Artificial intelligence (AI) is captivating investors worldwide with much promise of change and innovation, but how can income-focused investors benefit from this boom?

With AI growth exploding, listed Real Assets can provide steady income while benefitting from these substantial tailwinds. Critically, Real Asset investments such as Data Centres and Energy Utilities, are essential to AI’s growth.

Being active and owning the right kind of listed Real Assets matters. We believe a blend of select Property, Infrastructure and Utilities can truly benefit from the megatrends of explosive data growth and electricity demand.

Data Centres – The Backbone of the AI explosion

Data Centres are the backbone of the AI data explosion, housing servers and storage systems crucial for AI workloads and support cloud computing services. Clients of Data Centres include Hyperscalers such as Amazon Web Services, Microsoft Azure, Google Cloud Platform.

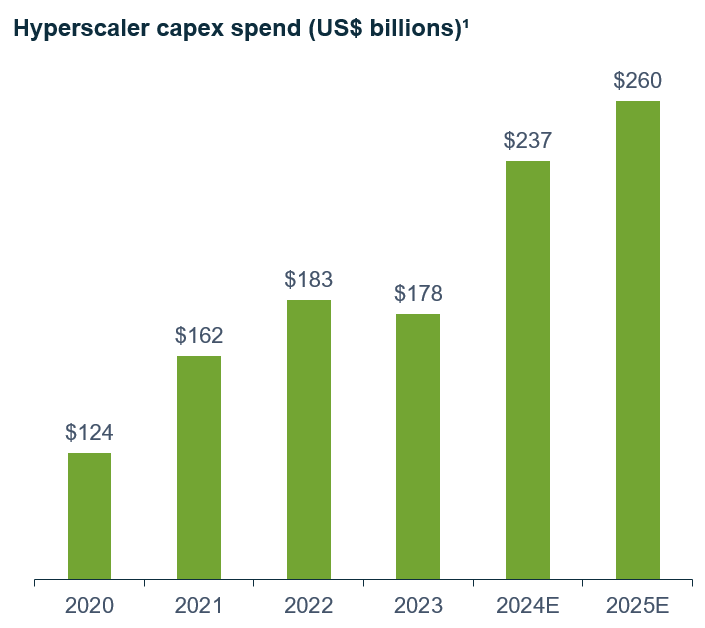

The global Data Centre market is experiencing rapid growth, driven by the increasing demand for these data services. The Hyperscalers have also set plans to more than double their capital expenditure (capex) from already very high levels of just five years ago1.

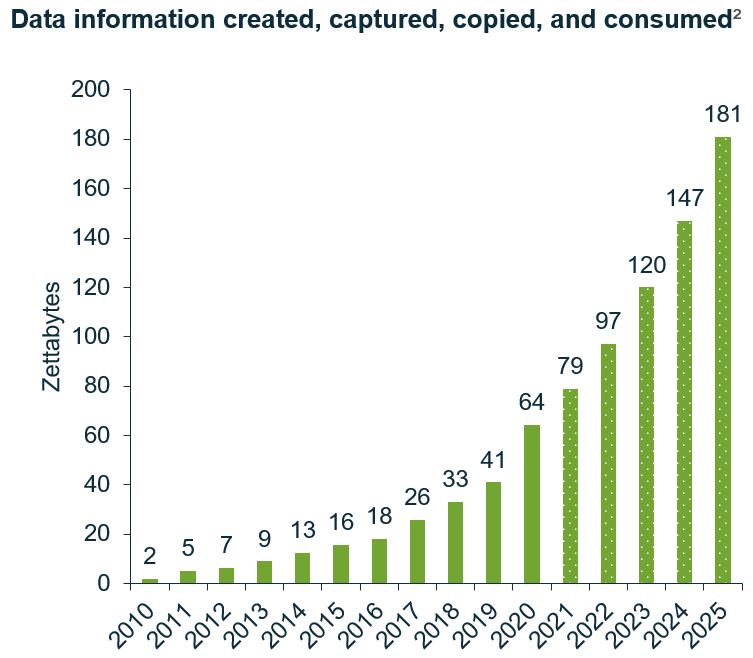

As technology advances, AI applications will generate massive amounts of data requiring more sophisticated, robust storage capacity and solutions2. Importantly, Data Centre landlords typically charge customers based on their data use, measured in kilowatts rather than actual space used. This contrasts with say office landlords where rent is charged on a square metre basis.

