Content navigation

Key takeaways

- Emerging markets sold off in the third quarter along with global equities.

- The US dollar strengthened vs. emerging market currencies.

- Growth continued to underperform value, which was driven by a rotation into energy and away from information technology (IT) and communication services stocks.

- The strategy underperformed its benchmark due to a sell off across our IT, financials, and clean energy-related stocks.

- We expect the market to reward high quality growth stocks as markets anticipate a slower global economic growth environment.

Market Overview

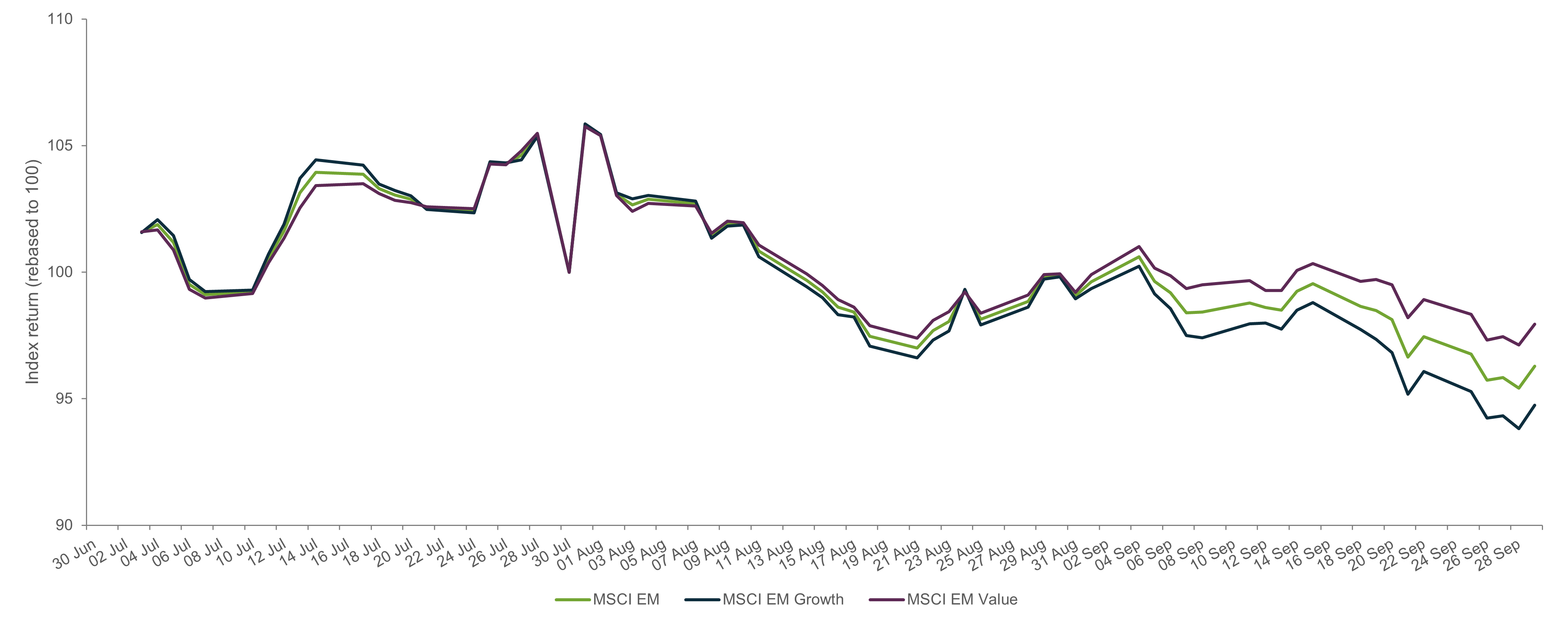

Emerging markets sold off in the third quarter along with global equities. There was also a strong divergence of styles, with the MSCI Emerging Markets Value Index strongly outperforming Growth (chart 1). Against this backdrop, energy outperformed the broader market as oil prices climbed. India was one of the best performing countries, with easing inflation reported in September and ongoing positive data points around its GDP growth and positive economic outlook.

