Content navigation

Snooze-fest to exciting times ahead

The 2024 UK election has come and gone, and the stock market has hardly blinked. While volunteers around the country worked tirelessly overnight counting votes, markets had a restful night’s sleep and woke with little to do. After all, a Labour victory had been priced in to markets many months before the election was even called.

This may have been the one of the most uneventful elections of the year, just behind Russia, but that doesn’t mean the UK is unexciting. Quite the contrary.

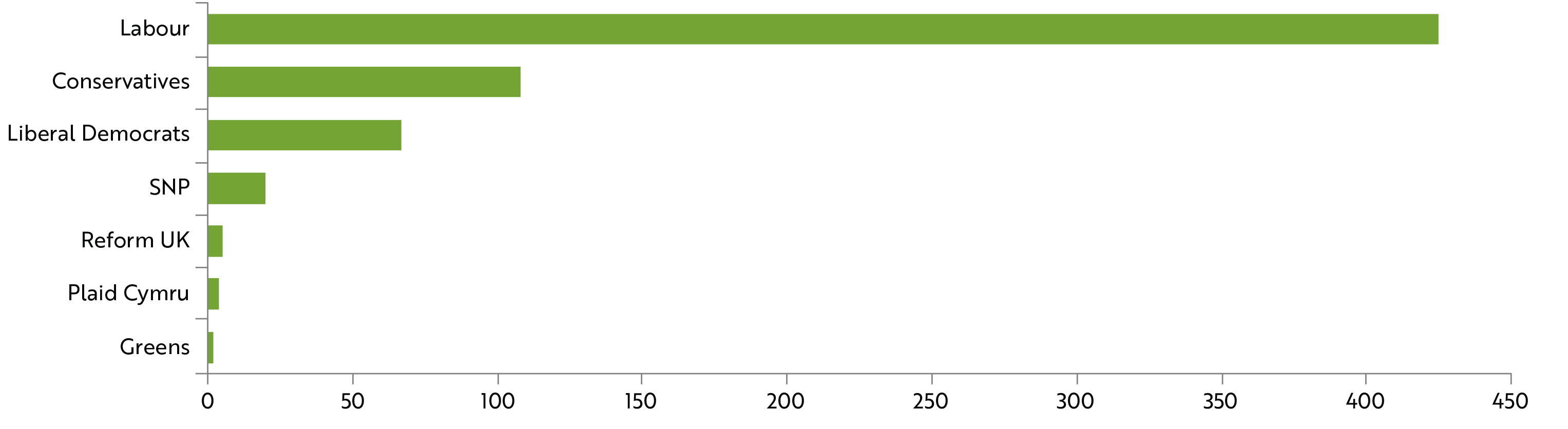

Projected number of seats won in the next general election in the UK in 2024

Source: YouGov, Statista as at 18 June 2024.

We’ve almost lost count of the number of Prime Ministers the UK has been through in recent years, and we certainly don’t have enough fingers and toes to keep track of the wider cabinet turnover. However, the UK now has a government in place with a clear majority, mandate to govern and little sight of near-term changes ahead. We’re not about to navigate the initial stages of Brexit negotiations and there’s hopefully not another pandemic looming. On this very day, we have the most stable backdrop the UK has had in almost a decade.

Of course, risk and uncertainty still exist, it always will. Something unexpected may be around the corner, especially as the Labour manifesto has left significant wiggle room for the policies they will begin to implement. However, the advantages that political stability can bring should not be understated, providing confidence to underlying business and both local and international investors alike. This is a stark contrast to other key economies and their ongoing elections.

Investors may begin quickly turning their attention to the UK shores. This new backdrop of political stability opens the door, allowing more investors to peek in. They may begin recognising the importance of the recent economic upside surprises. Inflation has fallen back to range, growth started the year by beating expectations, business investment is on the rise, and the consumer is now back experiencing real wage growth1. Some of this is beginning to be recognised, as markets have rallied, but even so, they remain close to historically low valuations. Next will be the hotly anticipated Bank of England rates cuts. Of course, challenges still remain but the UK has certainly become interesting.

-

This may have been the one of the most uneventful elections of the year, just behind Russia, but that doesn’t mean the UK is unexciting. Quite the contrary.