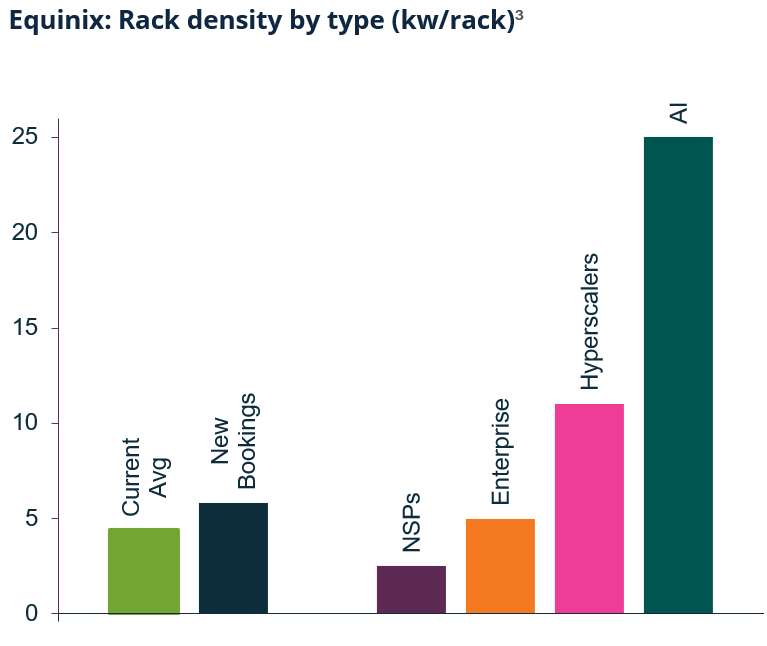

In Data Centres, this is analogous to charging tenants based on how many people sit on each floor (density) rather than the floor area itself – and AI is driving up density in a huge way. AI deployments ‘occupy’ up to five times more ‘space’ than current uses, as shown by Equinix’s rack densities in the chart below 3.

-

For income-focused portfolio, we prefer listed Real Assets that protect income streams against inflation and provide dollar income growth that meet our “essential ingredients” requirements.

Key Data Centre Investments:

We have identified several listed Data Centres that align with our “essential ingredients” criteria:

- Digital Realty Trust (US): A global leader in Data Centre ownership and operation, Digital Realty Trust benefits from the tailwinds of rising data usage. With 300+ data centres in over 50 cities, they exhibit healthy rental growth and a strong brownfield development pipeline. Their 15-year dividend growth track record highlights effective management despite the capital-intensive nature of the business. High returns on incremental capital reflects their meaningful value add, as tenants seek out their security of service, global reach and ability to deliver timely product.

- Digital Core REIT (Singapore): Sponsored by Digital Realty, this REIT owns a well-managed Data Centre portfolio with global assets, focusing on the growing hyperscale business. Rising interconnection fees on non-hyperscale assets boost organic growth.

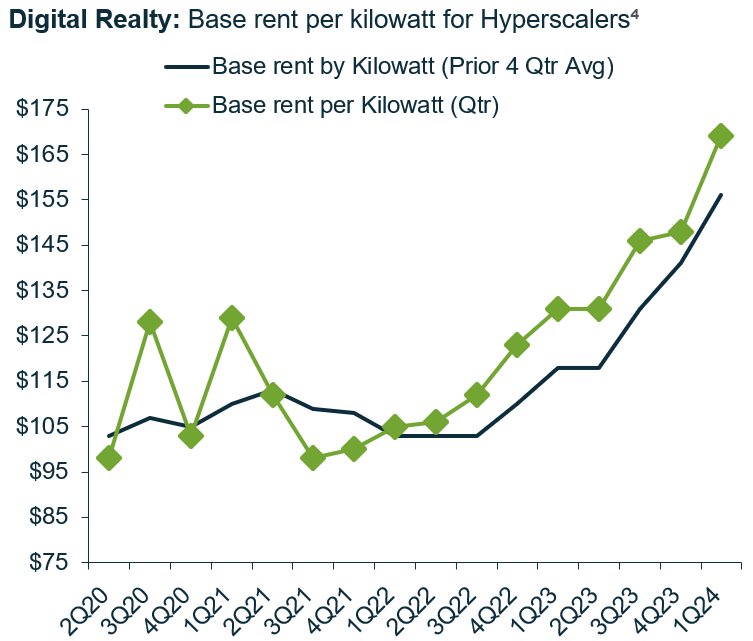

In the face of this very strong tenant demand, and despite large increases in supply, these incumbent Data Centre landlords are enjoying very strong pricing power through their ability to raise rent.

The chart to the right highlights the uptick in leasing activity for Digital Realty Trust4 .

However, not all listed Real Assets with Data Centre exposures meet our essential ingredients criteria. For example, Australia's Goodman Group, known for its logistics assets, is also entering the Data Centre market. Its focus on new ‘greenfield’ projects reinforces high development spend and lower dividends. Coupled with a high multiple, our preference continues to be for the incumbent Data Centre landlords who stand to benefit by billing out their current portfolios and brownfield developments at higher rents.

