Content navigation

Executive Summary

European parliamentary elections are taking place between 6-9 June. There is increased momentum from fringe and far-right parties, who have anti-European Union (EU) integration views. A shift away from the current centrist majority in the EU parliament would put a dent to the agenda of further integration.

Despite the rising momentum away from centrist parties, notably coming from the right, we believe that centrists will manage to retain a majority, even if it is by a slimmer margin.

Unless we are wrong-footed in our view, we do not see the EU elections as a major risk for financial markets. Neither do we expect any major policy shifts, with the EU’s focus to remain on the Energy Transition and Security in light of the increased geopolitical risks on its borders.

The real risk for Europe will be in the key member states' elections, notably the French presidential elections in 2027. Emmanuel Macron's presidential term is coming to an end and with his En Marche (LREM) party not having a clear heir apparent to succeed him, it could leave a vacuum in the French political landscape.

Marine Le Pen’s far right, anti-EU party, Rassemblement National (RN), could benefit from this vacuum in terms of votes and momentum. This is likely to be the bigger threat to the EU integration agenda over the next two years; something that the market is not quite ready to focus on, or pay attention to. That in our view, is where the risk lies.

Portfolio and market implications

We believe there is limited impact near term, assuming centrists retain a majority in the EU Parliament. Policies pursued so far interms of Energy Transition, Security & Defence, and Investment & Innovation are likely to continue to be focus areas, which underpin our three seismic thematic shifts, and our eight medium-term thematic opportunities.

There is however a more significant risk of increased volatility and slowdown in EU Integration. Should a far-right party be in a stronger position to win the national elections in 2027, this could be the risk in France, one of the key founding member states of the EU.

-

Marine Le Pen’s far right, anti-EU party, Rassemblement National (RN), could benefit from this vacuum in terms of votes and momentum. This is likely to be the bigger threat to the EU integration agenda over the next two years; something that the market is not quite ready to focus on, or pay attention to.

EU Parliamentary elections – of relevance to EU institutions

The EU Parliamentary elections are scheduled to take place between 6-9 June across all 27 EU member states, leading to the election of 720 members of the European parliament (MEPs). They are elected for a five-year term using proportionate representation. The parliament passes EU laws and approves the budget.

It is also responsible for approving the Commission President. However, it is important to highlight that the EU central decisions lie with the European Council and the European Commission, which is the EU’s executive branch.

Post the EU Parliamentary elections, we will have a new Commission being formed, with the Commission President being nominated by the European Council, and the parliament being tasked with voting on the candidate and the commissioners that make up the EU Commission in September-October.

Source: Martin Currie and Politico, 31 May 2024.