Key policies offering investment opportunities

Whilst we have your attention, we’d also highlight a couple of policy areas that, although well known, we think are being underappreciated by the market. Ones that we’d expect to have significant impact on the UK economy in the coming years:

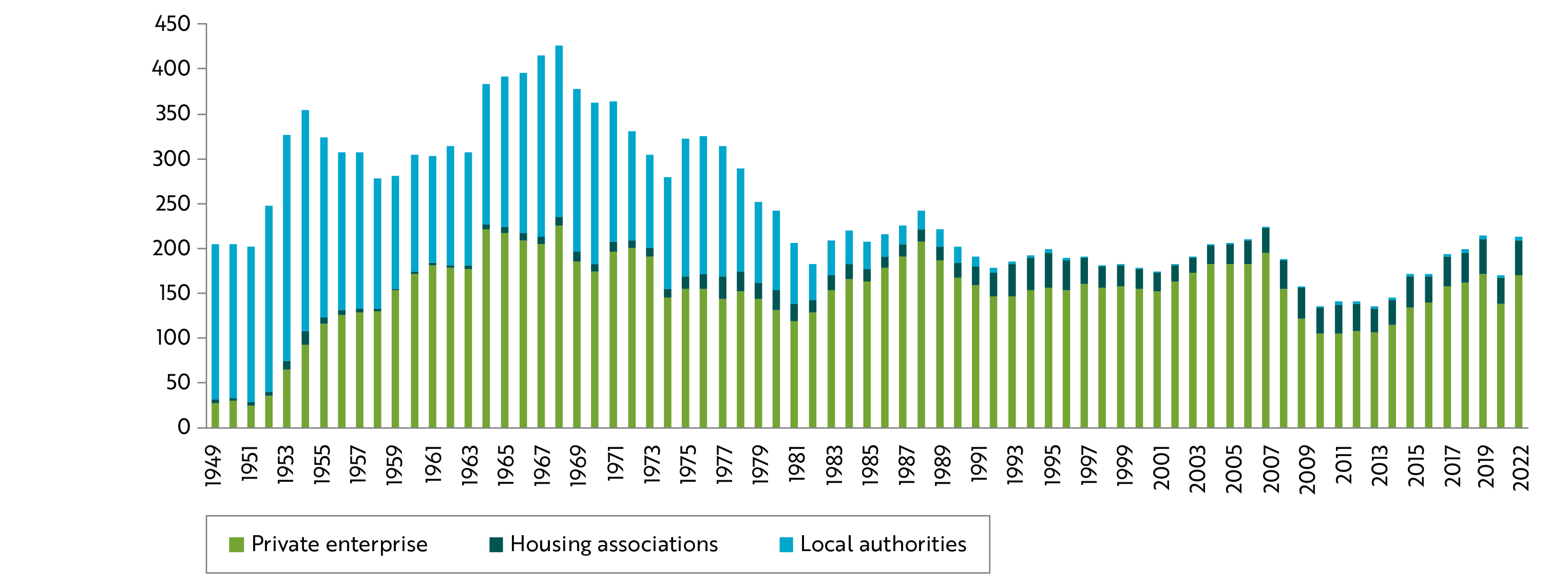

Housebuilding

Labour have committed to 1.5 million new homes over five years.2 To put this into perspective, the target number of new homes being created is more than that of Birmingham, the UK’s second largest city. There’s been much scrutiny on the achievability of our new Government’s target with many assuming this, like many political “promises”, is unlikely to be met. This could very well be the case, but we can say with some certainty that the direction of travel is clear. The government, and large swathes of the UK population, are demanding that new homes need to be built and in significant quantities. This has evident investment implications, particularly the massive tailwind being created for housebuilders and those involved in their supply chain. Housebuilders Bellway, (top 10 in UK Mid Cap as at 31/5/24)3 and MG Glesson (top 10 in UK Smaller Companies as at 31/5/24) are well run businesses positioned to benefit, the latter’s focus on affordable housing is particularly aligned with the government’s objectives focused on first time buyers.

New homes completed by private companies, housing associations and local authorities in the UK from 1949 to 2022

Source: Office for National Statistics, Statista as at September 2023.