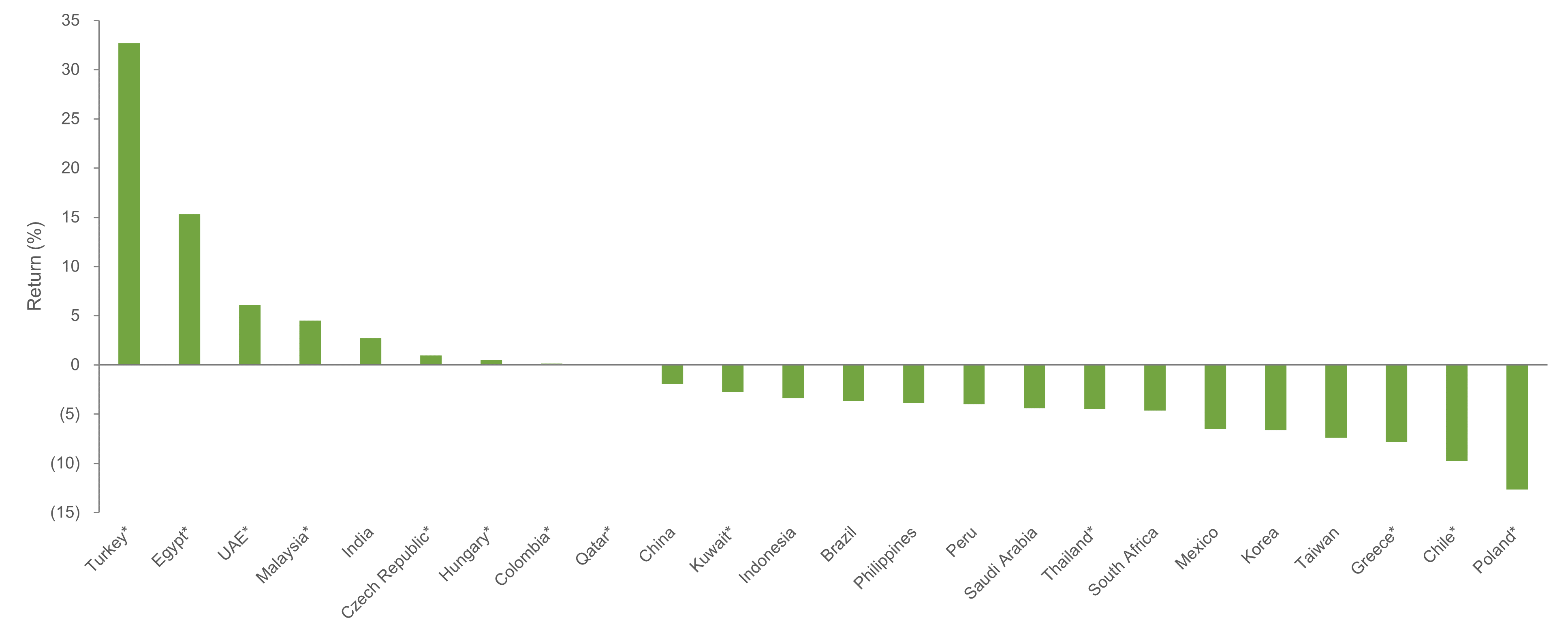

Conversely, the weakest performing countries were the technology-focused economies of Taiwan and South Korea. Mexico, which rallied in the first half of the year due to near-shoring optimism, sold off in Q3 after the economy grew less than expected. China held up better than the emerging markets index during the quarter but faced renewed concerns on its economic outlook with exports disappointing as global demand lagged. However, there were some bright spots, with improving infrastructure activity and stable consumption reported. Policy actions were also announced to address the property sector that could signal a recovery in the coming months.

Chart 1. Style divergence in emerging markets in Q3 2023

Source: MSCI, 30 September 2023.

Chart 2. MSCI Emerging Market Index country performance Q3 2023

Source: Martin Currie and Bloomberg, 30 September 2023. *Not held in the Martin Currie portfolio at end of period.