Polls show momentum from the far-right – albeit we still expect a centrist win

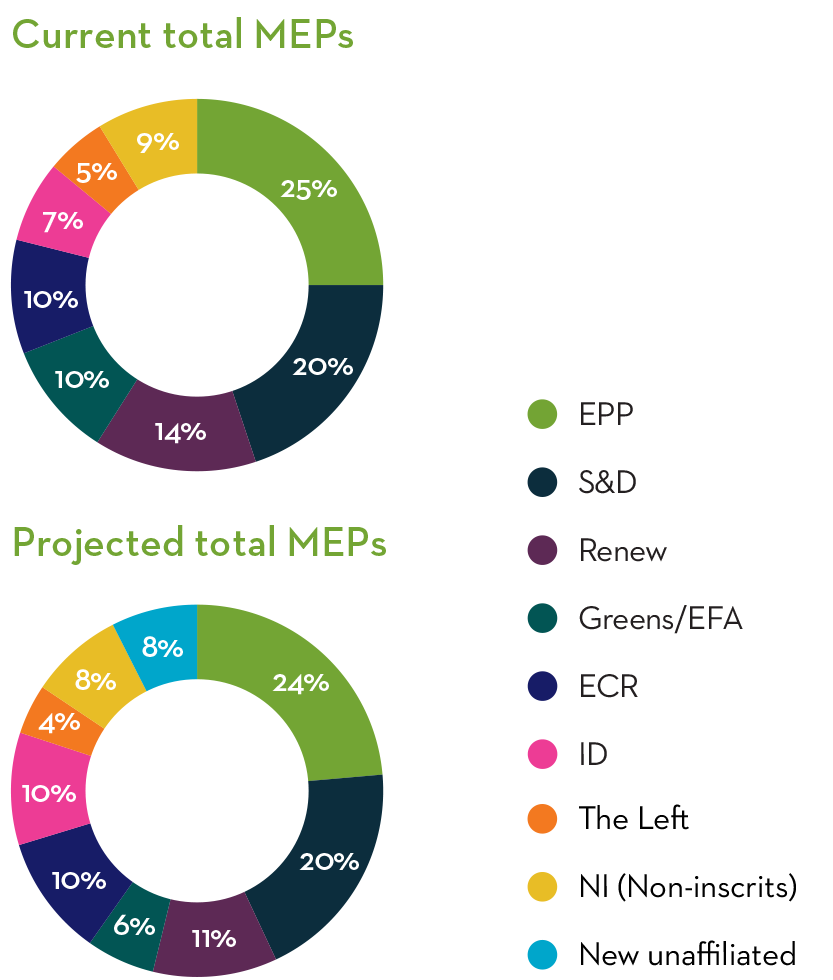

Polls currently show increasing momentum by the far right parties, to the detriment of centrists – centre-right European People’s Party (EPP), centre-left Socialists and Démocrates (S&D), and the progressive Renew Europe party (RE). At this stage, the prediction is that the centrist parties retain a majority (55% vs 59% previously) and therefore overall control of the European Parliament.

Right wing parties comprise the radical European Conservatives and Reformists (ECR), and the far-right Identity and Democracy (ID) – their share of the seats is predicted to increase to 20%, from c.17% in the current parliament. There are unaligned parties, the NI and New Unaffiliated parties. Whereas the Green parties sit in the Greens/EFA (European Free Alliance).

