Content navigation

French snap elections increase Eurozone sovereign risk and bring the 2027 elections into focus

The surprise decision by French president Emmanuel Macron to dissolve the lower house of Parliament, and hold a snap election, following the heavy defeat in the European Parliamentary elections this month, is bringing the spectre of the risk from 2027 Presidential elections closer to investors’ minds.

This is as we predicted prior to the elections, although we did not anticipate that this risk would surface so rapidly and so forcefully. French bond yields have been widening, although arguably simply capturing the increased political uncertainty, rather than behaving in a disorderly manner.

We believe that a significant win by the radical right party Rassemblement National (RN) in the snap elections could lead to bond yield spreads widening further, which could bring additional downside risk to the French equity market. This could however represent a good buying opportunity for investors in our view. This is on the basis that many of the more radical, anti-EU integration policies of the RN would be difficult to implement under a cohabitation government, with Macron retaining the presidency, and the RN party nominating the Prime Minister.

We would see any unusual bond yield widening and an equity sell off as a potential overreaction to the fear of radical policies being implemented versus the more likely reality of a status quo and political paralysis under that structure.

Whilst Macron’s decision to hold a snap election could be portrayed as a tête brûlée1 approach, there could be a more Machiavellian2 calculation behind his decision. It could either shake off the radical right threat by calling upon French citizens’ anti-extremes sentiment, or it could usher the radical right into the Prime Ministerial seat, which is a double- edged sword for that party. The threat of the 2027 Presidential elections is however omnipresent in any scenario, and will likely be an important risk event and focal point for investors.

In the following document we detail our thoughts and implications for investors.

1Tête brûlée is a French term that technically translates into “burnt head”, but is typically used to describe a person who voluntarily takes reckless and inconsiderate risks, in a kamikaze manner.

2A perhaps less known fact about President Macron’s past is that his undergraduate thesis was on Niccolo Machiavelli, perhaps making him an expert on the topic. Machiavelli was a 15/16th century Italian diplomat from the Renaissance era, best known for writing ‘The Prince’ a political treatise, giving rise to the term ‘Machiavellian’.

Machiavelli’s advice to rulers includes“avoid being hated. In the choice between siding with the nobles or with the people, it is always better to have the people on your side”.

-

It could either shake off the radical right threat by calling upon French citizens’ anti-extremes sentiment, or it could usher the radical right into the Prime Ministerial seat, which is a double-edged sword for that party.

Surprise French snap elections - A Machiavellian or tête brûlée move by President Macron?

Machiavellian perhaps

President Macron might be making a Machiavellian calculation, calling upon the French voters to give him a stronger mandate to govern over the last three years of his presidential mandate. His Renaissance party (RE) is lagging into third position ahead of the snap elections to be held on 30th June for the first round, and 7th July for the second round (all parties gaining 12.5% or more of votes move to the second round). This calculation relies on the traditional anti-Le Pen sentiment (both Marine and her father Jean-Marie) that has been expressed across a broad range of the French political spectrum in the past. We detailed this in our report ahead of the European parliamentary elections, which can be accessed here.

In effect, Macron is relying on a so-called silent majority of French voters who typically oppose extremist parties.

Should the radical right party of Marine Le Pen, RN, win a significant share of the votes, it could be in a position to nominate the Prime Minister of France for the next three years, i.e. until the next presidential elections to be held in 2027. For that to happen, if the RN party does not get an absolute majority, they would need to form some form of coalition with other parties, which could be difficult to achieve, given the historical dislike of the Le Pen radical policies on immigration and the Eurozone.

In any scenario however, Macron would remain as French President, and France would experience a so-called cohabitation regime, whereby the French political dynamics are split between parties with different policies and ideologies. This would likely lead to a political paralysis or a slower pace of decisions, as experienced in the past (1986-88, 1993-95, and 1997-2002) under the Francois Mitterrand presidency, with Jacques Chirac and then Edouard Balladur as prime ministers, and with the Chirac presidency, with Lionel Jospin as prime minister. Periods of cohabitation shift the political system from a presidential system to a parliamentary system.

