Content navigation

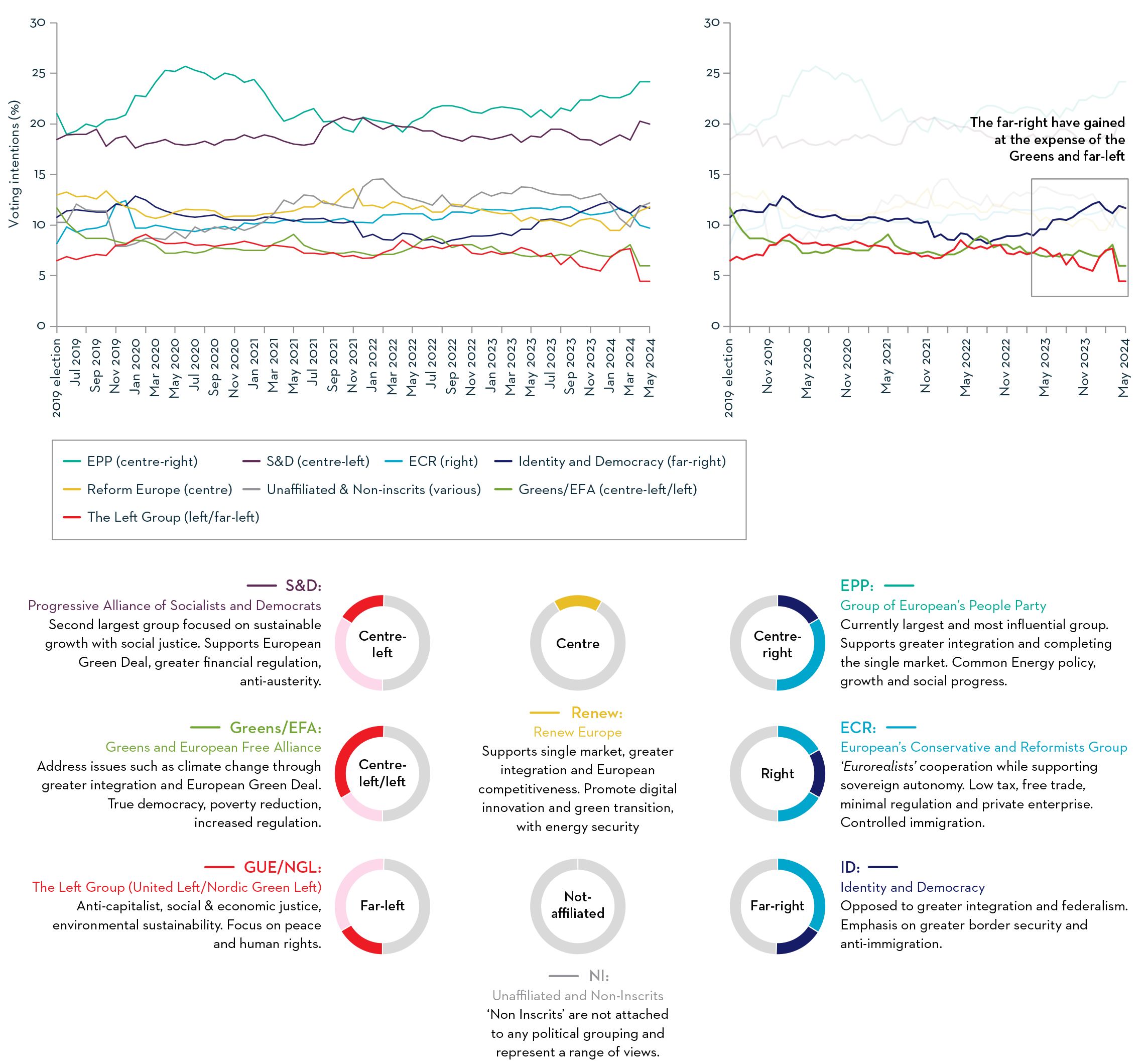

- The polls for the European Parliamentary elections are showing a distinctive shift to the right of the political spectrum.

- The increased right-wing presence could increase division in parliament and hamper the ability of the European Commission to implement policy.

