Content navigation

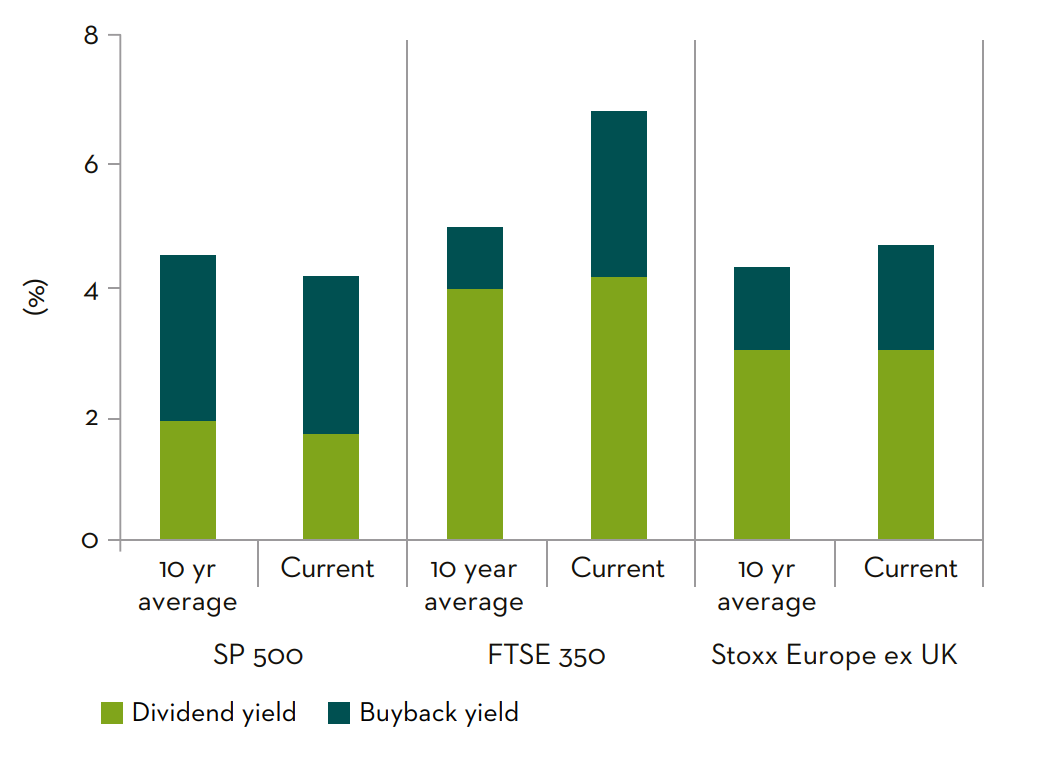

UK Equities are an exceptional opportunity for investors: This currently unloved asset class is trading at historically (and internationally) low valuations whilst offering access to a diverse range of interesting companies benefiting from an underappreciated UK economic strength. And let’s not forget an average dividend yield of almost 4% with share buybacks adding another 2% to returns1. Interesting, right?

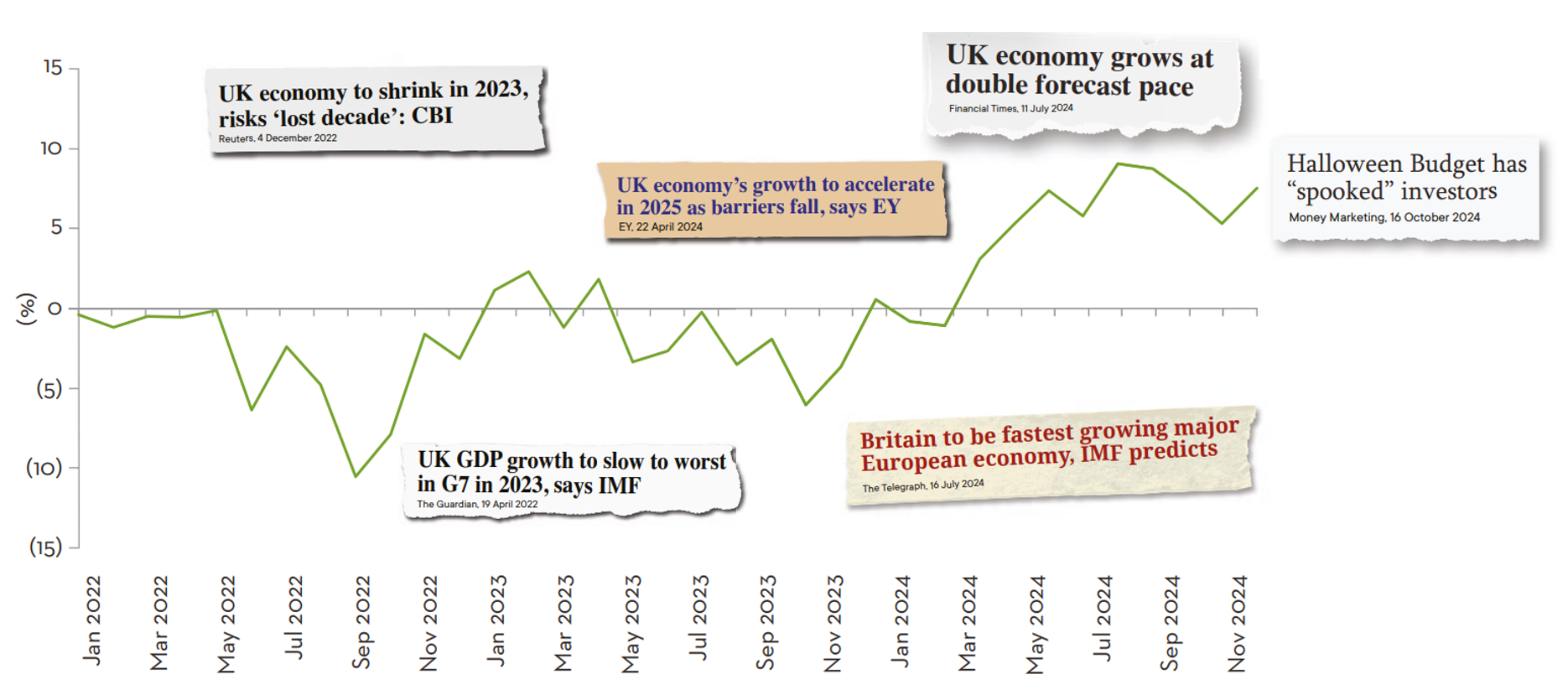

In late 2023 we saw strong returns start to gather pace, but these began to stutter and halt in late Summer 2024 as gloomy government rhetoric and increasing uncertainty around the impact of the Autumn budget hit markets.

