Content navigation

US headwinds are expected to ease

As the landscape within Emerging Markets (EM) continues to shift and adapt, we believe the possibility of EM’s positive returns appears promising. In this report, we highlight how the changing tides in US policy and macroeconomics may favourably impact the EM asset class.

- Core inflation has stabilised

- Policymakers have signalled that rates have peaked

- US dollar is expected to weaken following rate cuts

The US backdrop is increasingly favourable for EM investors

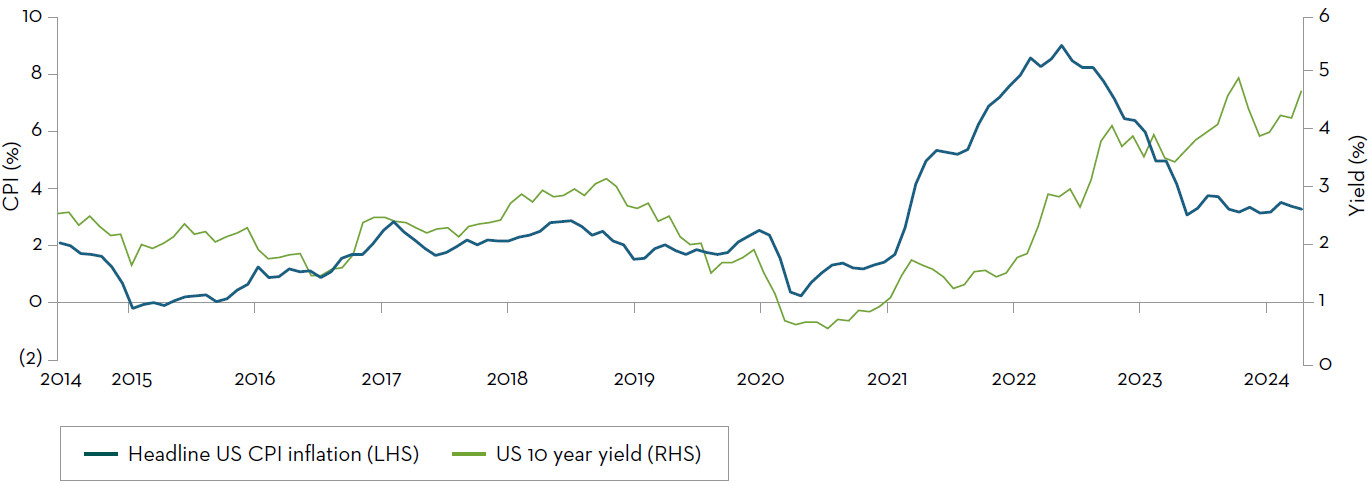

As can be seen in the chart below the Consumer Price Index (CPI) continues to fall. This signals the stabilisation of inflation levels. The high rates environment which was merited to manage inflation will no longer be needed, so we anticipate yields* to follow the same trend as inflation and decrease.

US headline CPI compared to US 10-year treasury yields

Source: FactSet as at 31 May 2024.

*Yield refers to how much income an investment generates, separate from the principal.

The peaking of US interest rates and the anticipation of rate cuts from the Federal Reserve1 (and other developed nations) have the potential to turn the tide for investors’ style preference and in their developed vs. emerging market allocation. Rate stabilisation and decreases in 2024 could also provide a boost if it leads to a weaker US dollar. Once the US establishes its first rate cut, we expect that other global policymakers will respond, including many in emerging markets.

