As a firm, our aim is to be a leader in ESG. To do this, we need to measure our own inputs and outcomes to the same set of standards that we expect of the companies we invest in.

We have used this latest edition of STEWARDSHIP MATTERS as an opportunity to hold a mirror to our own activities.

We have delved deeper into how we are executing on our corporate purpose of Investing to Improve Lives, and how we look to provide our clients with Outcomes Beyond Alpha.

In this edition we cover:

- Martin Currie’s recent, tangible actions as a business which aim to deliver results on Investing to Improve Lives:

- How our actions as active owners can influence positive change for the many stakeholders in the world around us and deliver Outcomes Beyond Alpha.

- The investment thematic of Investing to Improve Lives, and how sustainability and social impact can be both a risk and an opportunity to financial returns across our investment universes.

- Recent engagements where our investment teams have helped influence companies to make positive change.

- How proxy voting can facilitate change that benefits society, and how to overcome some of the challenges that it presents.

- A summary of the extensive engagement and voting activities undertaken by our investment teams in the year to date, despite the ongoing physical barriers imposed by the COVID-19.

It is important we deliver on our purpose of Investing to Improve Lives across our business. When we generate market beating returns for our clients, profits for our financial stakeholders and good compensation for our employees, we can also do more to benefit the communities in which we operate.

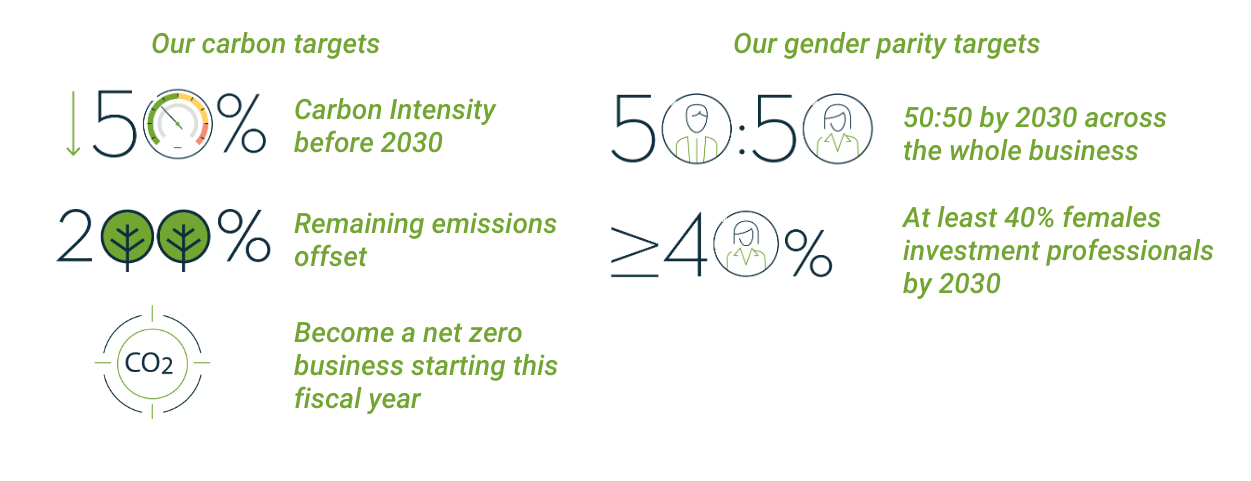

We are extremely proud of what we are doing to respond to the climate crisis, to foster a diverse and inclusive business, and how our investment teams work to deliver Outcomes Beyond Alpha through our active ownership agenda.

It is important we deliver on our purpose of Investing to Improve Lives across our business.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.