Markets are now back moving on economic data; each inflation release, Purchasing Managers’ Index (PMI) data update, and confidence survey, will be poured over by the market until it’s clear how the UK economy is fairing under its new leadership.

We remain positive that the UK economy is in much better shape than it’s given credit for and remain focused on finding the best opportunities at a stock level. After all, company fundamentals are what matter and will drive returns over the long term.

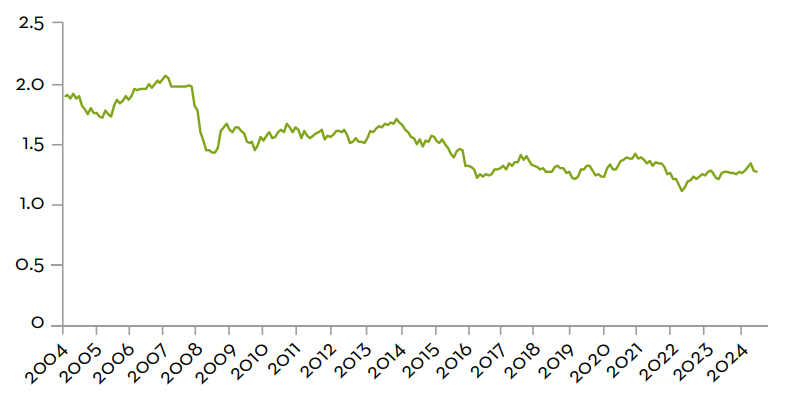

FTSE All Share Return

Source: Bloomberg as at 29 November 2024.