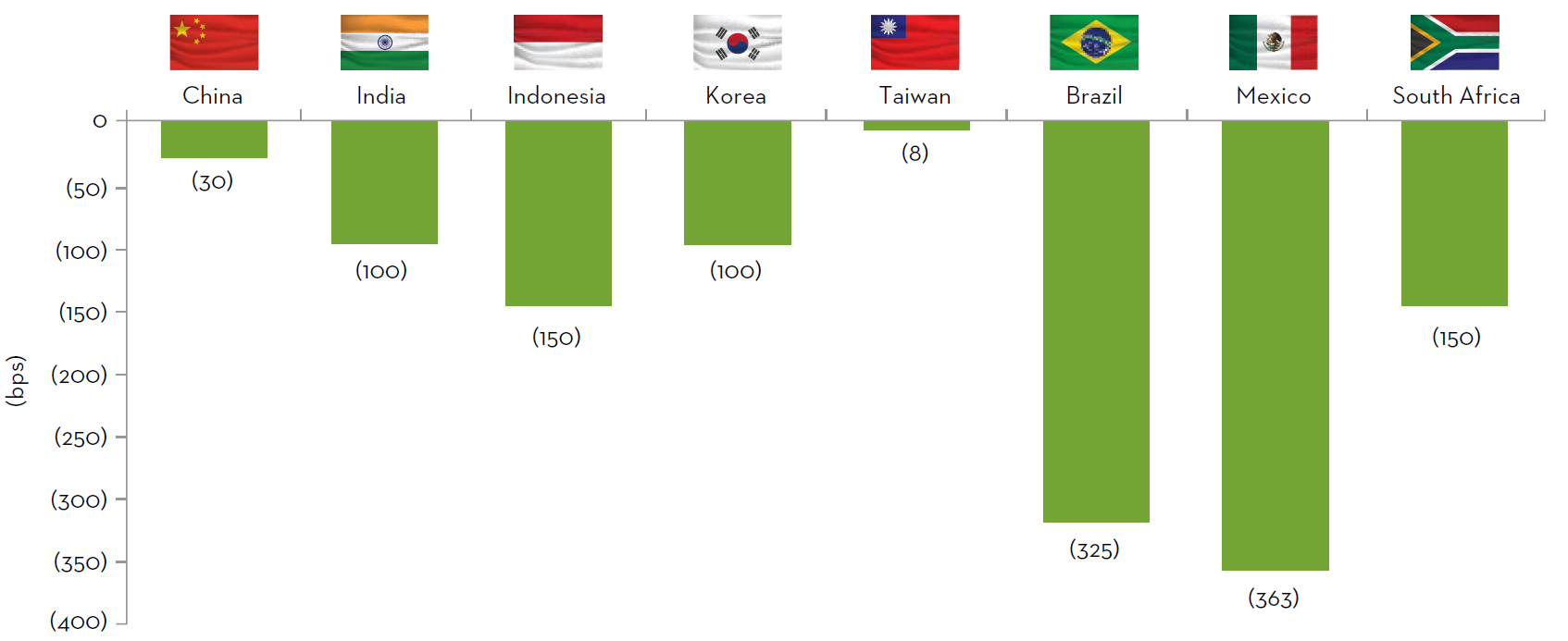

Broadly speaking, policy rates should become more accommodative in emerging markets. In addition, EM economies have been more disciplined in the post-Covid era with superior monetary and fiscal discipline. From a big picture perspective, most significant emerging economies are expected to have some form of policy rate cut. We highlight those of major economies in the chart below. Of the largest index countries, eight are expected to cut rates over the next two years: China, India, Indonesia, Korea, Taiwan, Brazil, Mexico and South Africa. These countries alone account for around 85% of the index and with the addition of the Middle East to this increases to over 90% of the index.2 A lower rates environment should stimulate domestic spending and boost EM economies, which would be positive for equity markets.

-

The high rates environment which was merited to manage inflation will no longer be needed

Large EM economies forecasted to cut rates over the next two years

Source: FactSet. Consensus projected rate change over two years (2023-2025), as of January 16, 2024.

With the Federal Reserve fund target rate expected to fall over the next few years, we believe this will add to US dollar headwinds. Macroeconomic factors such as a surging federal debt levels and increasing fiscal deficits may add to US dollar weakness as well as the potential shift of allocation from US dollar assets to non-US dollar assets. Besides the overweight that allocators have to US equities, there are many other asset classes (such as Private Equity and Private Credit) which are largely dominated by US-domiciled firms and as such are predominantly US dollar-driven.

However, EM equities can also benefit from a strong US dollar environment. For export-dominated EM economies such as China, Korea, and Taiwan, a weak local currency is a net beneficiary to export economies (makes exports more competitively positioned). From a company perspective, there is also positive operational gearing. For example, for semiconductor companies in Korea and Taiwan, they often have local operations with local currencies and sell products to US clients in US dollars. This means that even in a weakening local currency environment, these companies and countries could see positive terms of trade and positive operating levers.

We think that a weakening dollar can support EM performance, given the widely-held belief that they are negatively correlated by market participants. We anticipate that this will remove a further headwind which EM economies have faced in recent years.

The first step in mapping the EM landscape

As we witness the beginning of an easing cycle, we expect that monetary policy in the US and in EM will be more accommodative of EM equities. The weaker US dollar, rate cuts and stable inflationary environment should also be more supportive of quality growth companies – the types of characteristics that we look for. Those companies with high returns on capital, strong balance sheets, and market leadership will be able to shine again. We believe that the baton will pass from value to quality growth in the next phase of inflation and interest-rate stabilisation.

Sources

1https://www.ft.com/content/862f14fd-da31-4e38-8404-e70904a8fd4b

2Source: FactSet, May 2024.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be

issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee

of future results or investment advice. There can be no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document.

Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future

performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style. Holdings are subject to change.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

All investments involve risk including the potential for loss.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.

Copyright © 2024 Franklin Templeton. All rights reserved. Investment Products: NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE