Content navigation

Key takeaways

- Returns from UK mid-caps have shown long-term resilience.

- UK mid-caps are valued at 20% below their long-term average and offer an attractive income stream.

- Factors that could trigger a resurgence include interest rate cuts, a supportive economic backdrop and strong corporate fundamentals.

Mid-sized companies in the UK have historically offered attractive long-term returns. However, recent years have posed challenges as businesses grappled with the aftermath of Covid-19 and economic uncertainties.

Despite these hurdles, mid-cap stocks, representing both the best of domestic-focused firms and global leaders, are now emerging as compelling opportunities for astute investors. With multiple catalysts aligning, mid-cap stocks stand at the precipice of a potentially rewarding resurgence.

-

For investors, the current market presents an opportune moment to capitalize on attractive valuations.

Long-term resilience of UK mid-caps: An enduring trend

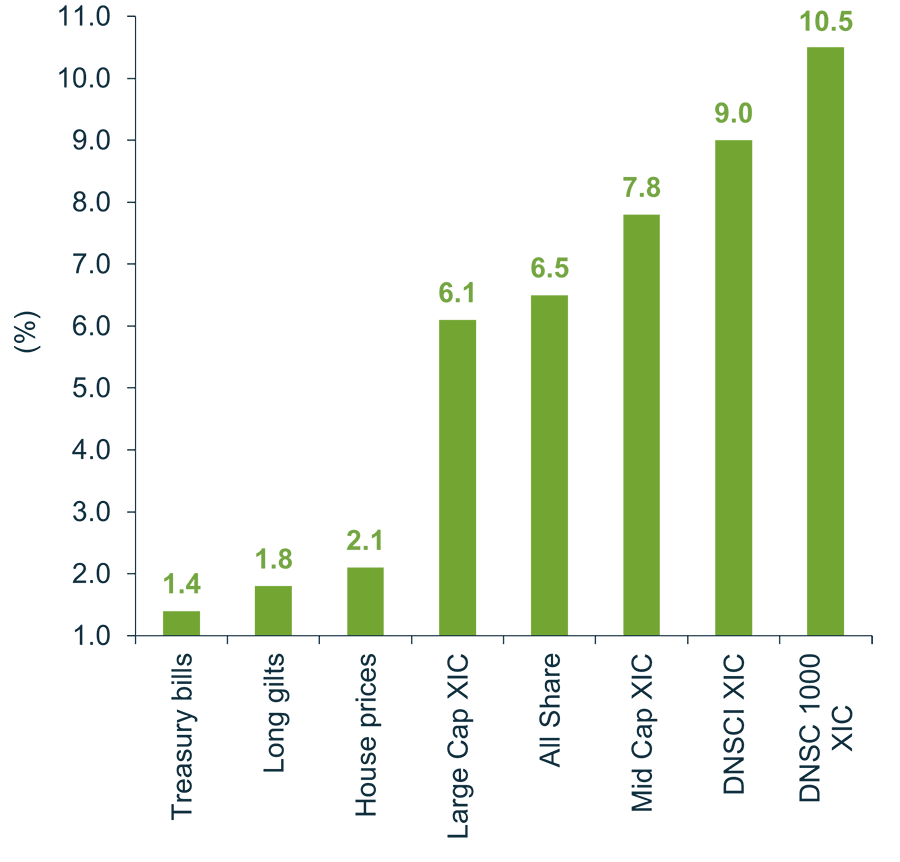

Annualised real returns for UK assets: 1955 - 2023

Source: The NSCI 2024 — Scott Evans and Paul Marsh as of 15 January 2024.

Charting back to 1955, UK mid-caps have demonstrated remarkable resilience. They have delivered an average real return (which accounts for the impact of inflation) of 7.8% annually, according to the Deutsche Numis Mid Cap Index. In monetary terms, this means that if you invested £1 in mid-cap stocks in 1955, it would now be worth £4,159.

This consistent performance outshines government bonds and UK large caps, underscoring the enduring strength of mid-cap companies. Despite economic and market fluctuations, mid-cap stocks have historically provided robust returns, which we think makes them an attractive proposition for investors eyeing long-term growth.

Overcoming short-term challenges

In recent years, mid-cap stocks have faced short-term underperformance amid macroeconomic challenges, including a sluggish domestic economy and rising interest rates. As a result, they have lagged their more globally oriented counterparts in the FTSE 100 and currently trade at their lowest valuation relative to large caps since the 2008 Global Financial Crisis (GFC).