Green policies: energy transition

One of Labour’s five missions, as laid out in its manifesto, is “Make Britain a clean energy superpower”4. They may have dropped their £28 billion per year green investment pledge, pointing to not being able to commit to a fixed amount of spending, but our new government is still placing the UK’s Net Zero commitments as a key policy cornerstone.

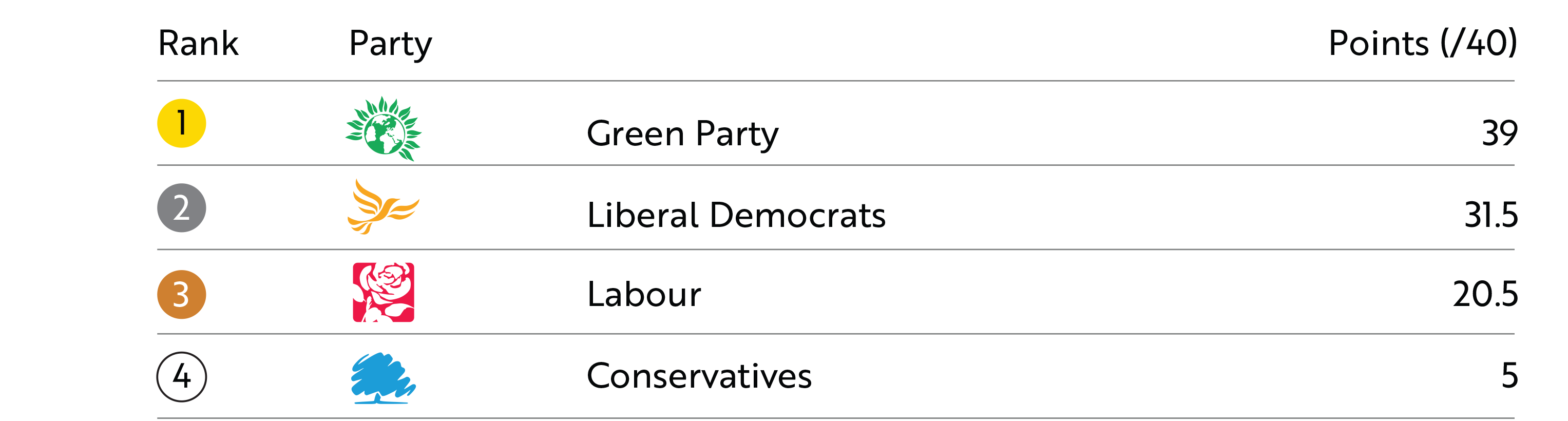

An analysis of key party manifestos carried out by green groups has shown Labour to be mid-table in its pledges, but four times more committed than the outgoing government. This means there will be a step change and, as with any structural shift, this poses risks and opportunities to different businesses. The policy level analysis notes one of Labour’s climate strengths is its focus on rapid renewable energy roll-out, especially with its objective of zero carbon electricity by 20305. The infrastructure behind our energy system will need to dramatically and quickly change with National Grid (Top 10 Holding in UK Equity Income as at 31/5/24)6 being a key facilitator. Earlier this year it announced it is investing £60 billion over the next five years7 in transmission and distribution infrastructure. They are doing so to meet not only the changing sources of the energy supplied but also, critically the growing demand, through greater electrification.

As green policies develop and strengthen, it’s not just infrastructure that we need to think about. As investors, we must consider all business and what they’re doing given the policies changes we will see across industries.

Overall manifesto rankings

Parties’ scores are based on strength of the climate and nature commitments in their manifestos and other major policy announcements.

Source: Greenpeace as at 2024

Bright times ahead

It may have been a snooze-fest of an election, but investors can wake up to exciting times for the UK.

Sources

1Source: Bank of England as at 20 June 2024. https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2024/june-2024

2Source: Labour Manifesto as at June 2024.

3Source: Martin Currie and Franklin Templeton as at 31 May 2024. FTF Martin Currie UK Mid Cap and FTF Martin Currie UK Smaller Companies Funds shown.

4Source: Labour Manifesto as at June 2024.

5Source: Labour Manifesto as at June 2024.

6Source: Martin Currie and Franklin Templeton as at 31 May 2024. FTF Martin Currie UK Equity Income Fund shown.

7Source: National Grid plc as at 23 May 2024

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited. The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

For institutional investors in the US:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.