Content navigation

Things can only get better?

The UK’s economic backdrop is suggesting this could be 1997 again

- Real wage growth and full employment has overturned a negative outlook and seen the UK economy grow - but the Purchasing Manager Index growth (PMI) actually suggests broader-based growth

- Post election, any incoming government will be fiscally neutral, reassuring bond markets. Certainty for corporate and consumers backed by interest rate cuts should support solid economic growth over next 12 months

- Sterling’s increasing strength is potentially a once-in-a-generation event. We’ve been here before in 1997 when currency strength and falling gilt yield supported a positive outlook for UK equities

The UK economy progressed as we expected in the first half of 2024. The perennial negative outlook was met by a series of betterthan- expected data points that has seen the economy gently grow, and the negative second half of 2023 has been overturned.

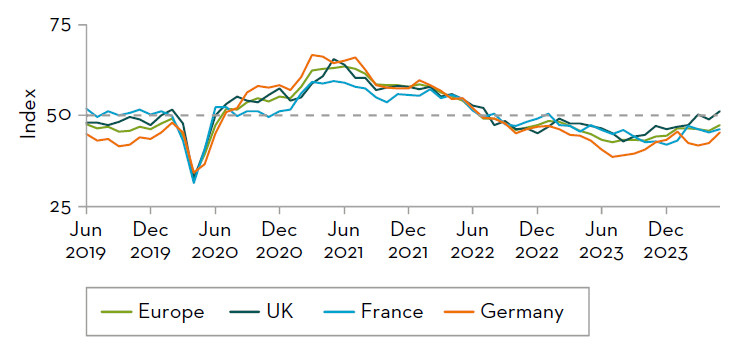

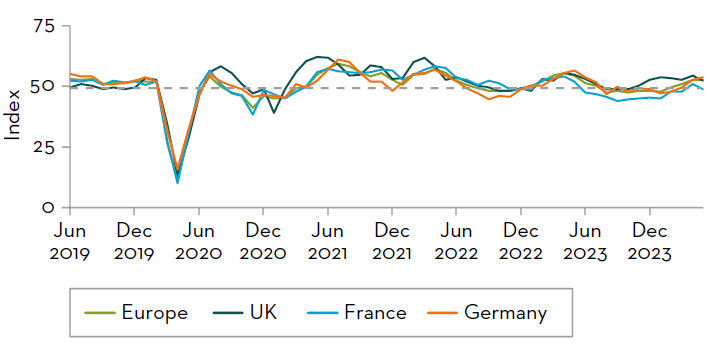

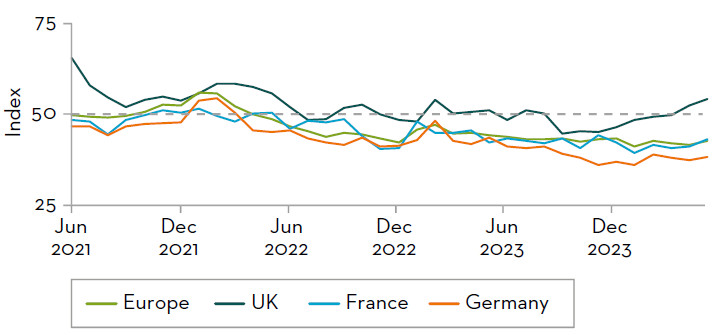

Key in the short term have been real wage growth and continuing full employment. But the reality is that the recovery has been broader than that: as the PMI data shows, the UK is the only country in Europe which has a positive outlook in services, manufacturing and construction and it is striking.

Manufacturing PMI – five years

Services PMI – five years

Construction PMI – three years*

Source: Martin Currie, FactSet and OECD, as at 31 May 2024. *Construction data only available since 2021.

-

The UK is the only country in Europe which has a positive outlook in services, manufacturing and construction.

Recovering confidence

The question is, what will happen in the second half of the year after the election, assuming the UK enters a period of stability? Whilst any incoming government will alter the balance of taxes, with windfall taxes on energy and utility companies, the overall position is likely to be fiscally neutral which will reassure the bond markets. The certainty given to both corporates and consumers will add confidence to the recovery and, backed by interest rate cuts, the next twelve months should show solid growth. Although not even the most ardent optimist would be predicting growth faster than 2%, that was the average growth rate from 2010-20191.

The key will be inflation. The accelerant of inflation is energy and the transmission mechanism to the consumer is food and fuel. Unless there is a major new conflict, energy prices ought to continue to stabilise and thus the secondary effects should as well. This will lead to a more benign inflation picture in 2025 and pave the way for further rate cuts.

