Content navigation

- UK economic conditions are in good health, supported by lower inflation, rate cuts, and a stable political environment

- Strengthening consumer demand will be a major driver of UK economic strength

- Domestically focused mid and small cap stocks are poised to gain significantly from the resurgence of the UK's economy

The UK economy is in solid shape. Data announced over the last few months has shown the economy to be gaining momentum, which bodes well for UK companies future growth prospects. In particular, the domestically-focused mid and small cap companies are looking increasingly attractive amidst early signs of a consumer-driven economic recovery.

After a shallow recession at the end of 2023, the UK’s prospects have u-turned with recent economic results being surprisingly stronger than forecast. Improving UK growth can be seen in the recent, better than expected Gross Domestic Product (GDP) numbers and upwards revisions to expectations for the next two years. Headline inflation is likely to remain close to 2% in the near term and easing price pressures are set to open the door to further rate cuts.

The Bank of England (BoE) has begun its rate cutting journey and this will be warmly welcomed by households and businesses where leverage is a feature. Given the rapid rise in interest rates over the past two years it’s important to appreciate that the extent of the impending cuts are likely to be limited. Returning to a period of ultra-low rates is out of the question, barring some significant external event. Market observers continue to expect UK rates to stabilise in 2026, likely in the 3-4% range1.

For those with mortgages, banks have already begun pricing in the upcoming rates cuts. The 5-year Sterling Overnight Index Average (SONIA)* swap rate, used by UK lenders to price loans, dropped to 3.8% in July2. As mortgage repayments represent many households’ largest outgoings, these reduced costs will be extremely welcome. Increasing mortgage affordability is also supportive of a strong property market, one that held up reasonably well as rates rose. Little wonder the GfK Consumer Confidence Index† is at 2-year high3.

The UK is a consumer economy, and improvements here will be the driving force in Britain's recovery. Consumer spending represents over 60% of GDP4 and increasing confidence will be supportive of growth. Challenges remain, the consumer is not one homogeneous, carefree group that’s ready to spend with the cost-of-living crisis not over for many. However, an increasing proportion of the population is now entering a period of real wage growth, with salary increases outstripping inflation. Moreover, in April 2024, a c.10% increase in the National Living Wage and a 4%5 cut to National Insurance were implemented. UK living standards, in aggregate, look to be on a positive trajectory.

Labour appears to have timed their ascent to power well. It’s perhaps not quite as positive a backdrop as Tony Blair entered Number 10 to in 1997, but the current nascent economic recovery is a reasonable starting point for the new government to inherit. A stable government reduces medium term political risk but Labour’s stated commitment to fiscal prudence, not wanting a repeat of Liz Truss's mini budget debacle, means the UK’s near-term outlook won’t be drastically altered.

-

We are only at the foothills of the opportunity. Early-stage shoots of growth, inflation at target, rates cuts; all coupled with UK valuations at historic discounts. The stars are aligning for the UK – it’s time for UK mid and small cap to reassert their leadership.

Investors will be closely scrutinising the new governments’ ‘Growth Plan’ as the new UK Chancellor Rachel Reeves has announced a series of measures to unlock GDP growth. Early announcements show a significant focus on planning reform and investment to get Britain building again. This won’t happen overnight, and many are sceptical their house building targets will never be reached, However there is already evidence of a rebound in the construction sector with recent figures showing construction grew at the fastest rate in almost a year in May, with house building and infrastructure boosting the industry.

So far, the market has reacted positively to the Labour victory as can be seen by the strength of sterling versus the dollar and euro. With UK growth having strengthened, sterling has jumped to its highest level against the dollar in almost a year. Sterling strength also has the effect of bearing down on inflation. All this bodes well for the more economically sensitive and domestically focused UK mid and small cap companies.

We are only at the foothills of the opportunity. Early-stage shoots of growth, inflation at target, rates cuts; all coupled with UK valuations at historic discounts. The stars are aligning for the UK – it’s time for UK mid and small cap to reassert their leadership.