This could prove to be a double-edged sword for the RN party, who would be seen to be in a position to govern the country, but who would in practical terms not be able to make major changes to policies. This could increase the risk of the RN being perceived as inexperienced to govern, which could impact the dynamic of the 2027 presidential race. If that is the case, the surprise snap elections by President Macron could turn into a good Machiavellian calculation on that front.

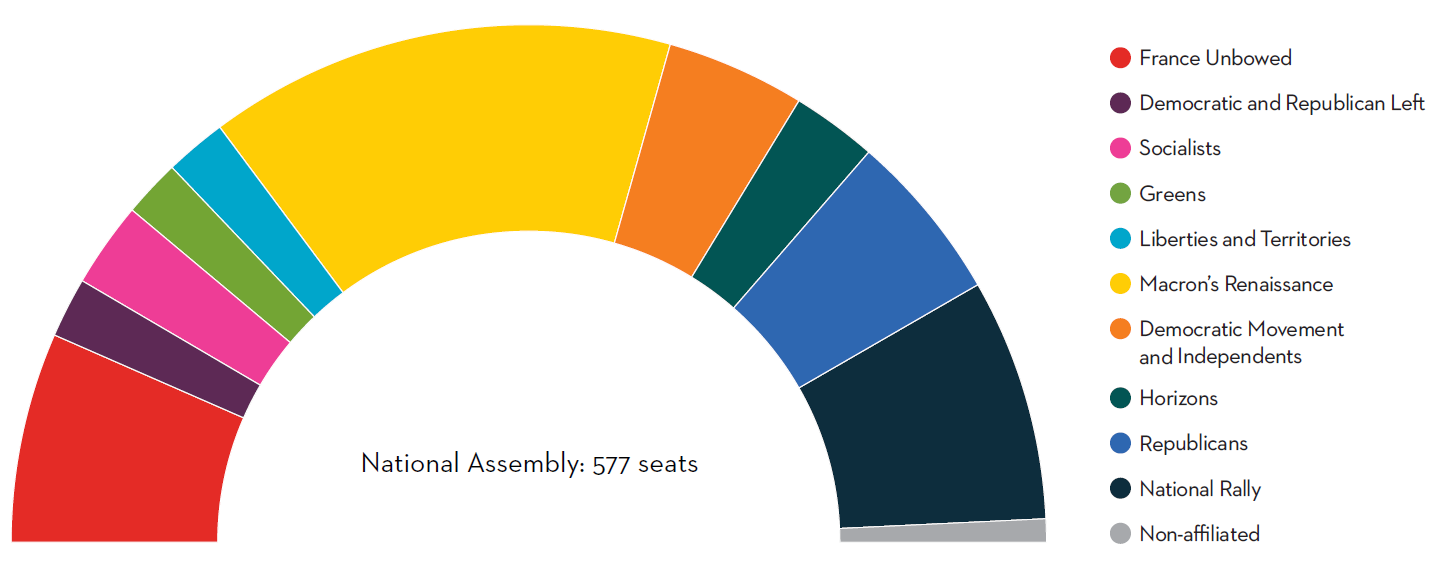

Current French Parliament split amongst parties

Source: Politico and OpinionWay as at 20 June 2024.

Back in the 2022 French presidential elections, Marine Le Pen received 23.2% of the votes in the first round (a rise compared to 21.3% in the 2017 presidential elections), while Emmanuel Macron won 27.8% of votes. Macron went onto win the second round by 58.5% to Le Pen’s 41.5%. That share of vote was already an improvement compared to the 2017 elections, when Macron won 66.1% of the votes in the second round, to Marine Le Pen’s 33.90% of the votes. The improving share of votes by the RN highlights that the party has become increasingly electable in the eyes of the French voters, which could point to a kamikaze approach by Macron, as we explore below.