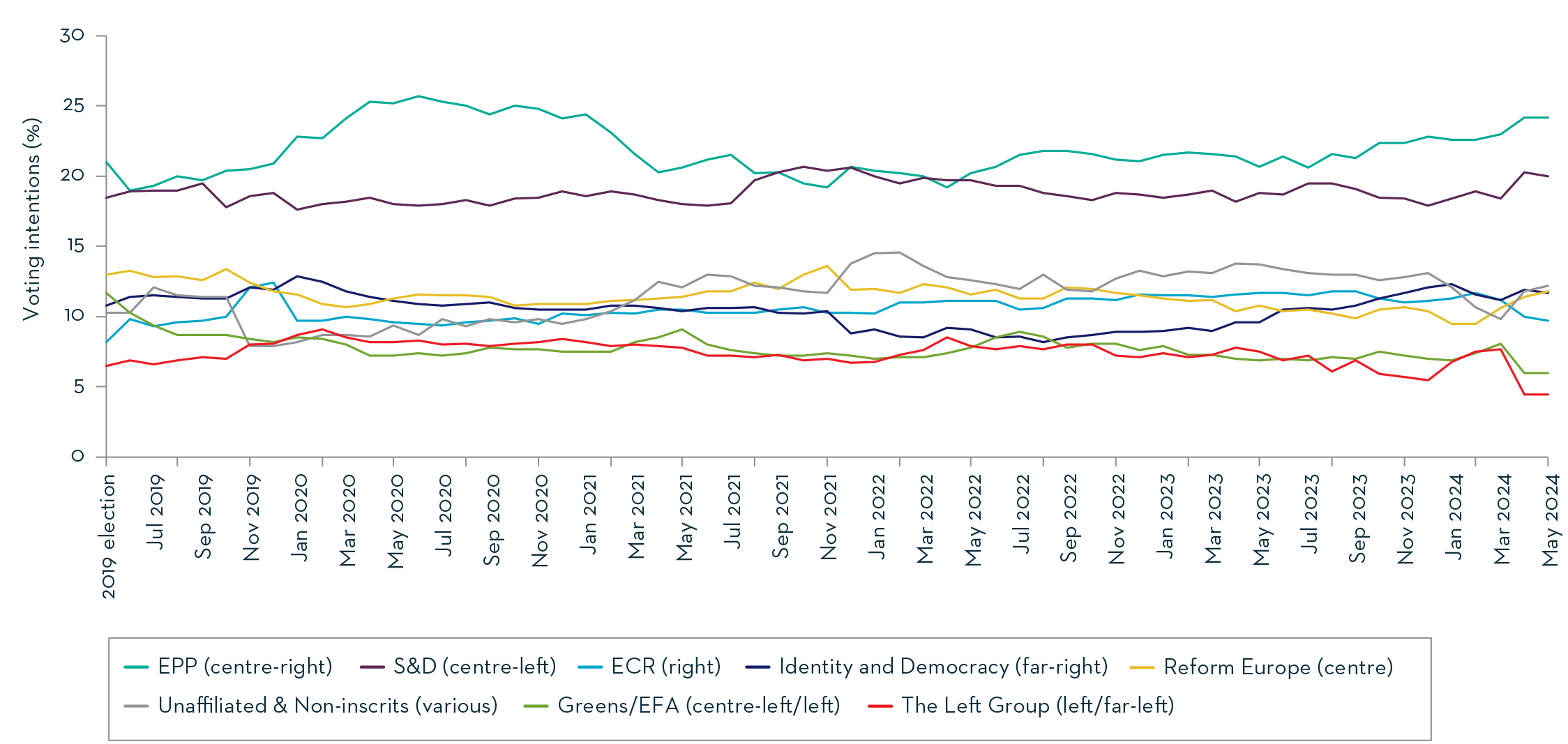

European Parliament Election Poll of Polls

The centre is the biggest voting bloc but the right are gaining ground

Source: Martin Currie and Politico, 31 May 2024.

Some dynamics to watch out for across the EU – the ongoing advent of far-right parties