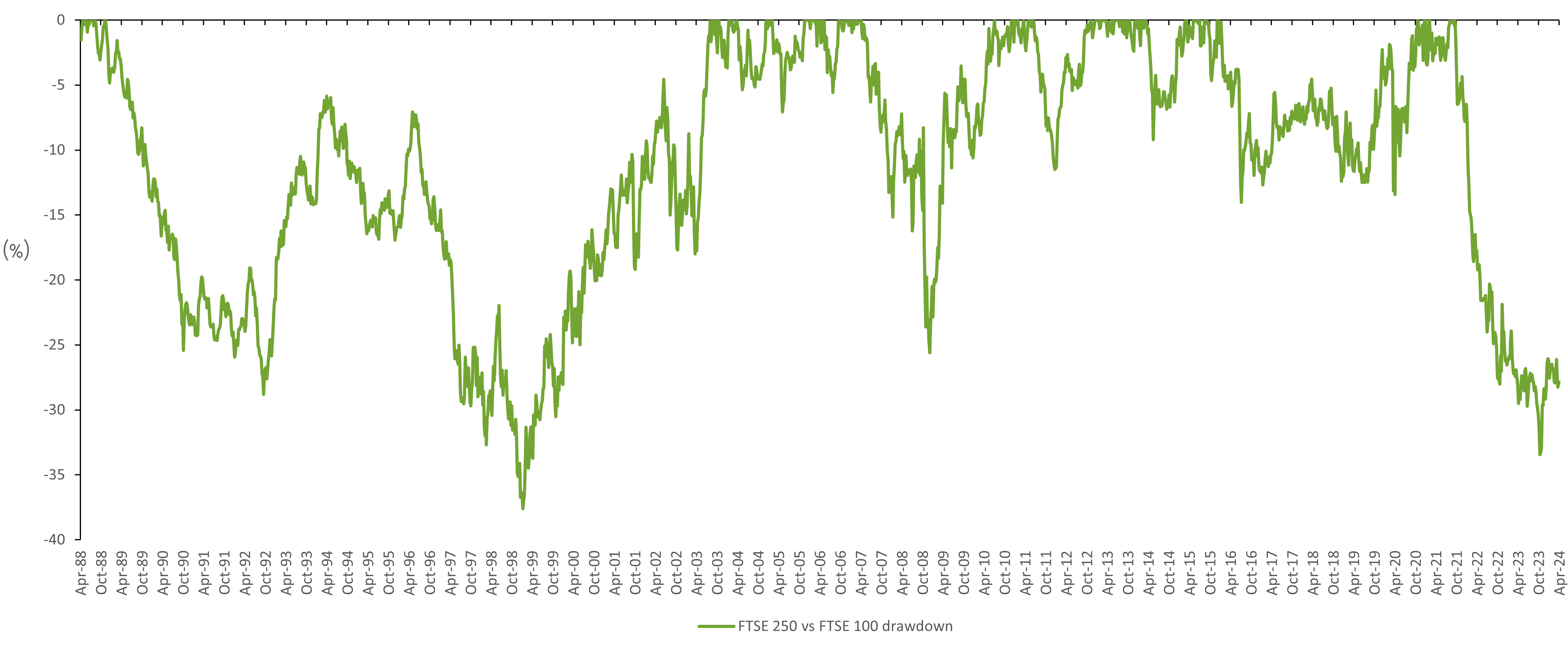

FTSE 250 versus FTSE 100 total return indices, drawdown from previous peak (since 1988)

Source: Berenberg as of 31 March 2024.

However, it's essential to note that the current market landscape differs significantly from that of the GFC. Mid-cap stocks comprise a diverse array of businesses, including market leaders and globally recognized companies with robust fundamentals, often overlooked amidst short-term market fluctuations.

Moreover, they have demonstrated resilience, emerging from the challenges of the Covid era with strong balance sheets and a proven track record of profitability.

Seizing opportunities amid adversity

For investors, the current market presents an opportune moment to capitalize on attractive valuations. Forward price-earnings ratios, a key metric for evaluating stock attractiveness, currently stand at 11 times earnings, representing a 20% discount from their historical average of 14 times1.

Additionally, the dividend yield on UK mid-caps, which measures how much a company pays out in dividends compared to its share price, is currently 4%. This is approximately 25% above its historical average of 3.2%2, providing investors with an attractive income stream while they wait for share prices to rise.