Political instability can generate risk aversion and volatility in the markets. - The focus post-election is likely to be on investment in the technology sector to increase competitiveness, energy security and defence spending. The latter two are in response to geopolitical threats.

The 2024 European Parliament Elections

On 6-9th June, the citizens of the European Union (EU) go to the polls to elect the 705 members of the European Parliament (EP). Current polls show that the centre right European People Party (EPP), will maintain their position as the biggest voting bloc, alongside the Progressive Alliance of Socialists and Democrats (S&D), on the centre-left.

The European parliamentary groups are not campaigning parties. Rather they consist of the underlying nation states political parties, who are unified by similar interests. For example, the EPP includes France’s The Republicans, Germany’s Christian Democrats/Christian Social Union and Italy’s Forza Italia.

In the S&D, major parties include the Spanish Socialist Workers Party, Germany’s Social Democratic Party and Italy’s Democratic Party. Whatever the outcome, fragmentation will be key in the parliamentary make up.

-

A swing to the right could lead to calls for greater domestic economic sovereignty. However, the Eurozone specifically has created strong interdependencies between member states.

A shift to the right – but external threats might provide unity

Same old, same old? Not quite. At the last election in 2019, the EU centrist parties were able to campaign on an ‘Anti-Trump’ and ‘Anti Brexit’ save the EU platform.

The political centre has been arguably overrepresented and we are seeing the steady rise of populist parties represented by the farright Identity and Democracy group (ID). This is coming at the expense of support for the Green and left-wing parties, shown both in the recent polling data and the Dutch election in November 2023. In the latter case, Geert Wilders’, right-wing Party for Freedom, became the largest party.

Does ID represent a united front beyond national sovereignty and a focus on restricting immigration? They will push against green issues but there is arguably no unified economic policy. Despite the loss of ground from the centre parties, with the threat from Russia, energy security needs to be addressed. Third place is up for grabs between ID, the centrist Renew and the right-wing European Conservative and Reformist party (ECR), they are all neck and neck in polls.

The ECR are more moderate than ID, they have a free trade, pro-business and ‘Atlanticist’ (pro-Nato) outlook. As experienced political operators they are likely to compromise with the centre. While hesitant on further integration, they are unified on opposition to Russia, supportive of the economic union and the need for the continent to remain competitive.

While green investment may face some headwinds, we would expect to see continued investment in digital innovation, energy infrastructure (both renewable and traditional) and potentially increased defence spending. The latter two in response to external threats and to boost the bloc's geopolitical clout.

China is both a major trading partner and economic competitor. Difference of opinions on the Ukraine war, human rights and market access have led to an unbalanced relationship, and the EU is seeking to derisk and diversify, reducing critical dependencies in its supply chains.

(Not) Dealing with crises

There is dissatisfaction amongst voters. Bar an almost 50/50 split on the handling of the Covid-19 crisis, a recent poll showed that most voters are unhappy with how the EU are handling the Ukraine crisis, climate change and immigration – on the last point only 17% of voters were favourable1.

A boost for the far-right? Perhaps not. The ECR the right-wing bloc has certainly adopted more stringent polices on immigration to avoid losing ground to the far right. However, voters do not consider migration to be the biggest challenge facing the EU2. The majority of voters in Greece, Hungary, Italy, Portugal, Romania, and Spain are either worried about emigration or both immigration and emigration equally.

So, what is concerning voters? It varies country to country but economic turmoil, climate change and the war in Ukraine are arguably more front of mind2.

The centre is the biggest voting bloc but the right have gained at the expense of the left

European Parliament voting intentions – May 2024

Source: Statista, Europe Elects and Politico as at 29 April 2024.

‘Populists’ could impact green investment and increase protectionism

The EU’s green policies, notably the Green Deal have proved divisive. The Green Deal seeks net zero for the continent by 2050, with economic growth decoupled from resource use. Given the choice between reduced energy bills or tackling climate change, more voters preferred the former. To illustrate this, Germany’s bill to introduce heat pumps and the associated cost to households, was highly criticised by the far-right AfD (Alternative for Germany) with the backlash directed at the Green party.