Contents

1. Inflationary risks

2. Monetary policy

3. Growth

4. Domestic resurgence

5. Valuation

Contents

1. Inflationary risks

2. Monetary policy

3. Growth

4. Domestic resurgence

5. Valuation

1. Inflationary risks

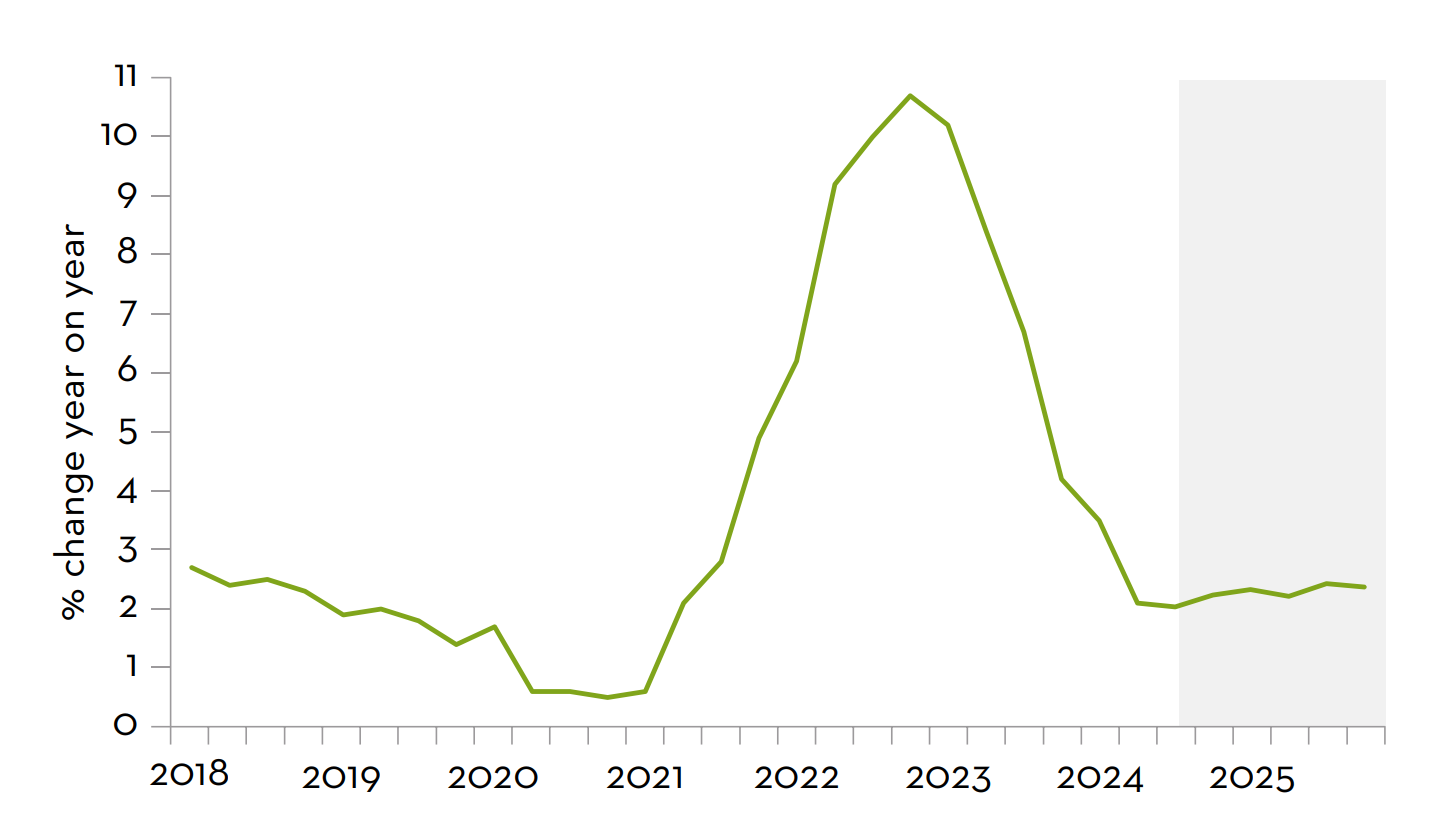

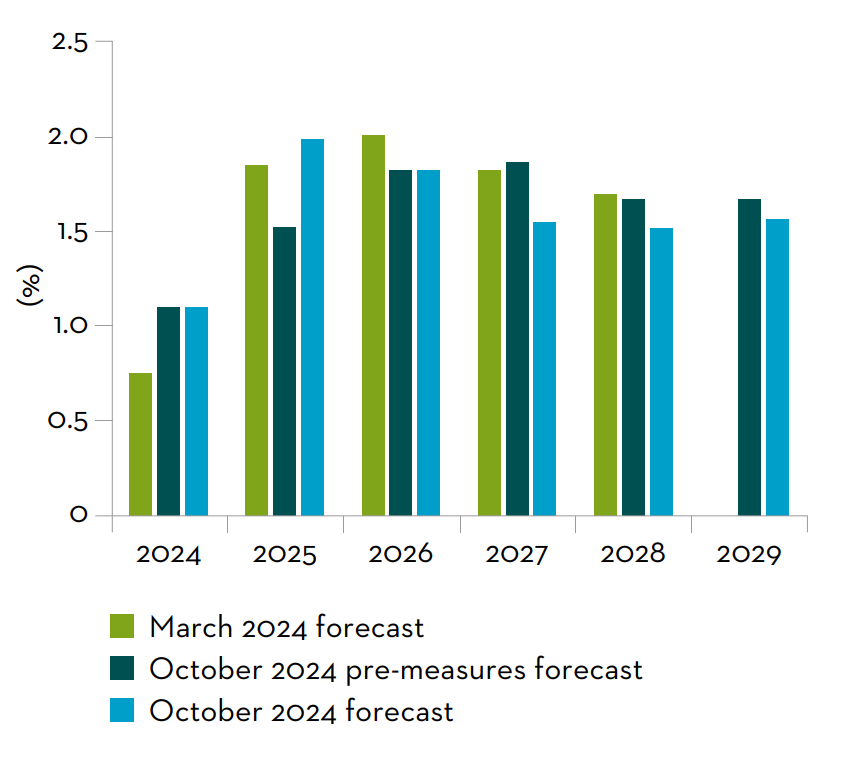

Inflation appeared to be coming back in line until the budget threw a spanner in the works. However, we believe well-run companies are more than capable of navigating an increasing cost base in 2025.

£24 billion pounds of National Insurance costs and a 6.7% increase in the minimum wage will certainly be felt by UK plc. Companies weren’t planning for this, and many will need time to adopt a strategy to mitigate this cost.

This is not a trip back to the 2022-2023 inflation rates of more than 10%, provided there are no external shocks. However, this is an inflationary pressure that will likely help keep inflation above the Bank of England’s 2% target and likely giving the Monetary Policy Committee pause for thought.

Well-run companies, with experienced quality management teams, have been through harder times and are ready to manage the implications of the budget. They maintain levers to manage cost increases, especially those companies with strong balance sheets and financial management discipline. Having spoken to many portfolio holdings in the weeks following the budget, they are quietly confident they can mitigate the increases through price rises and other efficiency measures.