Tête brûlée perhaps

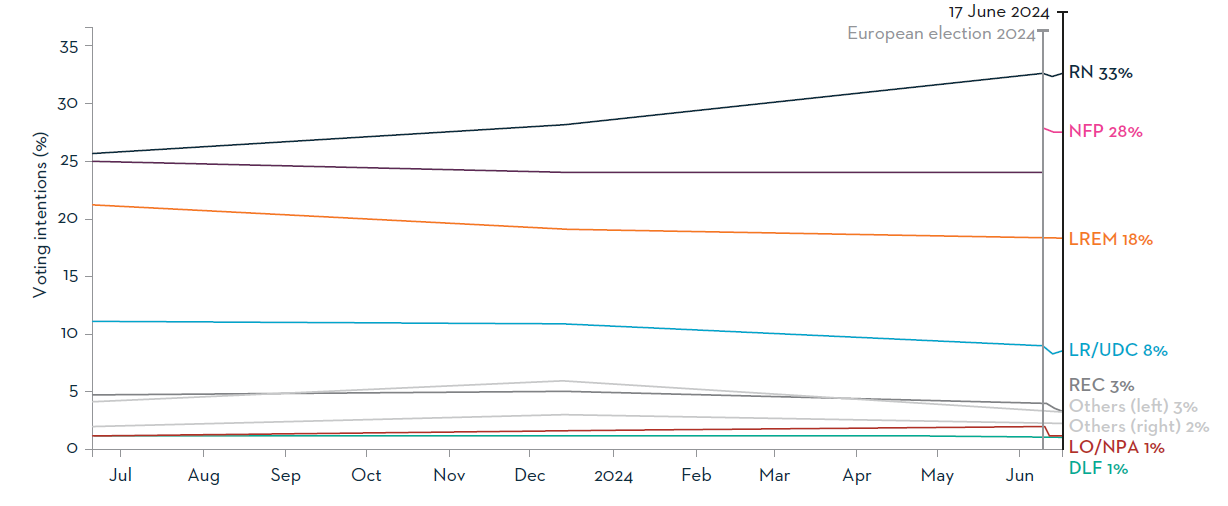

But the surprise snap elections can be portrayed as a reckless action by Macron as well. Given that his RE party is trailing at third position in the polls (18% of the votes), behind both the RN (33%) and the radical left New Popular Front (NFP, 28%). If the hope of a French citizens’ loyalty vote towards the moderate parties does not materialise,

Macron will be left as a lame President for the remainder of his term, potentially putting his party in a weak position for the 2027 elections. Macron will be coming to the end of his two-term mandate, so there will be a need to find a charismatic replacement candidate to pass the baton to. So far, there is no such charismatic moderate candidate on the horizon, although the three years until 2027 is a long time in political terms, so things can change by then.

The tête brûlée action could be down to Macron underestimating the fact that radical parties in France have made themselves more mainstream in their political views and policies, and have therefore become more electable to a broader range of French voters.

The RN party in particular has nominated a young candidate to represent it, Jordan Bardella. Not only has he a strong appeal with the younger voters given his age-group, but he is also not a Le Pen family member, therefore helping the RN party alleviate fears of historic legacy to the more radical Jean-Marie Le Pen of the 1980s and 1990s (Marine Le Pen, party leader, has also distanced herself from her father’s more radical views, and expelled him from the party).

The policies and views of the RN party have been garnering more support, and chiming more strongly with both the younger and the older voters within France, as a result of their anti-immigration views, and ambition to reduce the retirement age back down to 60. This increased popularity is showing in the polls, as can be seen in the graph below.

French parliamentary elections poll of voting intentions

Source: Politico as at 17 June 2024.

