Content navigation

What are semiconductors and why do they matter?

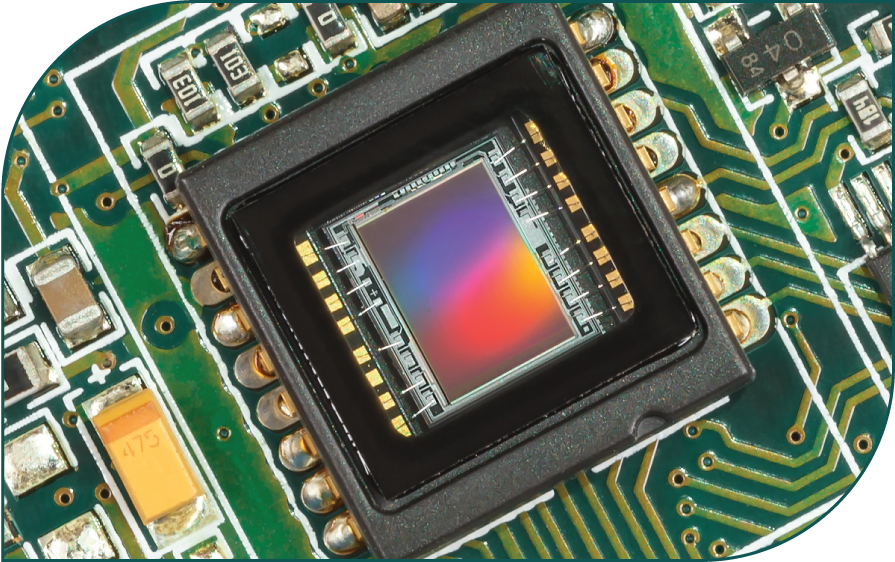

The generic term semiconductor refers to a material which can both conduct electricity (like copper or aluminium) and insulate (like rubber). More commonly when we refer to semiconductors, what we mean is semiconductor devices, or ‘chips’ (microchips).

Chips are created using semiconductor materials, giving the industry its name. They are crucial elements of almost all electronic devices, varying by function and intelligence. The ‘smarter’ the device, the more ‘intelligent’ the chip needs to be, from your mobile phone to your refrigerator or car. As such, semiconductor manufacturers benefit directly from the rise of digitalisation in society provided they invest in their businesses sufficiently to capitalise on that opportunity.

Semiconductors directly enable technological innovation in other industries and will continue to do so as new products are developed, both in emerging markets and the rest of the world. Firms in this industry are hugely concentrated in emerging markets, especially Taiwan and Korea. Companies in these geographies supply customers across the globe with their products for use across many areas such as computing, communications, consumer electronics, automotive and industrial equipment.

Semiconductor manufacturing process

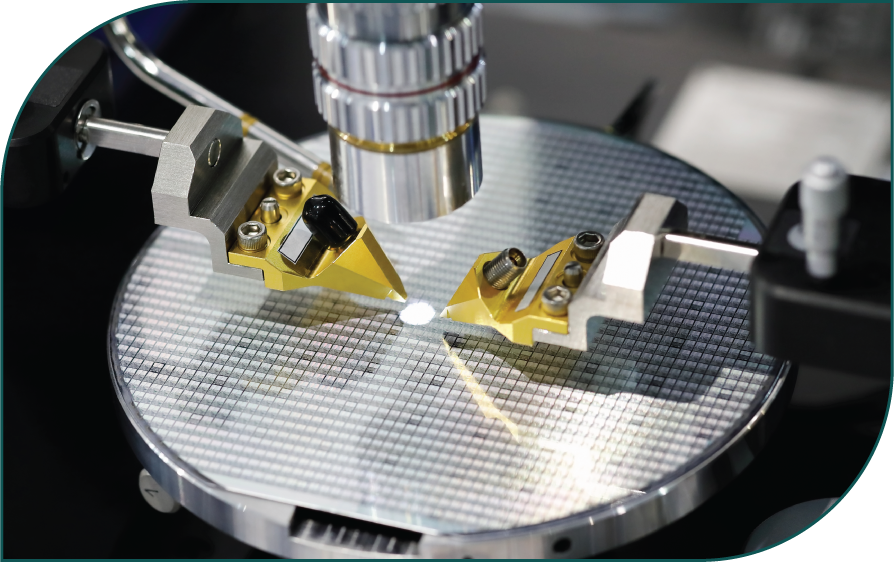

Semiconductor manufacturing is a critical industry which manufactures integrated circuits - these are sets of electronic circuits on a semiconductor material (or wafer) which is typically made from silicon. The process is highly sophisticated and involves three key steps:

The silicon wafer is created from a cylindrical ingot which is then sliced into discs roughly 1mm thick. The ingot can be a range of diameters including 150mm and 200mm but most commonly it is 300mm. The majority of semiconductor manufacturers outsource wafer production, purchasing them from a specialist wafer manufacturer.