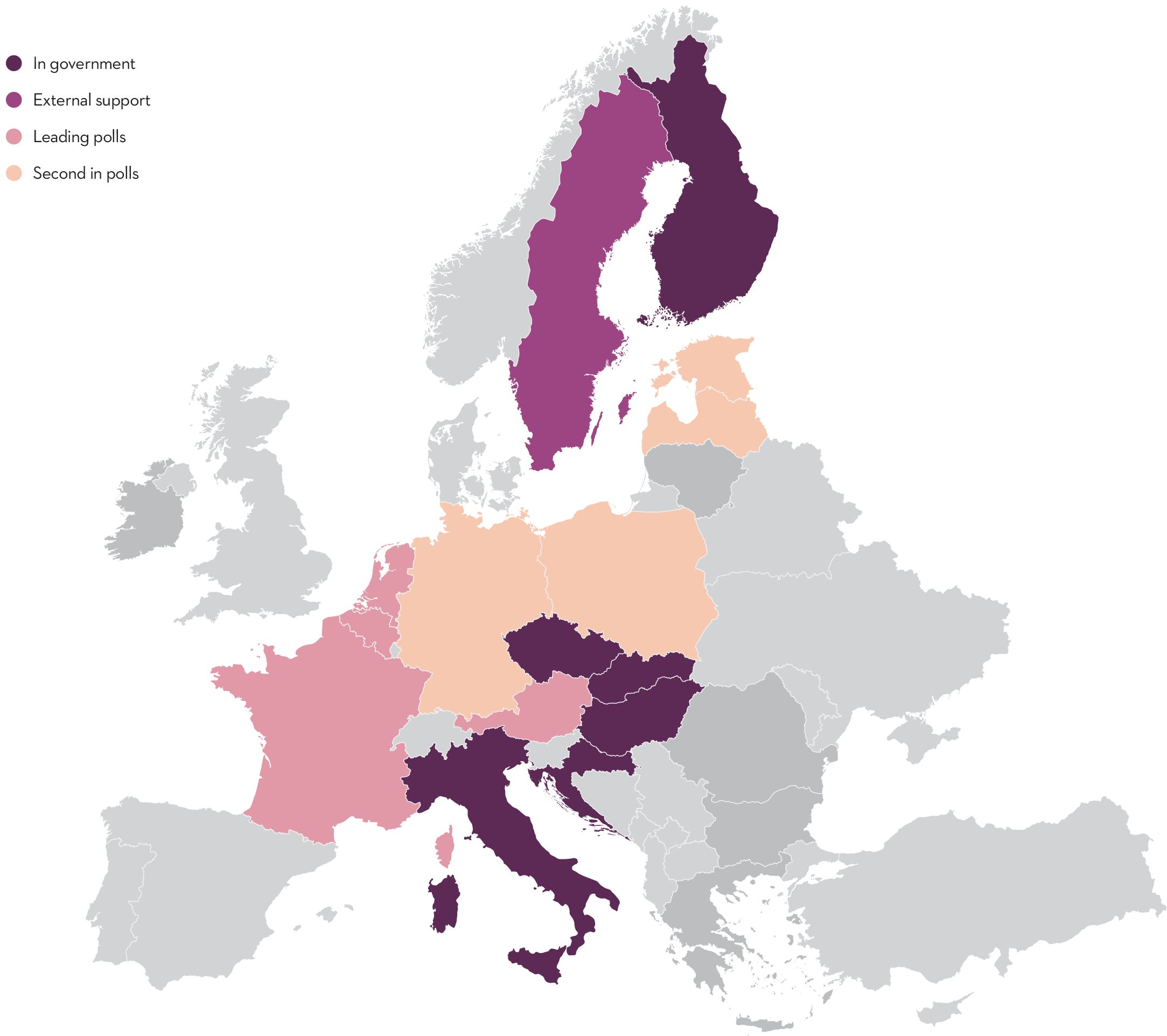

Far-right political parties are certainly gaining ground throughout Europe, in a worrying manner from the point of view of anti-EU sentiment, which could lead to a slower EU integration agenda. There are already six EU countries that are currently governed by hard-right parties: Italy, Finland, Croatia, the Czech Republic, Slovakia, and Hungary.

In addition, the Netherlands is heading towards a right-wing government. The Dutch coalition talks have just concluded, after six months of negotiations, leading to the agreement for Geert Wilders to form a government. Furthermore, the government situation in Sweden appears precarious, relying on a confidence agreement with the nationalist Sweden Democrats, which is currently the second largest party in parliament.

Worrying trends across other EU countries include France, Belgium and Austria where hard-right parties are leading in polls.

The countries where far-right parties are in second position in polls are also worth listing: these are currently Germany, Poland, Latvia, and Estonia.

The map below illustrates the current situation. Countries in light purple on the map are where the right is in a government coalition (Sweden).

The far-right in the EU

Source: Martin Currie and Politico, 29 May 2024.

In our view, the most important political event for investors to watch out for is not so much the upcoming European Parliamentary elections, given the expected retention of majority by centrist parties, as explained above, but rather the 2027 French presidential elections.