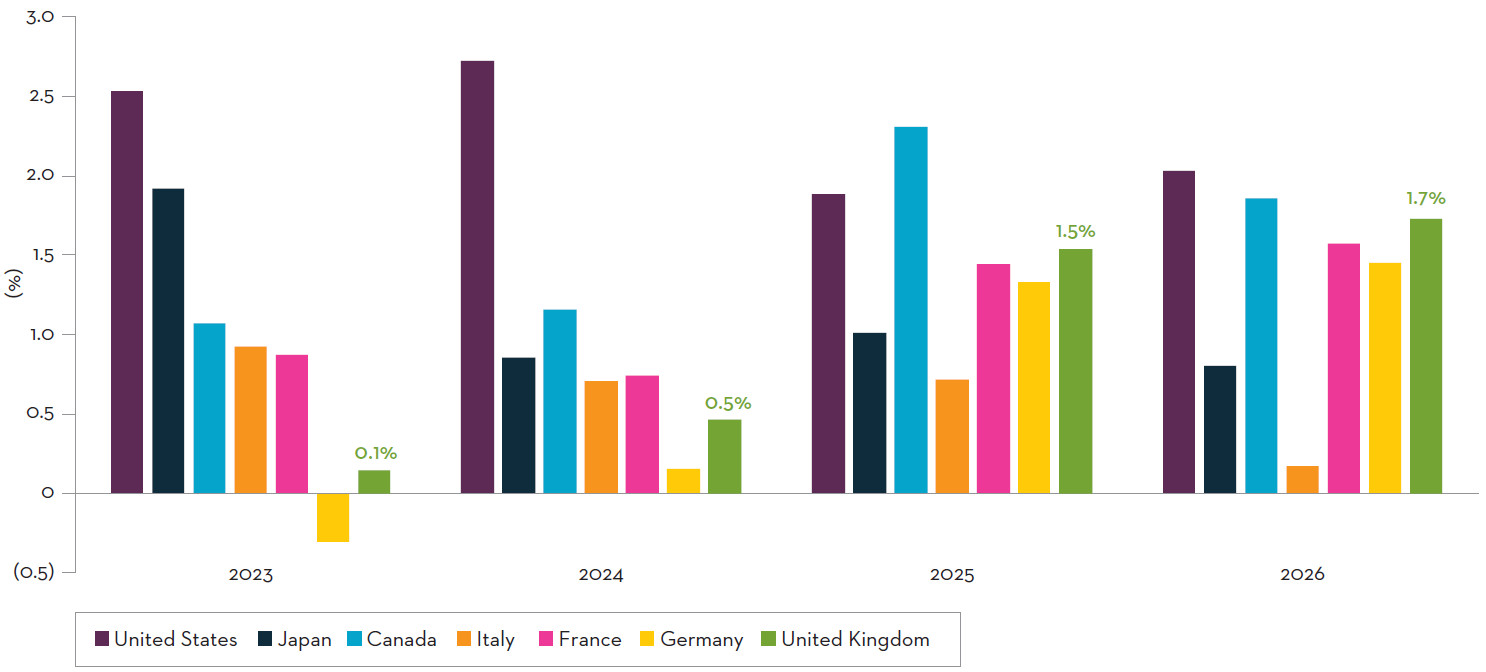

Britain is expected to rise up the G7 growth league

Source: International Monetary Fund and World Economic Outlook database as at April 2024.

-

UK Small Caps: Transformative Trends -

The customer is always rightIn the final instalment in our four-part series, Portfolio Manager, Dan Green, discusses how three resilient consumer brands are offering a competitive edge for investors.

Sources

*The Sterling Overnight Index Average (SONIA) rate is an interest rate benchmark used in the United Kingdom. It is the effective overnight interest rate paid by banks for unsecured transactions in the British sterling market.

†GfK’s Consumer Confidence Index (carried out on behalf of the European Commission) measures a range of consumer attitudes, including forward expectations of the general economic situation and households’ financial positions, and views on making major household purchases.

1Source: Bloomberg Finance LP, Tradeweb, Bank calculations and Bank of England as at 29 July 2024. https://www.bankofengland.co.uk/statistics/yield-curves

2Source: Bluegamma.io as at July 2024. https://www.bluegamma.io/sonia-swap-rates-uk

3Source: GfK as at 19 July 2024. UK consumer confidence up one point in July.https://www.gfk.com/press/uk-consumer-confidence-up-one-point-in-july

4Source: World Bank and Statista as at May 2024.

5Source: Gov.UK as at April 2024. https://www.gov.uk/national-minimum-wage-rates

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited. The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.