Consumer Price Index (CPI) inflation projections

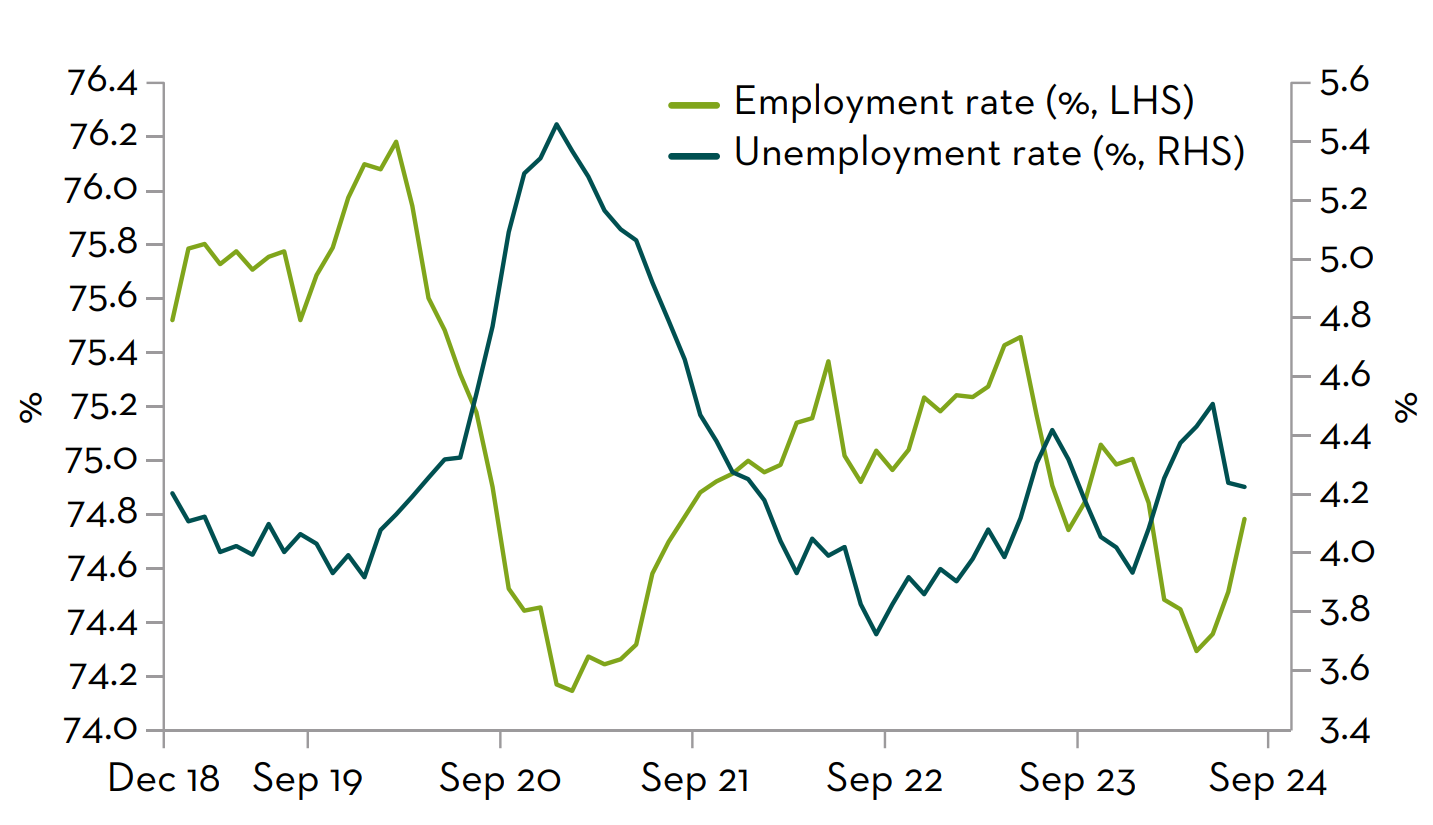

Employment and unemployment rate

Sources: Lazarus Economics, ONS, Bank of England as at November 2024. There is no assurance that any projection, estimate or forecast will be realised. Consumer Price Index is a measure of the change in prices paid by consumers. It is used to measure inflation.

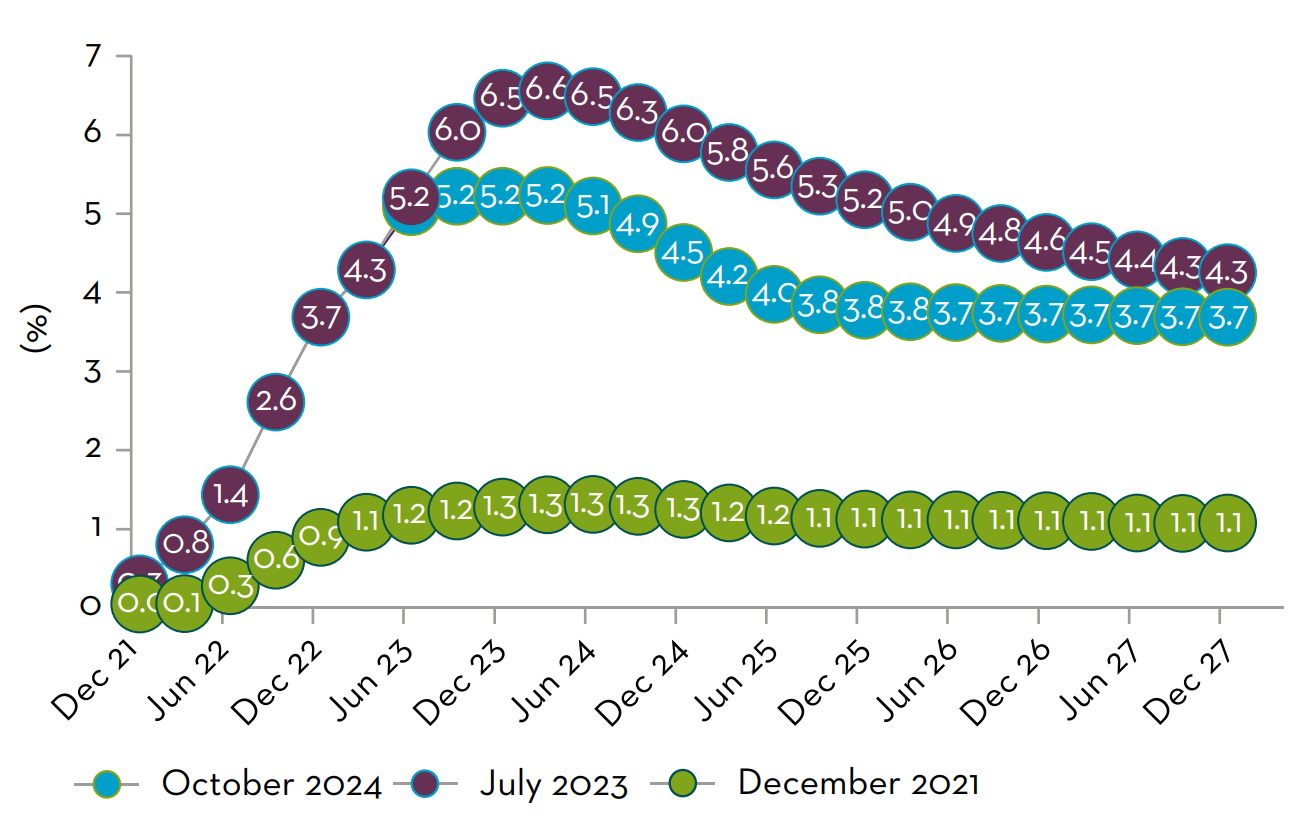

2. Monetary policy

Interest rates are forecast to fall, it’s just a case of how fast and how far. This is supportive of strength in the more domestically focused areas of the UK market in the years ahead.

The Bank of England has clearly expressed its preference for a slow and steady approach to loosening monetary policy, keeping an eye on what inflation does. The budget did change things, but this isn’t a repeat of the 2022 Truss-Kwarteng mini-budget. The yield curve was nudged upwards as the market digested the budget’s inflationary aspects, introducing further caution to the Bank’s outlook and the anticipation of a slower pace of rate cuts.

We assume some costs will be inflationary but companies will also need to find savings elsewhere, likely via productivity and efficiency gains, limiting future wage growth and reducing workforces. This could lead to interest rates needing to be reduced faster than anticipated to promote employment and further growth, something that would be supportive for UK equity valuations. It could be a case of bad news is good news for interest rates.

Market interest rate expectations

Source: Lazarus, Economics, Bank of England as at October 2024.