Higher representation for ID at the expense of the left and the Greens could deprioritise climate change initiatives, including the Green Deal, in turn impacting investment in renewable energy and green technologies. Instead, the focus may turn to traditional energy sources, again this could hold up work towards energy security. Equally they are not supportive of the EU’s opposition to Russia in the Ukraine war.

A swing to the right could lead to calls for greater domestic economic sovereignty. However, the Eurozone specifically has created strong interdependencies between member states. As the 2010’s sovereign debt crisis highlighted, it is impossible to leave the common currency. How many householders in Greece valuing their assets in euros would have liked to see it halved by returning to drachma? Therefore, the monetary union will shape the landscape the far-right will have to operate in for the foreseeable future. The far-right also lacks a unified approach to the Eurozone, some are broadly supportive of the common currency, others are opposed, and this limits their ability to influence policy.

Finally, back to immigration, if we are to see more restrictive policies, this could impact the sectors more dependent overseas workers, and this is not necessarily restricted to low skilled jobs. This could lead to labour shortages, increased production costs and higher wages. Neither are helpful when battling inflation.

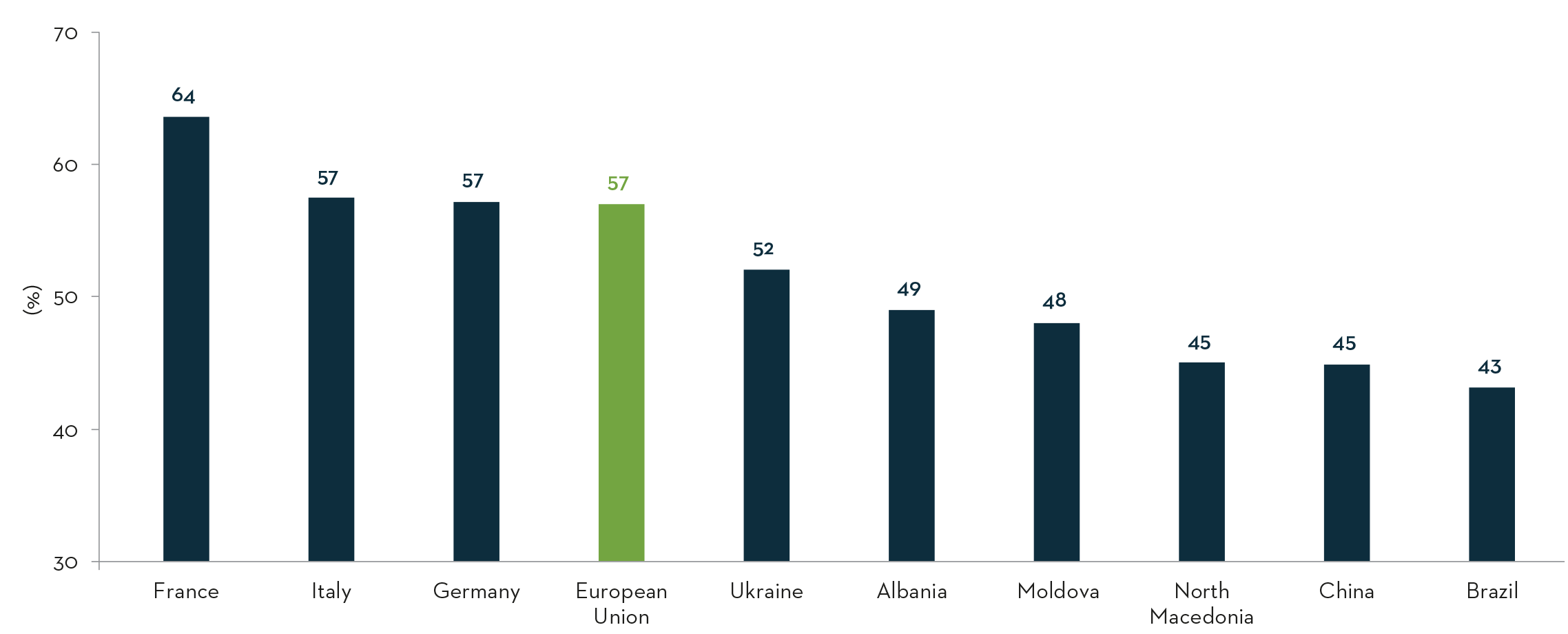

An aging population

Total dependency ratio – EU versus selected countries

Source: Statista and the World Bank as at 31 December 2023. The dependency ratio is a measure of the proportion of a country's population who are either above or below the age of being able to take up full time employment or past the retirement age. A higher dependency ratio generally means that a country must fund a greater amount of public services used by dependents from a smaller tax base of full-time earners.

