Content navigation

Key takeaways:

- As interest rates fall, UK mid-cap stocks have predominately outperformed the wider UK stock market

- As the Bank of England (BoE) consider cutting rates, we believe it’s time to consider an investment in mid-cap stocks

- Active management can help navigate the volatility between falling rates and economic recovery

The underlying feeling in the equity markets is that good news is coming. The inverted yield curve was right in forecasting a recession, even if it was much milder than the BoE’s Monetary Policy Committee (MPC) prediction1. We are on the cusp of falling interest rates again as central banks await the data that will allow them to start what looks like a long descent.

A lesson from history

Equity markets appear excited by both the prospect of rate cuts and of a much better backdrop in 2025.

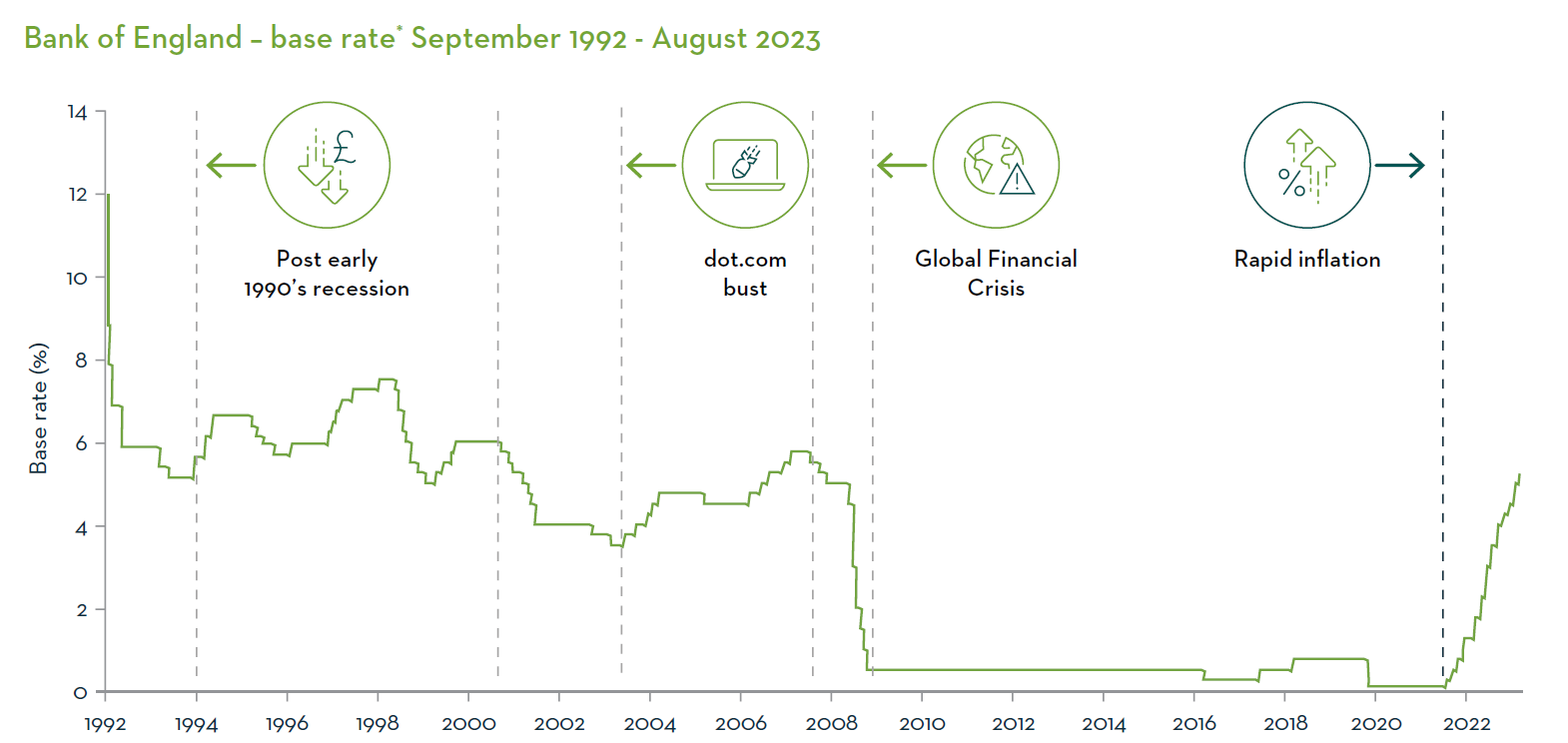

So, what next? What has happened when the MPC cuts rates? It doesn’t happen often, but we looked at the rate cutting cycles of 1992-94, 2000-03 and 2007-09 for guidance and if this feels from a long time ago, it was! Such was the legacy of the Global Financial Crisis (GFC).