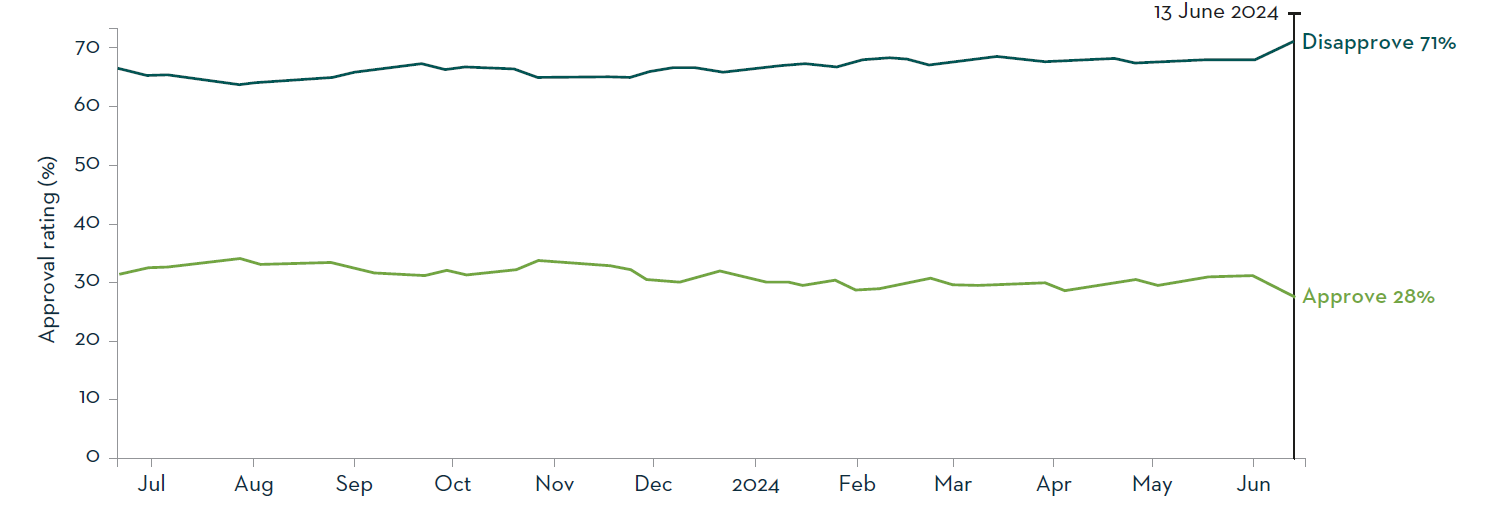

Macron’s risk in calling the election is captured by his low and declining approval ratings, shown in the chart below. This means a lower probability of Macron’s party turning the situation around.

President Macron’s approval ratings

Source: Politico as at 13 June 2024.

Political uncertainty is increasing sovereign risk perception in the European Union

