Content navigation

As the dust settles on Labour’s first budget, we reflect on what this means for the UK's equity markets.

- We continue to see an underlying cyclical recovery

- The trajectory of the recovery may be shallower given measures in the budget

- We remain focused on the opportunities at a stock level

We’ve not been shrinking violets about our positivity that a UK domestic resurgence has begun. Over the past couple of years, we’ve been banging the table about the underappreciated opportunity in UK equities through the combination of historically low valuations and economic strength not yet realised by the market. Eventually, markets did begin to sit up and take note. In late 2023 we saw strong returns start to gather pace, but these began to stutter and halt in late Summer 2024 as gloomy government rhetoric and increasing uncertainty around the impact of the Autumn budget hit markets.

Labour came into power on a strong footing with businesses due to its pre-election courtship with company leaders and its growth focused agenda. This, combined with restoring a long-lost political stability in the UK, was initially taken well by markets. The government’s business friendly attitude has so far appeared to be more of a pre-election phenomenon than a post-election one, as its first budget brought a £25 billion tax on employers1 via national insurance contribution changes, a 9.8% increase in minimum wage2, and an increase in the cost of debt. We eagerly await further detailed information on the new governments long term pro-growth policies, something the budget failed to appropriately address.

As we reflect on the implications of the budget, upfront we would say it doesn’t directionally change our medium to long-term outlook. Our view is that the UK economy will continue to see an underlying cyclical recovery, one that is certainly not priced into equity values. However, we need to be mindful that the trajectory of the recovery may be shallower given the knock-on effects from some of the measures announced.

After the budget, the yield curve shifted upwards due to the budget’s inflationary implications and the increased likelihood rates may fall slower, which was not as far as previously expected. A move further supported by the subsequent Bank of England rate cut to 4.75%3 with an accompanying message of moderating the likely future pace of cuts.

-

Alongside the budget, the Office for Budget Responsibility’s growth prospects aligned in upgrading near term growth expectations yet took a slightly more cautious view on the medium-term prospects. Growth is still very much the direction of travel.

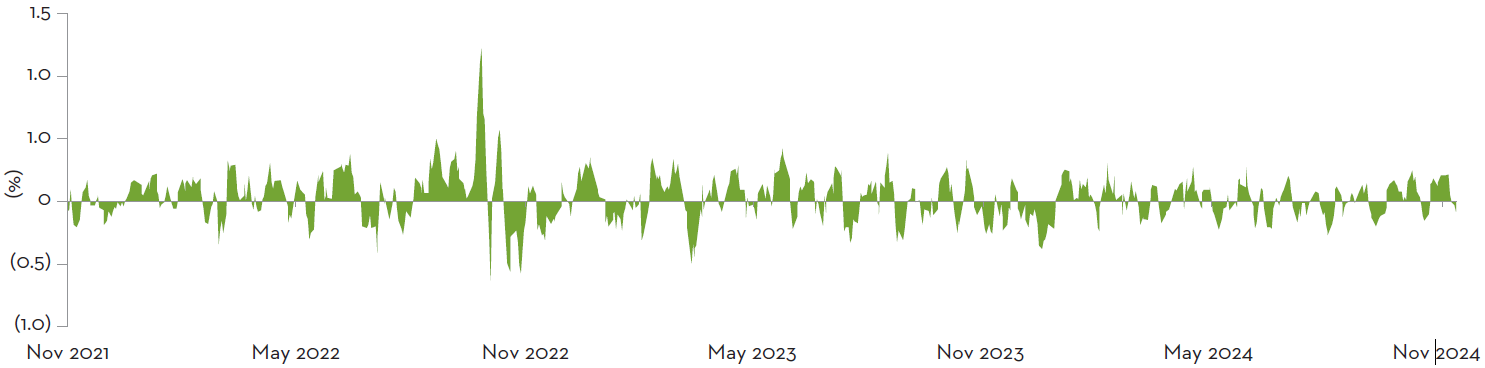

Not a Truss budget

10-year gilt yield

Source: Bloomberg as at 12 November 2024.

Vitally, this isn’t a repeat of Liz Truss's budget, with it sharp accompanying 1% shift in gilt yields. This was a much gentler move in yields.

The world has a striking habit of underestimating the UK. In the run up to the budget both the IMF4 and OECD5 upgraded their growth forecasts which now show the UK as one of the fastest growing economies in the G7, ahead of the eurozone but behind the US. Alongside the budget, the Office for Budget Responsibility’s growth prospects aligned in upgrading near term growth expectations yet took a slightly more cautious view on the medium-term prospects. Growth is still very much the direction of travel.

Real GDP growth

Source: Office for Budget Responsibility as at October 2024.

The consumer backdrop looks like a beneficiary of the budget. You’re seeing significant real wage growth through the increase in the National Living Wage, and no increase in direct taxation to “working people” (which we’ve now learnt should be interpreted as the majority of the population). This should be a big positive for consumption, the question then remains one of confidence. Will this simply result in an elevated savings rate, or will they go out and spend? While consumer balance sheets are strong, with saving rates potentially staying higher for longer, the temptation might be to defer discretionary expenditure.

The large tax raising measures were aimed at the business sector, specifically employment costs with a rise in employer National Insurance contributions. This is an additional cost headwind that many companies weren’t planning for. Many will need time to adopt a strategy to mitigate this cost and this may result in a hit to profitability. What is likely it that companies will look to mitigate the cost increase through a combination of greater productivity and efficiency, limiting future wage growth and increasing the price of the cost of the good or service. It’s an area will we be exploring in depth with our holdings once companies have worked through the detail.

We believe businesses will ultimately deal with these headwinds. Think of the wage inflationary pressures many have felt since Covid? Many were able to successfully manage this environment and maintain profit margins. We didn’t see earnings collapse during this period, in fact corporate earnings have demonstrated great resilience.

We remain focused on the opportunity at a stock level. Company fundamentals will always matter over the long-term, and we remain alert that the potential market volatility is likely to produce many more investment opportunities. Many valuations remain attractive, still below their long run averages, with attractive dividend yields, and strong balance sheets.

Sources

1Source: HM Treasury as at October 2024.

2Source: GOV.UK as at 21 November 2024. https://www.gov.uk/government/publications/minimum-wage-rates-for-2024.

3Source: Bank of England as at 7 November 2024. https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2024/november-2024.

4Source: International Monetary Fund as at October 2024. https://www.imf.org/en/Publications/WEO/Issues/2024/10/22/world-economic-outlook-october-2024.

5Source: OECD Economic Outlook as at 25 September 2024.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.