Source: Bank of England, December 2023. *Repo Rate (1994 – 2005) and Official Bank Rate (2006 – date) are interest rates. The Minimum Band 1 Dealing Rate are discount rates (1992-1994). 16.9.92, UK leaves the European Exchange Rate Mechanism. Base rate was raised to 12%, and planned to be 15% (with effect from 17.9.92; never implemented).

Source: Bank of England, December 2023. *Repo Rate (1994 – 2005) and Official Bank Rate (2006 – date) are interest rates. The Minimum Band 1 Dealing Rate are discount rates (1992-1994). 16.9.92, UK leaves the European Exchange Rate Mechanism. Base rate was raised to 12%, and planned to be 15% (with effect from 17.9.92; never implemented).

-

We are on the cusp of falling interest rates again as central banks await the data that will allow them to start what looks like a long descent.

Negative markets?

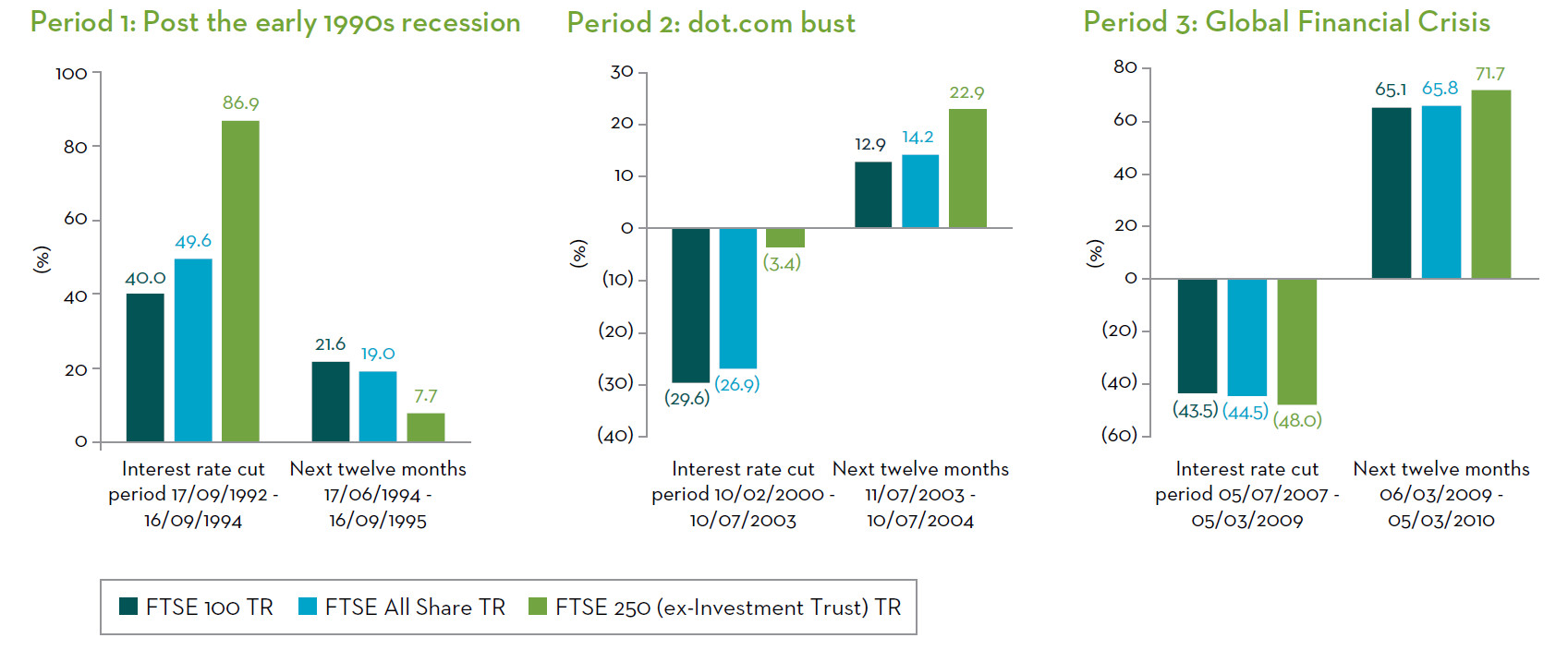

In 1992-94 equities rose with the FTSE All Share rising a phenomenal 49%.

This was in sharp contrast to their performance since the Millenium. During the rate cut periods, they fell 27% in the dot. com bubble of 2000-03 and dropped 44% in the GFC2.

It’s a different picture across the market cap spectrum

Underneath the FTSE All Share there are some surprises.

In 1992-94 whilst every part of the index rallied, the FTSE 100 was the worst performer, with the total return of 40%. But the FTSE 250 (ex-Investment Trusts)* rose an astonishing 87%. Halcyon days.

Source: Morningstar over periods shown. Performance of FTSE 100, FTSE All-Share and FTSE 250 (ex-Investment Trust) shown. Performance in £.

Source: Morningstar over periods shown. Performance of FTSE 100, FTSE All-Share and FTSE 250 (ex-Investment Trust) shown. Performance in £.