GBP–USD exchange rate

Source: Bloomberg as at 29 October 2024.

Not a Truss budget: 10-year gilt yield

Source: Bloomberg as at 12 November 2024. Gilt yield is the interest rates paid on British Government bonds.

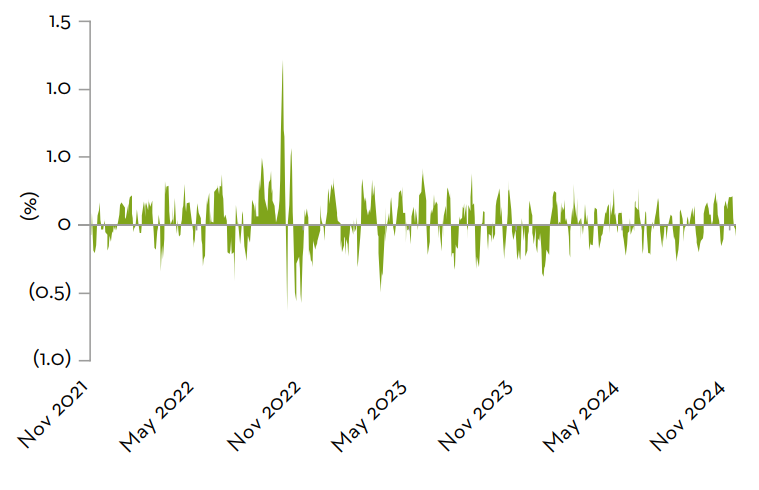

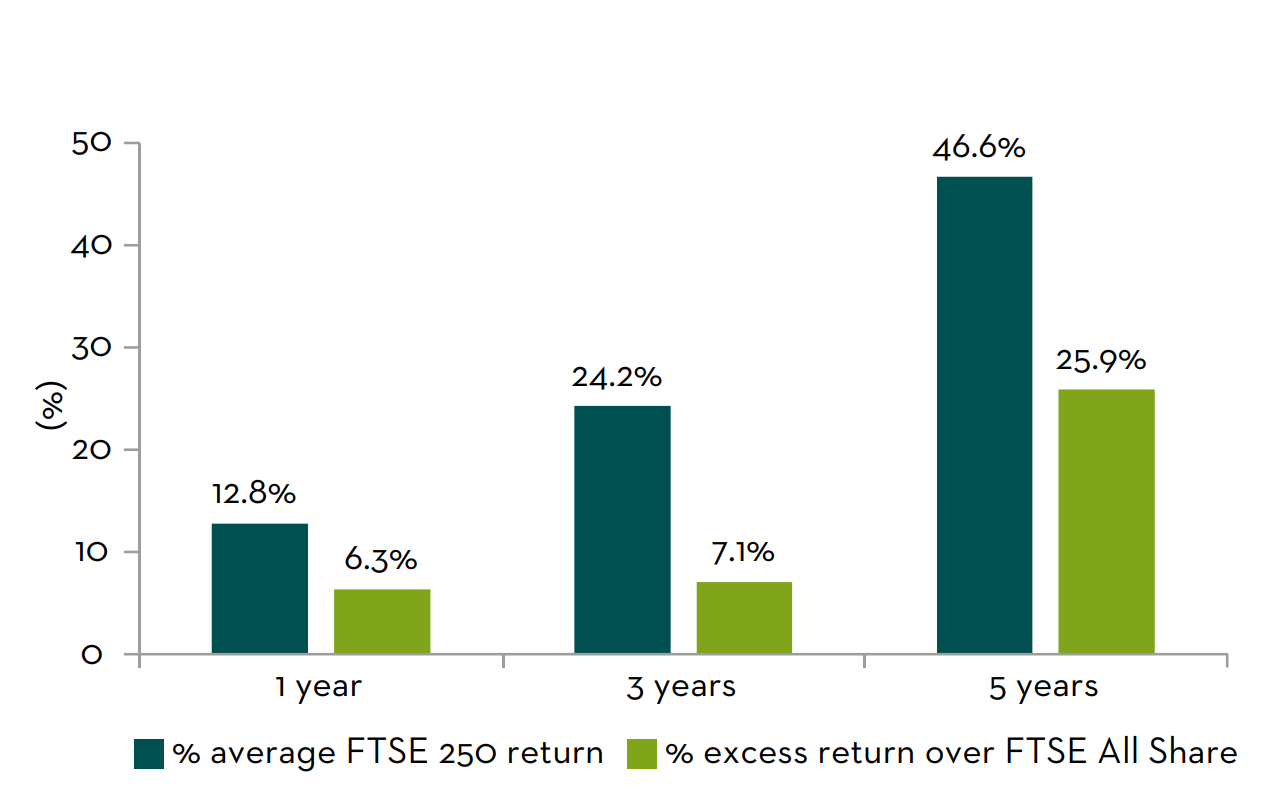

FTSE 250 returns after first UK interest rate cut

Source: Martin Currie and Bloomberg as of 31 May 2024. Data is month end index for the month when UK interest rates were first cut. Date range analysed is 1990-2024 (7 rate cut periods)

-

UK Equities offer exceptional value to investors. The market is undervalued by historical and international standards, with its return potential further buoyed by attractive dividend yields and share buybacks.