Moreover, the recent downturn in mid-cap share prices, driven by concerns over economic growth, belies the underlying resilience of these companies. Despite economic uncertainties, corporate profitability has remained robust, which we think lays the groundwork for future share price appreciation.

Catalysts for future UK mid-cap growth

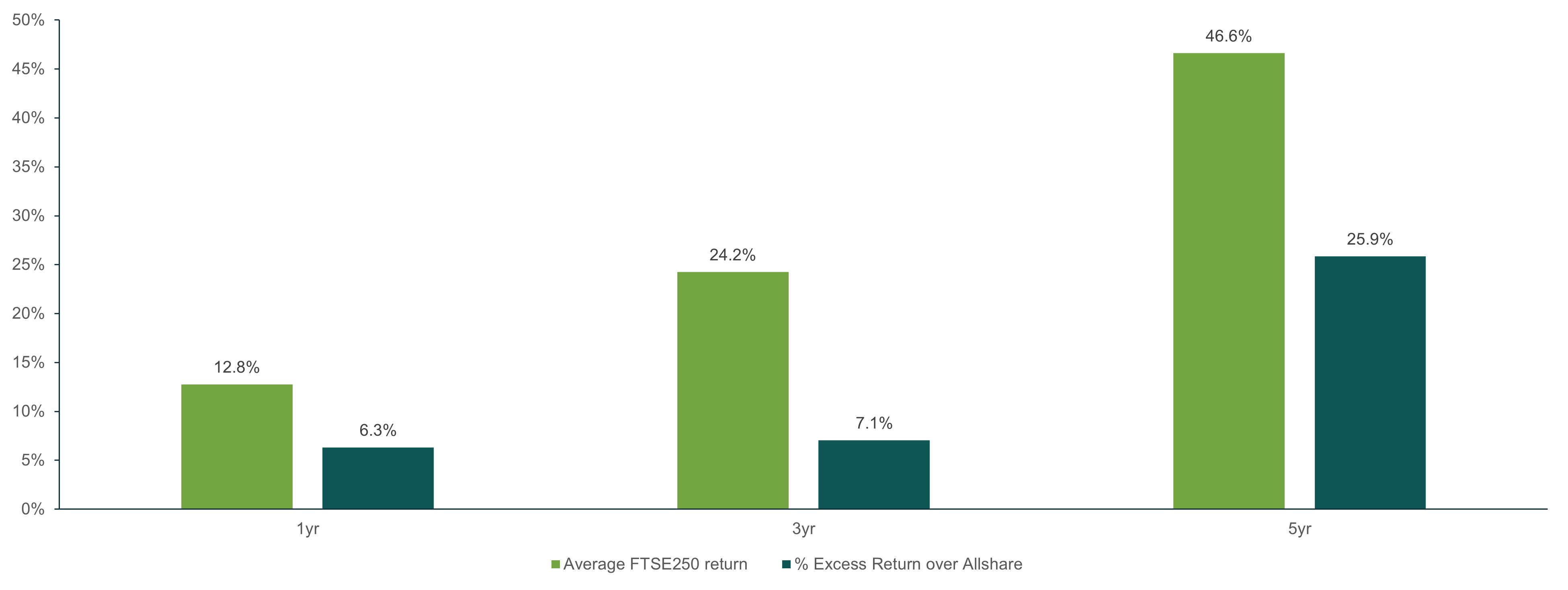

Looking ahead, several catalysts point towards a resurgence in mid-cap performance. Early indicators of economic improvement, including rising wages and falling inflation, bode well for consumer spending. Moreover, optimism surrounding potential interest rate cuts and positive manufacturing and services data signal a favourable environment for mid-cap companies to thrive.

Historically, mid-caps have outperformed the broader market following interest-rate cuts, paving the way for sustained growth over several years. As economic momentum gathers pace, mid-cap stocks are poised to reclaim their position as performance leaders.

Mid-cap Outperformance After First UK Interest Rate Cut

Source: Bloomberg, 1 April 2024. Time period: 1990 – 2023.

Conclusion: Unleashing UK mid-cap potential

In conclusion, we believe the stage is set for mid-cap stocks to shine once again. With a supportive economic backdrop, potential interest-rate cuts, and resilient corporate fundamentals, UK mid-cap stocks are well positioned for meaningful growth. By carefully navigating short-term market fluctuations and capitalizing on attractive valuations, investors can unlock the full potential of mid-cap investing.

Sources

1Source:Source: Berenberg, as at 1 April 2024

2Source:Source: Berenberg, as at 1 April 2024

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.’