The chips are created in batches on the silicon wafer, with multiple chips being manufactured at the same time at a minute scale with thousands of automated steps.

An integrated circuit (IC) is a single semiconductor (semi) chip which has other components all integrated. These may include diodes, resistors, transistors or inductors, for example. ICs help to support complex circuits.

Chips are created in batches on the wafer. The factory in which this takes place is called a fabrication plant, or fab. There are high barriers to entry with costs of building and operating a fab reaching tens of billions of dollars.

The largest semiconductor firms by sales are reliant on emerging market companies; although the top ten includes several developed market companies, most of these are fabless and rely heavily or exclusively on emerging market companies for their chips.

Semiconductor industry

The semiconductor industry has two main business models: either the company designs and manufactures its own chips, or it designs them and then outsources their manufacture. Companies operating the former operating model are called integrated device manufacturers (IDMs). Those operating the latter model are called fabless semiconductor companies, outsourcing the manufacturing of their designs to foundries. The majority of companies rely heavily on foundries for their chips.

The split of these types of companies across the industry varies depending on the type of chips designed and produced. For example, those focusing on memory are mainly IDMs, including Samsung Electronics, SK Hynix and Micron. The IDM model provides an advantage because by designing and producing the chips themselves, the companies have more control over the whole process.

There has been a shift in recent decades with chip manufacturing whereby it has become more concentrated in Asia and less common in the US, reflecting the prevalence of the foundry-fabless model over IDMs. Currently it is estimated that 12-13% of chip manufacturing is domestic US, having been >30% in the 1990s.1 Of the ten major US semiconductor companies, only two have in-house chip manufacturing capability (Texas Instruments and Intel), with the others needing to outsource it to a foundry.

Top 15 semiconductor companies worldwide market capitalisation

(at December 2022 in billion US dollars)

![]()

Source: FactSet at 30 May 2024. Using market capitalisation denoted in billion US dollars, based on publicly traded companies and Factset industry classification of these companies as Semiconductor companies with the following definition "This industry group consists of companies engaged in the manufacturing of integrated circuits for electronic applications."

The largest semiconductor firms by sales are reliant on emerging market companies; although the top ten includes several developed market companies, most of these are fabless and rely heavily or exclusively on emerging market companies for their chips.

- Five of the top 10, Intel, Qualcomm, Broadcom, MediaTek and Nvidia, use either TSMC or Samsung Electronics foundry services.

- Three are US IDMs: Intel, Micron and Texas Instruments.

- Three are emerging market companies themselves: Samsung Electronics, TSMC and SK Hynix.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/fund/ security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

The shape of the industry today

The semiconductor industry has historically been quite cyclical, driven by industry, macro factors and product cycles. Cyclicality has reduced in recent years as companies invest more in technology and as the manufacture of chips gets increasingly complex. This has increased the barriers to entry, alongside addressing cyclicality.

- Inventory cycles: driven by supply and demand of semiconductor inventory.

- Macro factors: sales are correlated with GDP, meaning that the health of the economy can be a key driver of the semiconductor cycle.

- Product cycles: these are the cycles of the end markets which use semiconductors. Their product cycles may be wholly different from macro cycles or driven by specific trends in, for example, autos, the Internet of Things (IoT) or smartphones.

There is a mismatch in the industry between suppliers of the technology and those companies using it. It takes time for the companies to adjust their supply to meet demand, given the production timeline, which creates both an up and down cycle.

- Down cycle: this is where inventory has been over-built and so companies respond by reducing excess levels through under-shipping their end demand. This leads to depleted inventory and helps build up chip demand again.

- Up cycle: as demand builds up again, companies work to rebuild their inventory levels at a higher rate than end demand in order to catch up with it.

The industry is currently experiencing a down cycle and is at the point where there are concerns over the build-up of inventory levels and over demand in end markets. This led to some profit-taking in recent months, with valuations being lowered as much as 30% in some cases. However, we believe this correction is to be expected given the cyclical nature of the industry.

The long-term opportunity which is presented by this industry remains a key area in which we have conviction. As enablers of advances in technology, semiconductor firms benefit directly from the rise of digitalisation and innovation in society.

There does remain an element of geopolitical risk which impacts the industry as a whole. This is largely driven by recent moves by US authorities regarding technology and encouraging domestic US production, including through subsidies. The aim of this is to reduce reliance on certain geographies and to stimulate domestic growth and innovation. The semiconductor industry is one component of this broader drive. For now, the focus area of risk is a small part of the overall emerging market technology sector (specifically, high-powered computing) and we have confidence that companies within the sector will be able to successfully navigate the resulting headwinds.

Sources

1Source: Morgan Stanley Research, ‘Clash of the Chips: TSMC, Samsung, and Intel’, May 2022.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in the document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For institutional investors in the USA.

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

For institutional investors in Canada:

The content of this website is suitable for Permitted Clients for the purposes of NI 31-103 only. The information on this section of the website is not intended for use by any other person, including members of the public.

For wholesale investors in Australia.

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.