Portfolio Discussion

The Martin Currie Global Emerging Markets strategy underperformed in a large part due to the portfolio’s growth tilt, as value outperformed during the third quarter. The portfolio’s overweight to IT detracted, as the sector declined by the most in emerging markets. Within our largest active weights, three companies experienced double digit declines: Taiwan Semiconductor, HDFC Bank and AIA Group. These companies have been long held in the portfolio and remain some of our highest conviction holdings as we view them as high-quality compounders. Additionally, the portfolio companies relating to clean energy (e.g., solar glass, electric vehicle batteries) lagged as investors favored traditional oil and gas companies.

Portfolio Activity

We added one company to our clients' portfolios:

Tata Consultancy Services: Over the past 30 years, the IT services sector has consistently outperformed, thanks to advancements in technology that often result in the need for investment in software and IT services solutions. Additionally, the Indian IT Services sector has benefited from the maintenance and development of older IT systems. Tata Consultancy Services (TCS) has delivered in this changing hardware and software environment. As we head into a new software services cycle, TCS should benefit from solid earnings-per-share (EPS) growth and a higher valuation rating.

We exited four companies:

ENN Energy: Following the release of its H1 2023 results, where there was a material miss with respect to one of our signposts regarding volume, we exited the position. We had been expecting volume growth in the region of mid-single-digits, and a return to high-single-digits in 2024. The company reported negative volume growth of -7%.This was also below ENN Energy’s peer group and previous company guidance. At this point, the exact cause for reported results diverging so significantly from previous guidance is unclear, with management citing an internal system failure. The lack of transparency from management, and the divergence from its previous trend of very consistent volume growth, is a breach of our investment thesis. As such, we exited the holding.

SEA Ltd. Following the successful transition to profitability for its e-commerce operations, SEA’s management abruptly changed its focus back to growth. The willingness to accept further losses from here in the pursuit of top-line growth violates our investment thesis and we exited position as it undermines our expectations for the future profitability potential of the business.

LG Household & Health Care: The company has been negatively impacted by structural changes in the market: the disruption to travel retail and the changing appetite for luxury cosmetics in China. Additionally, it is experiencing potential brand issues with Whoo which has created a difficult backdrop for the business. The weak rebound in Chinese consumption and limited bounce-back in travel retail mean any recovery continues to be pushed out. Coupled with a need to reinvigorate the Whoo brand, the scope for both a top line and bottom line rebound remains uncertain. The stock no longer displays the growth and return characteristics we seek and uncertainty remains around a recovery, so we exited the position.

Jio Financial Services: As existing shareholders of Reliance Industries, the portfolio received shares of Jio Financial Services (RIL) in July when Reliance Industries de-merged its financial services business. With limited conviction in RIL as a separate entity, we took the opportunity to exit the position.

Outlook

While emerging market performance has been weaker than expected this year, we remain positive on the asset class and quality growth stocks in particular as we consider the catalysts for stronger returns:

i) Return of quality in a low global growth environment

Global GDP is expected to grow at about 3% in 2024, with advanced economies’ growth expected to decelerate while emerging market growth is expected to accelerate moderately to 4.1% by 20241 . At this juncture we believe a slower growth environment globally with muted inflation will be more favourable for higher quality growth stocks, especially following three consecutive years of value outperforming growth in emerging markets.

ii) Improving company fundamentals, supportive policies, and looser regulations in China

Whilst sentiment continues to be weak for Chinese equities, our portfolio companies have largely experienced stronger earnings progression this year. We expect growth to improve thanks to liquidity support and rate cuts from policymakers. Additionally, regulators have made steps to alleviate the regulatory crackdown that began in China in Q4 2020. We continue to monitor the property market in China and anticipate the Chinese government will implement targeted stimulus measures.

iii) Opportunities in information technology

We have two key areas of long-term secular growth. First, we are excited about IT services companies where we believe growth will be driven by enterprise demand for AI ecosystem upgrades. Our IT services companies cover geographies ranging from South America, Central and Eastern Europe, and Asia (India, et al).

Second, another subsegment of growth in information technology is semiconductor chips and hardware. We believe that AI chip demand will power a new demand cycle that is capitalised by names such as TSMC, Samsung, and Hynix. We have long argued for the intellectual property and leadership positions of these companies and now this is coming to fruition.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

1 Source: IMF World Economic Outlook, July 2023.Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.