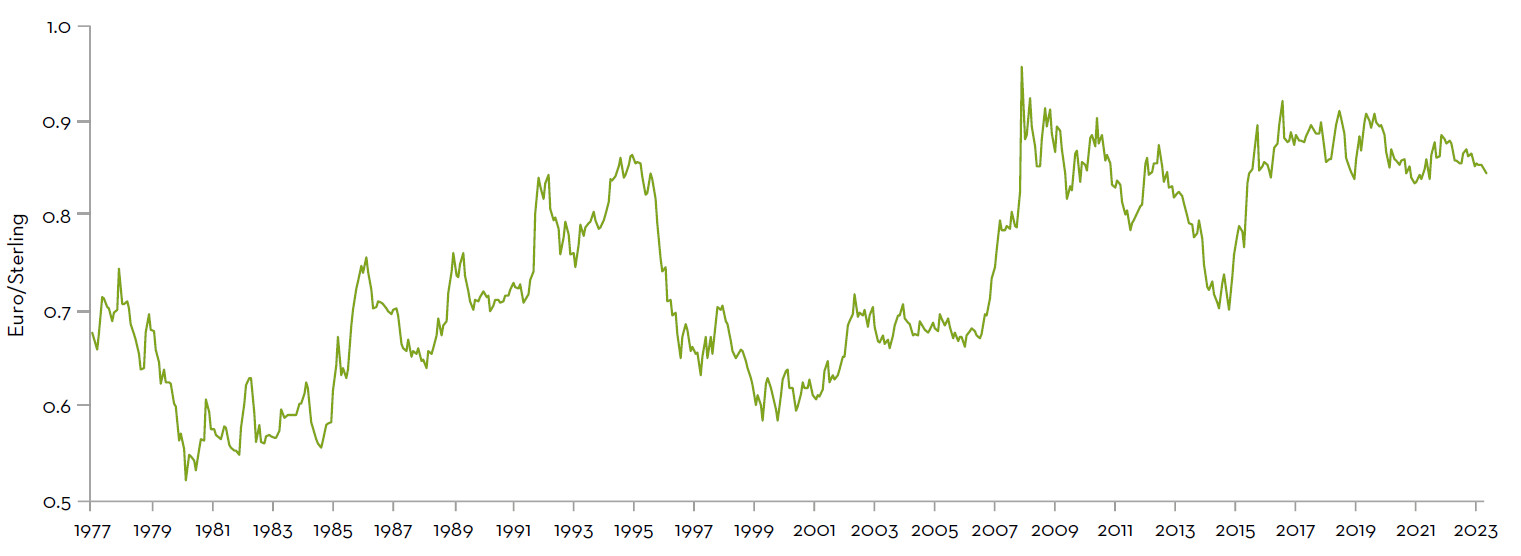

Sterling’s strength could be a once in a generation event

It is worth recognising that the international perception of the UK is changing. A change of government, to one more moderate and international in tone, coupled with a deterioration of the European political stability, notably in France, indicates that there remains room for sterling to appreciate. This would be beneficial for lowering inflation rates even further.

Should the Bank of England’s Monetary Policy Committee (MPC) be slow to cut rates in the second half of 2024, while the European Central Bank is doing the opposite, then the chance rises for sterling to further appreciate. At the same time, a reduction in the risk premium for UK assets could accelerate sterling’s move and positively surprise the equity market.

We’ve seen this before, with three reversals of the euro agianst sterling (prior to 1999 the European Currency Unit is used). In each period, we’ve seen a fiscally prudent UK versus a weak and uncertain Europe.

Sterling versus the euro – 30 years

Source: Bloomberg as 25 June 2024. *Prior to 1 January 1999, the European Currency Unit is used, a basket of European Economic Community currencies.

In late 1970s and early 1980s, Margaret Thatcher had taken over and was squeezing inflation through high interest rates in the UK, this was as France’s Francios Mitterrand was pursuing an agenda of nationalisation. Then from 1996-99 as the euro was being introduced there was real economic uncertainty, especially in Germany. In contrast the UK economy was strengthening, then Tony Blair was elected in May 1997. Finally, between 2010 and 2015 with UK Conservative/Liberal Democratic coalition, there was a period of sound money management and low growth. Europe was recovering from the sovereign debt crisis.

Let’s make one more comparison, again with 1997 and an incoming Labour government. UK gilts and sterling were rallying and continued to do so once Blair was elected.

Sterling versus the euro – 30 years

Source: Bloomberg as 25 June 2024.

We are seeing the same conditions now, could this be a repeat of 1997? Sterling is getting stronger, and we are more than likely to have an incoming Labour government. To quote a well-known campaign slogan from 1997 ‘things can only get better?’ With the current backdrop we would like to think so for the UK’s equity assets.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

For institutional investors in the US:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.