Energy Utilities – Powering the AI Surge, sustainably

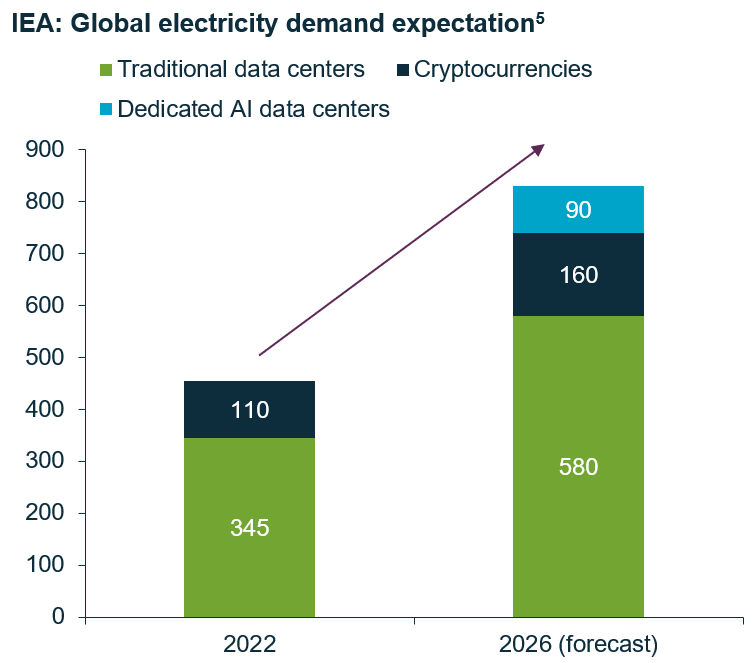

AI operations, particularly deep learning, require significant computational power. Data Centres must ensure continuous, reliable power supply to prevent downtime and data loss. The International Energy Agency (IEA) reported that an AI query uses around 10 times as much energy (2.9 Wh of electricity per request) as a traditional Google query (0.3 Wh)5, translating to high electricity consumption by the Data Centres. The IEA report also suggests that global Data Centre electricity demand is set to double by 20266, equivalent to Japan’s entire electricity consumption.

As the energy demand grows, the focus shifts towards renewable and sustainable power solutions to reduce carbon footprints and meet regulatory requirements. A shortage of available power and transmission connections could limit Data Centre growth, an issue already observed in some markets. A synergy between AI, Data Centres, and Energy Utilities is crucial, especially as the world shifts towards greener energy sources and upgrades to the transmission grid are required.

Key Energy Utility Investments:

We have identified several utility companies that are supporting the growing AI market and are also expanding their renewable energy portfolios:

- Southern Co, Duke Energy and Dominion Energy (US): These U.S. Sunbelt-based integrated Energy Utilities are investing in network upgrades and renewable energy projects to ensure consistent power supply. Data Centre demand growth already drives their demand growth, with Southern Co reporting a 12% increase in electricity sales in the first quarter of 2024, compared with the same period last year7.

- AGL Energy (Australia): A leading integrated energy company, AGL is focusing on battery storage and renewable energy to support the growing Data Centre market. Significant expansion plans in Australia’s Data Centre sector announced over the last 12 months are expected to drive energy demand growth in the years ahead 8.

- National Grid (UK): This British multinational operates UK energy transmission networks predominately in electricity. In mid-2024, the company announced a significant step up in energy infrastructure investment worth around £60 billion over the next five years¸ supporting the energy transition and growth in Data Centres, AI and electrification9.

Martin Currie’s listed Real Asset strategies align with the AI boom

Investing in AI-related opportunities extends beyond the expensive, dividend-less tech giants like NVIDIA and the ‘magnificent seven’. Savvy investors, especially those seeking reliable income, should consider the critical infrastructure supporting the AI ecosystem as Data Centres and Energy Utilities.

Through active management, the Martin Currie Australia Real Income and Global Real Income strategies can provide an effective exposure to these sectors:

- Avoiding Concentrated US Bias: Passive Real Asset investing, particularly through ETFs, often focuses on indices with a concentrated US bias, neglecting opportunities in other regions crucial for AI development.

- Transparency and Liquidity: Focusing on listed investments provides access to Data Centres and Energy Utilities sub-sectors not well-represented in the unlisted market, avoiding many transparency and liquidity issues.

- Balanced Approach: Investing in Data Centres and Energy Utilities alongside a blend of best-in-class listed Infrastructure/Utilities securities, offer a balanced approach, combining growth potential with stable income generation.

- Diversified Exposure: A broader opportunity set limits individual security, sector, and industry concentration risk, enabling strategic moves between the sectors when better opportunities arise to increase income and total returns.

- Managing Valuation Risks: This diversified exposure also helps manage the valuation risks seen in other segments of the AI ecosystem.

Ultimately, we believe that our unique listed Real Asset strategies will help investors align with the AI boom and offer a stable income stream, making them an attractive option for income-focused portfolios.