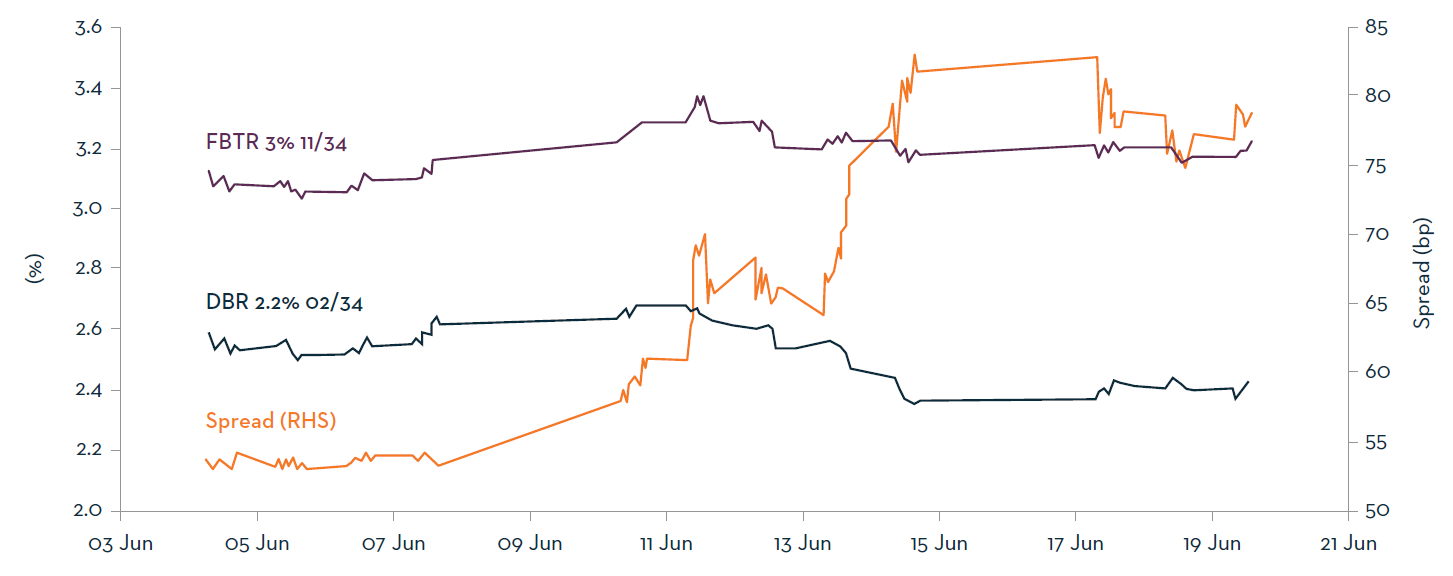

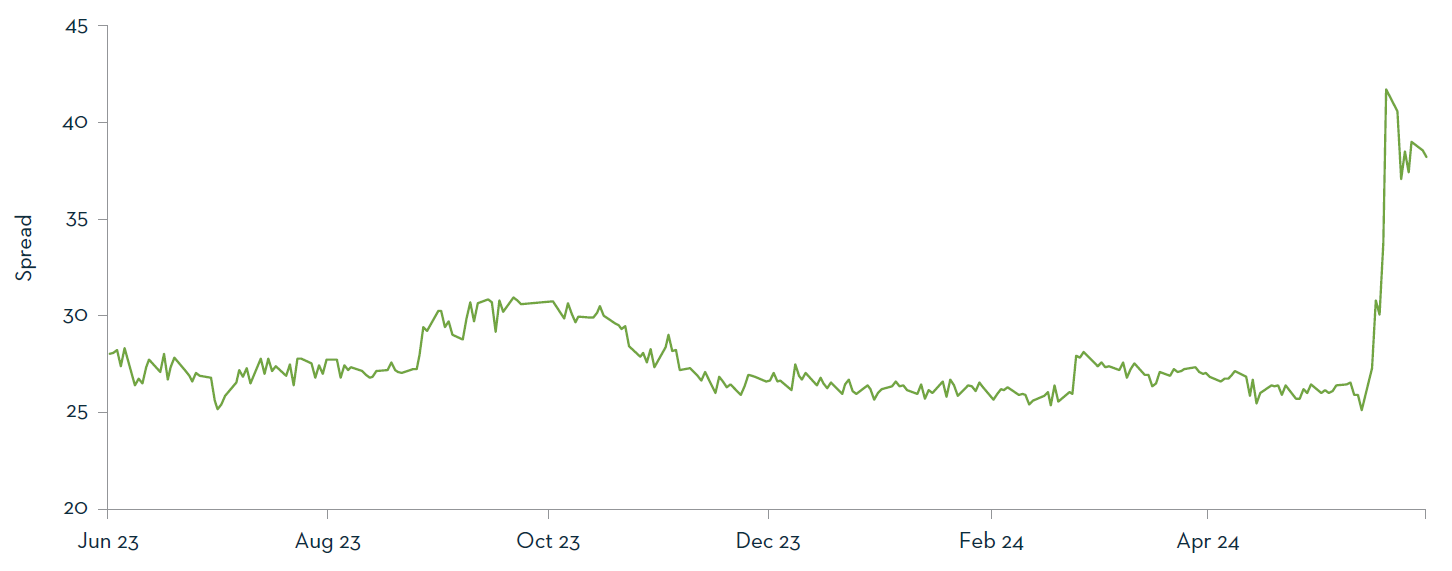

With the surprise snap election announcement, French sovereign spreads have widened, taking into account the increased political uncertainty. We believe that such widening is indeed a reflection of increased uncertainty, rather than being disorderly.

Should France end up with a Parliament led by an RN party-nominated prime minister (most likely Jordan Bardella), French sovereign bond spreads would likely widen further, and the French equity market would have further downside risk in our view. We do however believe that in such event of a marked sell-off, investors would be presented with an opportunity to buy into the market fear, given that the market might be overestimating the potential for a major change in policies by France, vis-a-vis the European integration, and indeed vis-a-vis its international policies, given that Macron would still remain as president under a cohabitation government structure.

French and German 10-year government bond yields and spread

Source: Bloomberg and HSBC as at 21 June 2024.

France five-year scenario CDS spread – 12 months

Source: Bloomberg as at 25 June 2024.