3. Growth

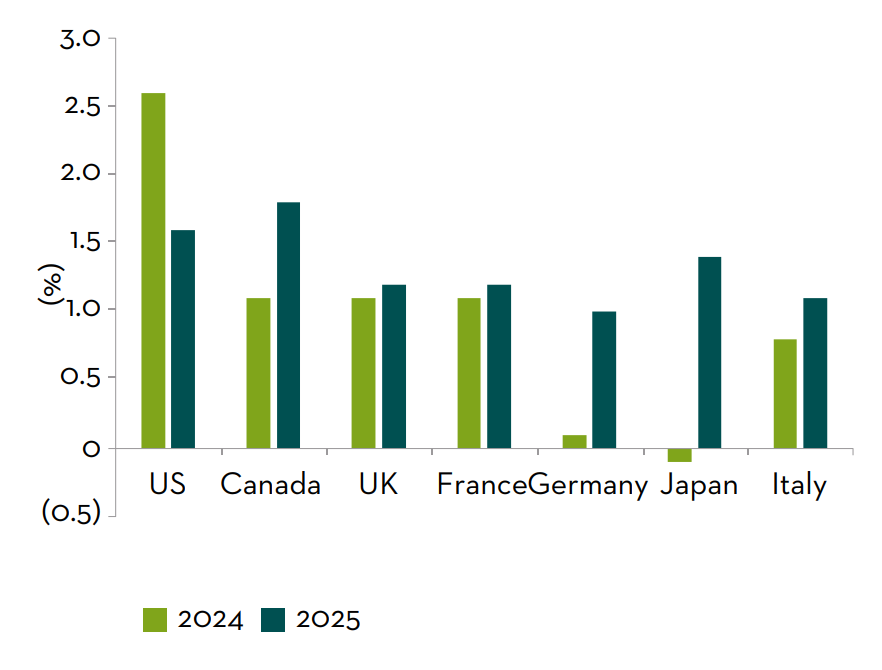

The world has a striking habit of underestimating the UK. In the run up to the budget both the International Monetary Fund (IMF) and Organisation for Economic Co-operation and Development (OECD) upgraded their growth forecasts which now show the UK as one of the fastest growing economies in the G7, ahead of the eurozone but behind the US.

Yes, the recent budget has slightly muted the medium term growth forecast. However, growth is still very much the direction of travel, one which we believe will be further supported by monetary policy decisions. High quality companies with strong balance sheets can prosper under these economic conditions.

G7 growth

Real Gross Domestic Product (GDP) projected growth rates in G7

Source: OECD Economic Outlook, Interim Report September 2024. G7 consists of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

GDP

Changing Real GDP forecast

Source: Office for Budget Responsibility as at October 2024.

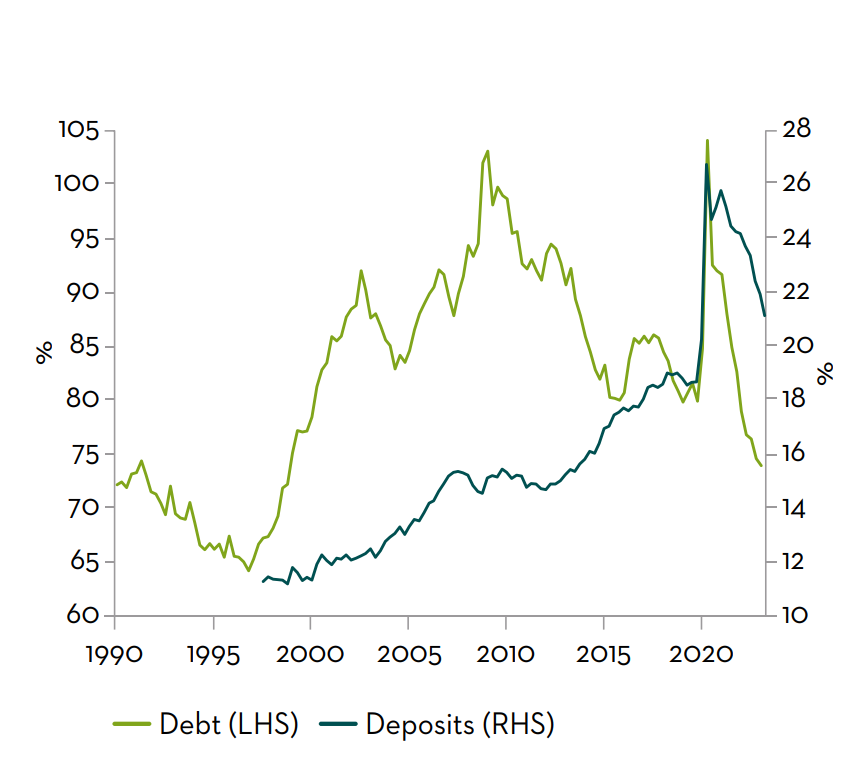

Debt

Corporate debt and deposits as a % of GDP

Source: Berenberg, as at 31 August 2023. Chart shows debt and deposits of private non-financial corporations as a % of GDP. Dividend yield shows how much a company pays out in dividends each year relative to its stock price. Buyback yield is the ratio between the value of a company's purchase of its stock versus its market capitalisation.

-

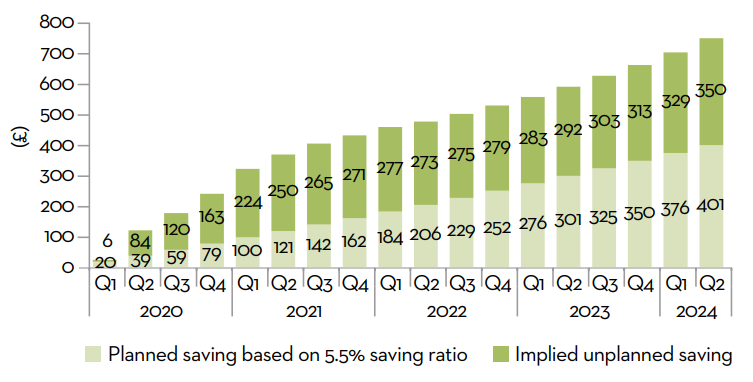

What will consumers do next? Keep saving in the face of falling base rates or will they begin spending more? This is something we will be watching closely as 2025 unfolds but we feel the domestic resurgence is ready to take flight.

