies6, further volatility is expected. The market will now look for confidence around measures such as Pemex reform (the stated owned energy firm), finance ministry, and fiscal revenue engines.

Sources

1Source: Statista Research Department and Indian Electoral Commission, 22 April 2024.

2Source: Bloomberg as at 6 June 2024.

3Source: MSCI as at 31 December 2023. Weighting MSCI India 31 December 2018 versus 31 December 2023.

4Source: Statista and IMF World Economic Outlook. Data calculated to 31 December 2023, released in April 2024, amended 21 May 2024.

5Source: FactSet and MSCI, as at 31 December 2023.

6Source: Bloomberg as at 6 June 2024.

Important Information

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria.

Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.