Limits to political decision making

A cohabitation government could have more impact on domestic French policies, which could lead to market concerns over increased fiscal expansion, widening government deficits, and anti-EU integration measures. We highlight however that the European political institutions require each national budget plan to be approved by the European Commission. This ensures that each member state stays within an EU-imposed and ratified budget deficit limit of 3% of GDP. If a country overshoots the budget deficit target, it is put under the Excessive Deficit Procedure (EDP), which imposes a 0.5% reduction in its deficit annually, until the deficit is brought back in range. France is already under that EDP list, as the 2023 deficit was already larger than 3% of GDP.

As such, the room for manoeuvre around any fiscal excesses would also be limited, in our view, unless the RN party disregards the EU fiscal deficit constraints. Hence our conclusion that we would see any unusual spike in French bond yields, and sell-off in French equity market, as an opportunity for investors.

In addition, it seems that the RN party is conscious that, should it be in a position of leadership in the parliament, it would be closely watched for credibility. The short-lived 2022 Liz Truss government in the UK, triggering a gilt market crisis, is a reminder to the RN party in France that irrational and fiscally over-expansive policies will be met by significant negative market reactions in the sovereign debt market. As RN Member of Parliament Jean-Philippe Tanguy is quoted as saying in the Financial Times on 17th June 2024: “The RN will hold the line on deficits and present a credible plan. The markets will be severely on us, so we really have no choice but to do so.”

It seems that the RN party is conscious that French voters will be assessing whether a RN party in power is a plausible option over the next three years, in the run up to the 2027 elections.

Russia’s meddling in election dynamics is a risk to monitor

With Europe siding with Ukraine in its conflict against Russian aggression, and France’s Macron being an important and vocal supporter of more military support to Ukraine, there could be an increased risk of Russian meddling in the election campaign and dynamics. This would be in a similar way to what appears to have been the case in the US presidential elections of 2016, when Donald Trump won the electoral race against Hilary Clinton. This is something that will need to be monitored closely, and that could further dial up the geopolitical risk in Europe, if there was a blatant act of hostile sovereign involvement by Russia against France, which could take the form of cyber-aggression, or social platform manipulations.

This risk is also more likely given that Le Pen has in the past made positive comments about Russian President Vladimir Putin.

-

This risk is increased, given that the radical right party RN is now seen as more mainstream and electable, having dialled down some of its extreme policy and ideological views.

The 2027 French Presidential elections remain the major political risk event in Europe

We continue to see the 2027 French presidential elections as the major political risk event for investors looking at Europe. There is an increased risk that the radical right could end up winning the presidential race, should the moderate parties fail to put forward a charismatic candidate, and the French so-called “unity” vote not materialise in the same way as it has historically. This risk is increased, given that the radical right party RN is now seen as more mainstream and electable, having dialled down some of its extreme policy and ideological views.