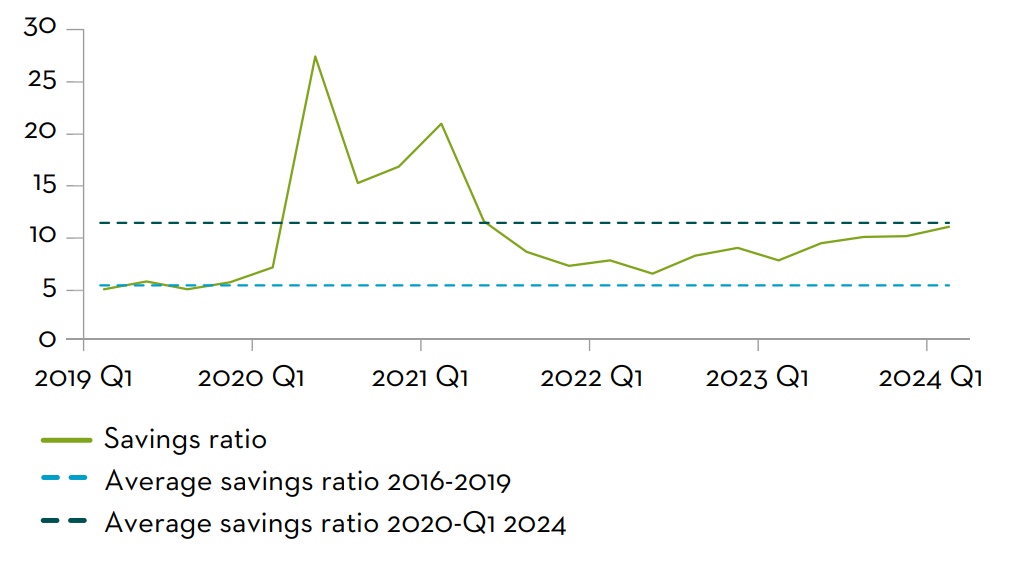

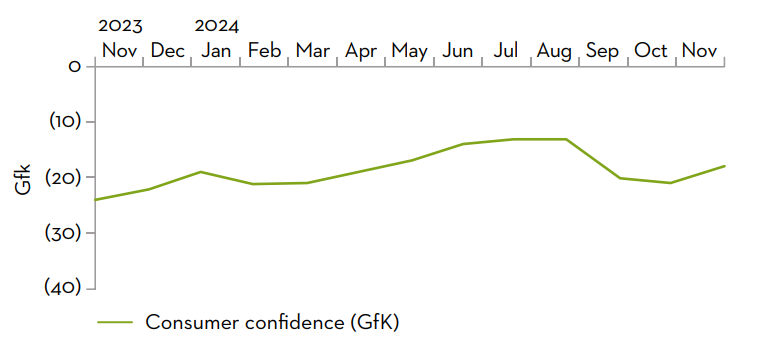

4. Domestic resurgence

A domestic resurgence is on the cards, the question remains one of confidence. The new Labour government's pessimistic messaging briefly reversed the upwards trend in consumer confidence. Those that could spend held back, leading to a precautionary increase in the UK savings ratio, with high interest rates further growing savers’ pots of money.

The thing is, the economy is growing and even if inflation ticks up, we’re not heading towards another cost-of-living crisis. Disposable incomes are creeping upwards too – most obviously for the two million people on the minimum wage9 who are due to receive a 6.7% increase in 2025, hot on the heels of a 9.8% increase in 2024.

What will consumers do next? Keep saving in the face of falling base rates or will they begin spending more? This is something we will be watching closely as 2025 unfolds but we feel the domestic resurgence is ready to take flight.

UK savings ratio

Source: Lazarus Economics, ONS, Bank of England, July 2024. There is no assurance that any projection, estimate or forecast will be realised.

Consumer confidence is key

NIQ as at 22 November 2024. GfK (originally GfK-Nürnberg Gesellschaft für Konsumforschung e.V., 'Nuremberg Society for Consumer Research') is the largest German market research company.

Estimated planned & unplanned household saving

Source: Lazarus, Economics, ONS as at October 2024.

Year-on-year change in Asda Income Tracker

![]()

9Source Income: Asda Income Tracker, as at July 2024.