The EU has a high dependency ratio, while this measure includes both young and old people, it is Europe’s increasingly elderly population needing support that is driving this . This is notable in France, Italy and Germany and it is considered an economic weakness of the bloc. One solution is further enlargement of the bloc to countries with more youthful populations, for example North Macedonia and Albania. However, this also raises concerns about further immigration from within the (expanded) bloc.

Needless to say, further fragmentation and division within the political parties will make it harder for the EU to take action on these issues. However, this also raises concerns about further immigration from within (the expanded) union.

A focus on technology, energy and defence

Although the polls are pointing to a shift to the right, the centrist collation of the EPP, S&D, Renew (RE) could still maintain the majority in the parliament. The soft Eurosceptic ECR could also make gains, however as a group they have a history of working with the centrist parties. Importantly they are broadly Atlanticists, supportive of NATO, and strongly oppose the Russian invasion of the Ukraine. Even if we see further opposition to renewable energy infrastructure, the ECR will be broadly supportive of energy security for the continent. The action taken to expel the AfD from the ID, led by Italy's Premier Giorgia Merloni, gives us a clue as to their desired outcome.

They want to be seen as a mainstream party, with the respectability and power that grants. This would downgrade green issues but upgrade energy security, and in turn further reducing the influence of the left.

ID, despite a focus on immigration and national sovereignty, represents a broad collation of economic policies. The individual underlying parties have different views on fiscal policies, and this opens the way to policymaking after the electoral rhetoric dies down. This would add certainty for investors.

With the centrist parties remaining the largest bloc albeit with an enlarged presence from the right, we would expect the following:

Support for the technology sector.

Supporting innovation, digital infrastructure and technology, companies can create a strong competitive digital economy. There is feeling amongst the member states that Europe is missing out harnessing the potential of the Artificial Intelligence (AI) boom. If properly addressed, this could lead to increased investments and job creation in the tech sector.

Focus on energy.

Against geopolitical instability, energy security is an important concern. Support for European-made green technologies to aid the energy transition will continue, but a more pragmatic approach is likely to support the ‘traditional’ energy sectors.

Increased defence spending.

There is likely to be greater focus on boosting EU defence capabilities, including increasing investments in defence production and procurement. With a reduced presence from the Green and left-wing parties in the traditional opposition to this will be reduced. Although elements of the right may be cautious on developments that potentially could lead to an EU armed forces.

Reduced power to the commission, increased power to the ministers

The European elections will show a significant shift to the right, something not witnessed before. It will produce a challenge to the European Commission, in particular who are the body that produces the laws on which the parliament vote. This division will make it harder to take action and thus more challenging for the EU to be effective, especially in a crisis.

With political instability in the EU, as well as in its largest members, we may witness risk aversion from investors and increased market volatility. This could slow down the central spending plans. But it will have one significant side effect, that of increasing the power of the Council of Ministers, the body that represent their member states national executives. So despite the Lisbon agreement and Brexit, it could be back to the future for the EU decision making process, reliant on the national heads to cut deals rather than the institutions.

Sources

1Source: ECFR. Source: Survey conducted in September/October 2023 by YouGov and Datapraxis in Denmark, France, Germany, Italy, Poland, Portugal, Romania, and Spain; and by Norstat and Datapraxis in Estonia.

2Source: ECFR. Survey conducted by YouGov and Datapraxis in January 2024, in Austria, France, Germany, Greece, Hungary, Italy, the Netherlands, Poland, Portugal, Romania, Spain, and Sweden.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.