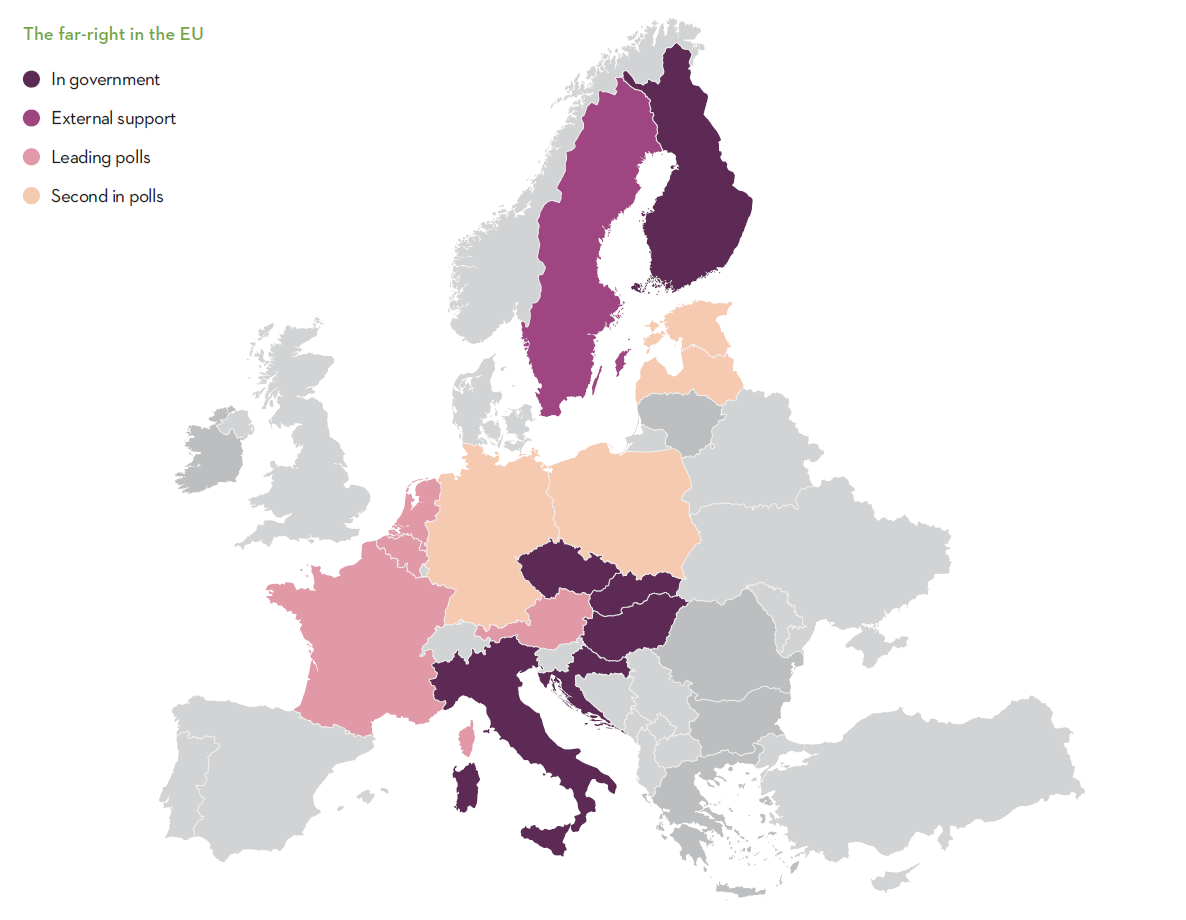

It is also worth flagging that there is an increase in radical right parties either in power, or in a coalition within the Eurozone member countries. There is also an increase in the number of countries that have the radical right polling in second place, as can be seen from the map below. This clearly highlights the rising risk of the European integration agenda being challenged by parties that are typically against further integration.

There are already six EU countries that are currently governed by hard-right parties: Italy, Finland, Croatia, the Czech Republic, Slovakia, and Hungary. In addition, the Netherlands is heading towards a right-wing government as well, as the Dutch coalition talks have just concluded, after six months of negotiations, leading to the agreement for Geert Wilders to form a government. Furthermore, the government situation in Sweden appears precarious, relying on a confidence agreement with the nationalist party, Sweden Democrats, which is currently the second largest party in parliament.

Worrying trends across other EU countries include Belgium and Austria, where hard-right parties are leading in polls. In Germany, Poland, Latvia, and Estonia hard-right parties are in second position in polls.

The map below illustrates the current situation. Countries in light purple on the map are where the right is currently in government in a coalition (Sweden).

European Union countries where hard right parties are in government, in coalition, or leading in polls

Source: Politico as a 21 June 2024.

Overall, European sovereign risk is increasing with the surprise French snap parliamentary elections being called by President Macron. There is the risk of a kamikaze action by Macron, leading to him losing a coalition majority in parliament, and bringing in a period of cohabitation in France until the 2027 Presidential elections.

This would likely lead to a widening in French CDS spreads, and further selling pressure in the French equity market. It will also likely bring a period of political paralysis, which means that the fear of policy slippages and unorthodox fiscal actions could be overdone, which could create an opportunity for investors.

At the same time, we could have a Machiavellian situation by Macron, whereby his call for French unity against extremes gives him a renewed support in parliament to enact the reforms that he has been keen to implement. This scenario would be met by a significant positive reaction in French bond and equity markets. Under any scenario, the spectre of the 2027 French presidential elections is the more important risk for the market in our view, something which this parliamentary election is bringing to the fore.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to

facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton

Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.