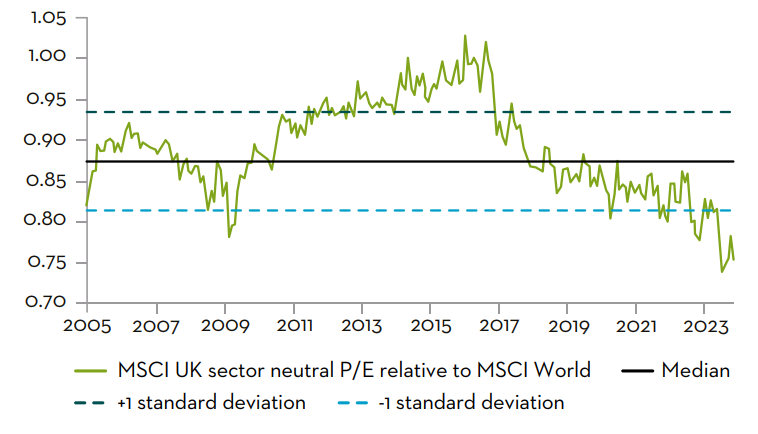

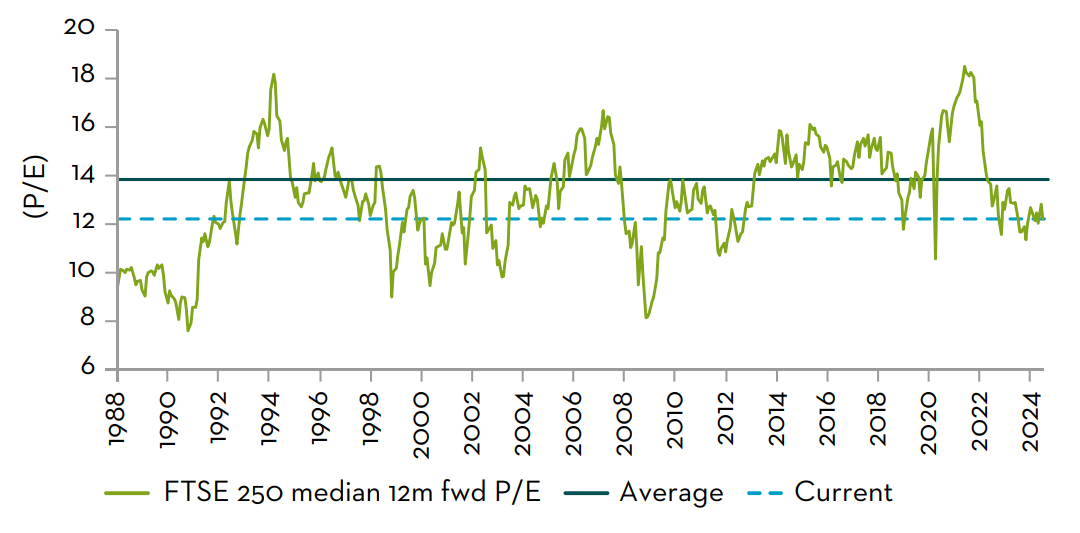

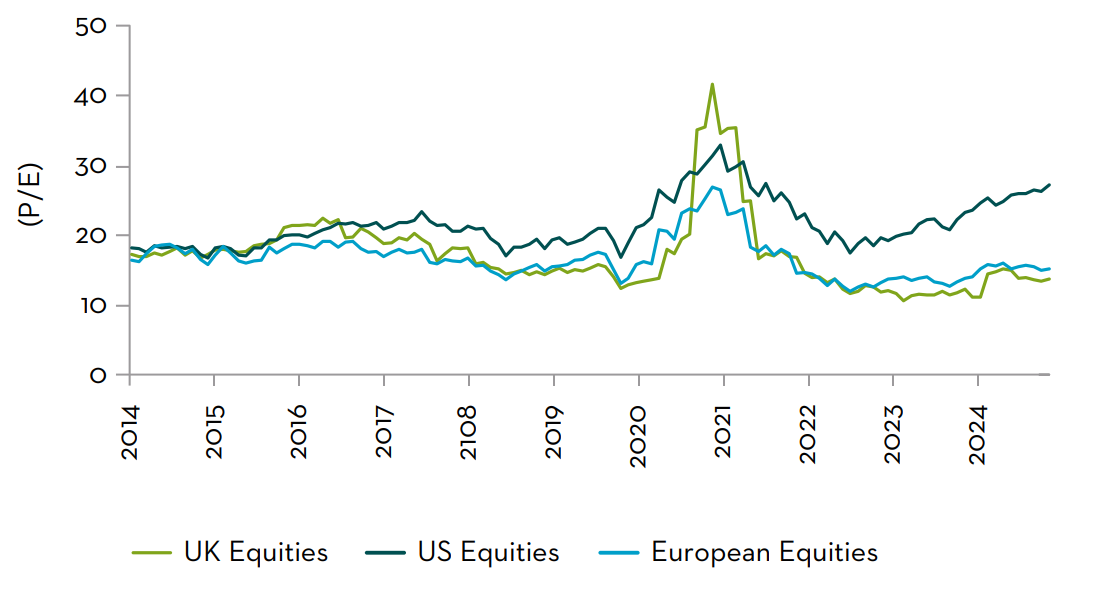

5. Valuations

UK Equities offer exceptional value to investors. The market is undervalued by historical and international standards, with its return potential further buoyed by attractive dividend yields and share buybacks.

The million-pound question is when will the market re-rate? That we cannot predict. What we do know is that the UK stock market offers incredible value; those who are invested when it finally re-rates could be richly rewarded.

MSCI UK sector neutral 12 month forward P/E

Source Forward P/E: Berenberg as at 1 July 2024.

FTSE 250 median 12 month forward P/E

Source: JP Morgan, as at 30 November 2023.

Forward P/E Multiple International Comparison

Source: Bloomberg as at 30 November 2024.

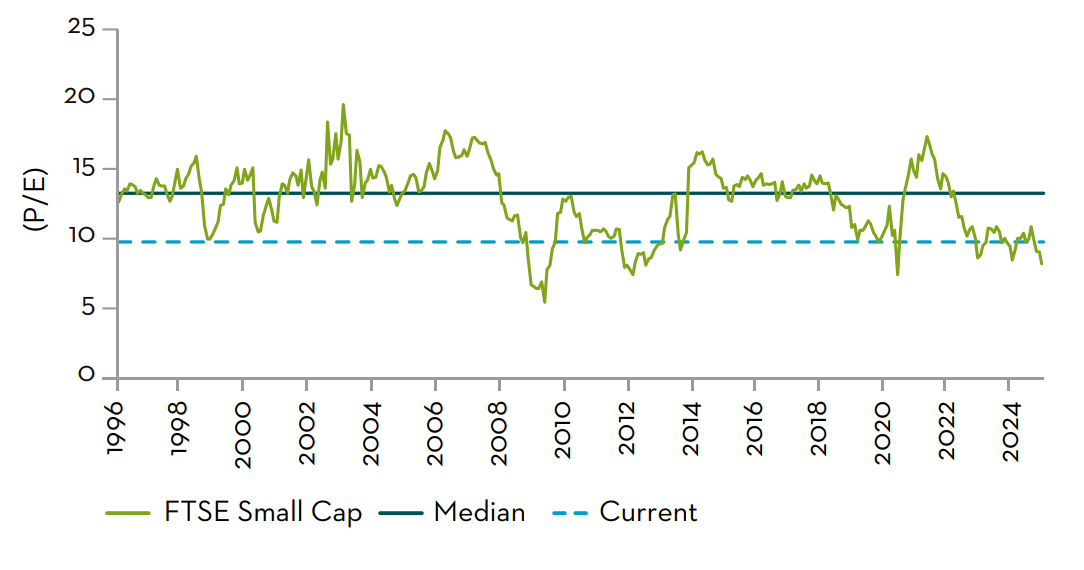

FTSE Small Cap median 12 month forward P/E

Source: Bloomberg as at 30 September 2024. P/E = Price to Earnings

Dividend yields UK versus US and Europe (ex UK)

Source: Liberum, Bloomberg as at May 2023.

Sources

1Source: Bloomberg as at 4 December 2024. Purchasing Managers’ Index (PMI) is an indicator of the prevailing direction of economic trends in the manufacturing and service sectors.

2Source: GOV>UK as at 27 March 2024.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.