Content navigation

- Dividends and share buybacks boosted returns of UK companies in 2024

- Many UK businesses are in good shape with strong balance sheets

- Share buybacks are likely to remain an option for enhancing shareholder value, while UK equities trade at low valuations

Let’s discuss total returns. Capital appreciation has been held back in recent years by a de-rating in UK equities although the UK's strong dividend culture has provided some relief to investors. Interestingly, another positive market dynamic has been gaining importance: share buybacks.

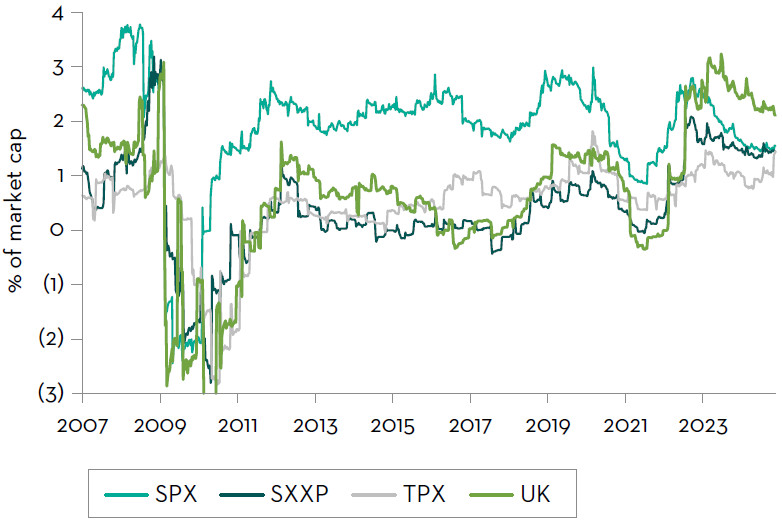

The recent prevalence of share buybacks should not really be surprising, given market conditions have been just right. Many UK companies have strong balance sheets, with excess capital to return and valuations look attractive to do so. The pandemic has also likely played a part – rapidly changing conditions reminding management teams the flexibility that buybacks can bring over returning cash via dividends. The influence of the US equity market will also have played a role. With investors and management teams alike noting the positive impact buybacks have had on the US equity market.

Finally, whilst valuations look this low, UK management teams are also dealing with the heightened concern of becoming an acquisition target. A buyback can therefore act as a defence mechanism against potential acquirers. The percentage of market cap being acquired (c2%) is now higher in the UK than in the US, which is significant. The question is, will companies continue to retire equity at these elevated rates into 2025 and beyond? Well, like many things in life, it depends.

-

Despite all the uncertainty, many UK businesses are in good shape with strong balance sheets. Furthermore, the UK consumer is in a robust position – helped by the savings built during Covid.

Global comparison of share buyback prevalence

Source: Bloomberg, UBS, as at 18 December 2024.

Global comparison of dividend yield and buybacks

Source: Panmure Liberum, Bloomberg as at January 2025

Companies should not be over-paying for their shares. UK equities currently trade at a significant discount to long term averages, more so than European equities, and quite at odds to the hefty premium valuations seen in the US market. For many companies, they can continue to buy back shares, even at significantly higher prices and it will still add value. It’s therefore a decision of how companies should allocate their excess capital. Management teams with a proven track record of sensible capital allocation is certainly a trait we look for when investing.

Companies should only be returning surplus cash. They should be prioritising investment in their business, where needed, so if a company finds a compelling investment opportunity, such as M&A, buybacks could slow. At the other extreme, if there were to be a sharp economic downturn we could see companies reduce or cancel buyback programmes, to conserve balance sheet strength. Today many businesses have healthy balance sheets and generally a low appetite for large scale M&A. Hence we are seeing companies retiring equity, at the same time as continuing to invest in their businesses’

Businesses across the board are currently facing heightened uncertainty due to unclear UK government policy, increased employer costs and evolving international policies, especially from the US. This increases the near-term range of outcomes and makes the environment tricky. Problems have compounded since the new Labour government came in with an aggressively pessimistic view of the economy and a budget that squeezed the private sector to fund more spending on the public sector, which is not traditionally viewed as the best way to encourage growth. This has acted to depress business and consumer confidence and defer spending decisions. Yet, despite all the uncertainty, many UK businesses are in good shape with strong balance sheets. Furthermore, the UK consumer is in a robust position – helped by the savings built during Covid.

While businesses grapple with uncertainty, their shares trade at bargain valuations and balance sheets remain healthy, the current rate of share buybacks could well be sustained. Continued share buybacks will act to support returns, alongside the impressive dividend yields already available to UK equity investor returns.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.