2027 French Presidential election could be an investor and geopolitical event risk

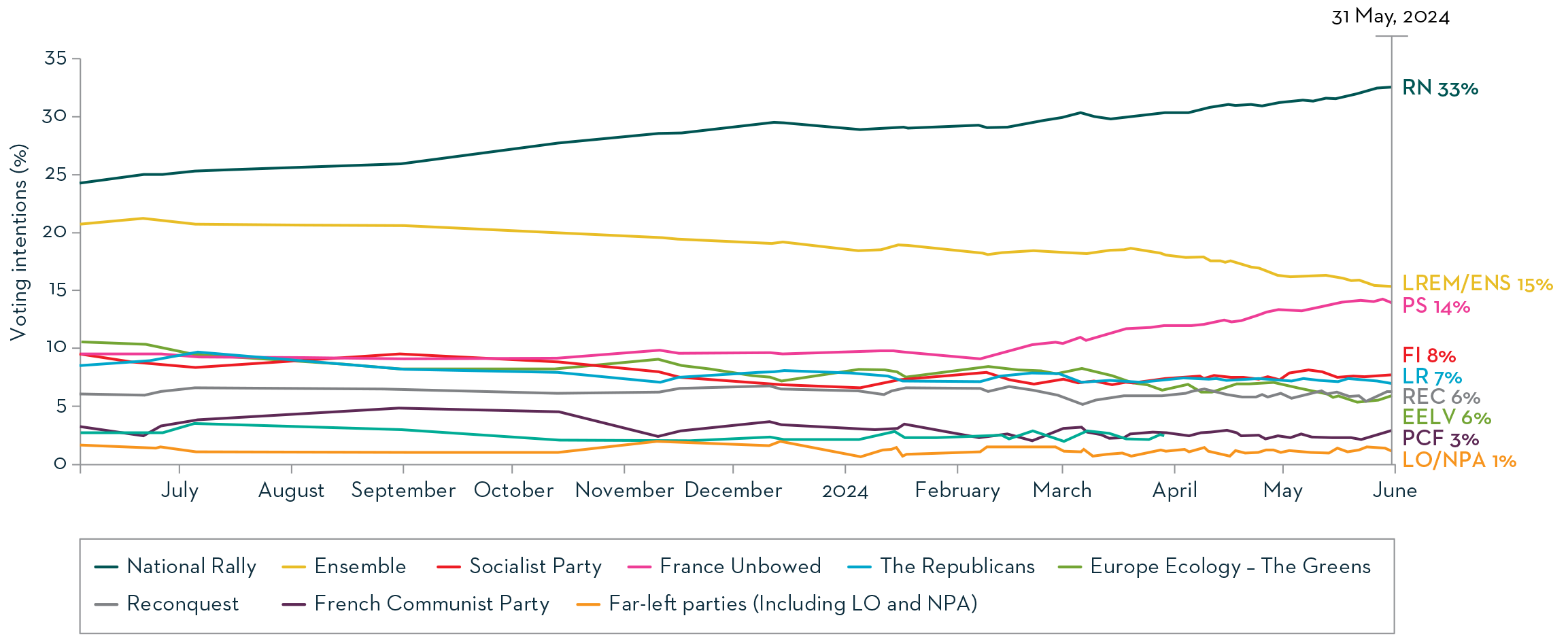

France is a key EU member state, so the French Presidential elections scheduled for April 2027 could be an event risk for investors, in turn dialling up the geopolitical risk in Europe. The hard-right party of Le Pen, RN, is currently leading in the polls, with 33% of votes, versus Emmanuel Macron’s party, LREM only polling at c.15%, whilst the Socialist Party (PS) polls at 14%.

President Macron will be coming to the end of his two-term mandate, which means that there will be a need for some credible candidate to take over from him. Should there be a lack of charismatic candidates to oppose Le Pen, we could be at higher risk of a worrying historic win by the RN party. President Macron’s approval rating is currently at c.30%, with a high disapproval rating of 68%.

France – European Parliament voting intentions – May 2024

Source: Martin Currie and Politico as at 29 May 2016.

Back in the 2022 French presidential elections, Le Pen got 23.2% of the votes in the first round (a rise compared to 21.3% in the 2017 presidential elections), vs Macron winning 27.8% of votes. Macron went onto win the second round by 58.5% to Le Pen’s 41.5%.

EU policy direction – do not expect any major shifts

The EU will have a new five-year policy plan, which is likely to be a continuation of the previous five years, in terms of focus on the Energy Transition. The policies will however be influenced by the increased geopolitical tensions, with a higher emphasis on alternative energy sources rather than simply green energy, and more spending channelled towards national security and defence.

We also believe that more initiatives will be taken to equip the EU with harnessing the Artificial Intelligence (AI) opportunity in a more rapid manner, through initiatives to stimulate investment in innovation. Ongoing focus on regulation related to AI, and increased regulatory scrutiny on big tech companies is likely to continue.

Finally, there is likely to be an increasingly more aggressive stance towards unfair competition from China, as a way to protect domestic industries, notably the auto industry.

Our eight medium-term thematic opportunities remain well underpinned

Many of these potential policies capture our eight medium-term thematic opportunities, and three seismic thematic shifts, which are Energy Transition, Ageing Population, and Resource Scarcity. These are illustrated below, and written about in our report, ‘Seismic thematic shifts bringing opportunities and disruption’.

Three seismic shifts capturing our eight medium-term thematic opportunities

Sources

1Source: Politico as at 31 May 2024.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document.

Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.