But what of returns in the negative post-Millenium period? In 2000-03 the FTSE 100 total return was a horrible -30%, however the FTSE 250 outperformed, down a “mere” 3%. This was the markets’ “Fright Night”.

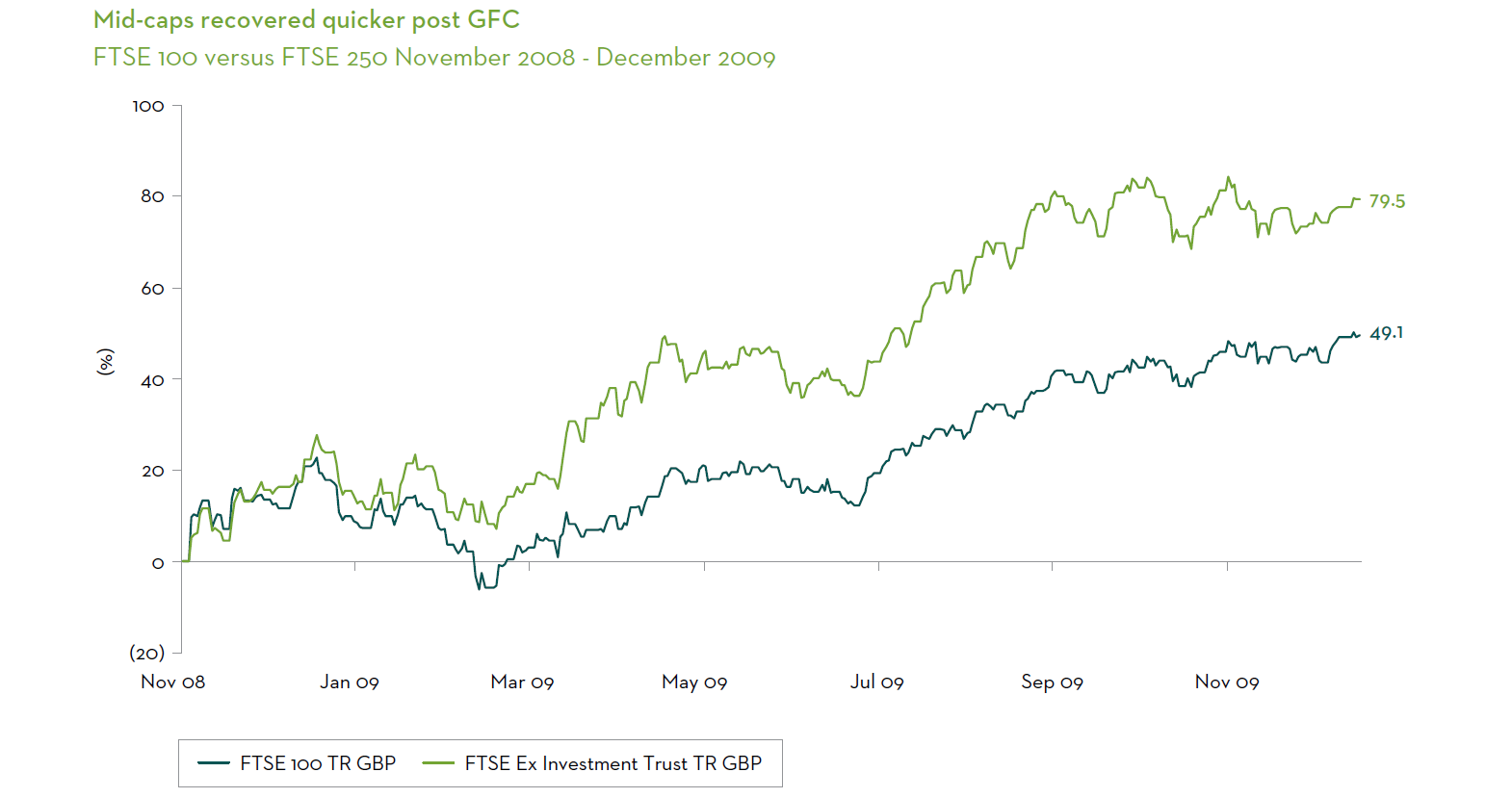

The GFC saw further losses as rates were cut, markets fell and the FTSE 100 was down 43%. The FTSE 250 was worst affected down 48% over the whole period. But, this doesn’t show the whole picture3. If we look at the chart below, the FTSE 250 recovered earlier, hitting the market low in November 2008, and recovering quicker than the FTSE 100 in the subsequent 12 months.

So, in periods of economic stress, we believe it is time to start looking at UK mid-caps.

Source: Morningstar. Returns shown from 21 November 2008, this was the market low for the FTSE 250 following the GFC. Performance of FTSE 100 and FTSE 250 (ex-Investment Trust) shown. Performance in £.

Source: Morningstar. Returns shown from 21 November 2008, this was the market low for the FTSE 250 following the GFC. Performance of FTSE 100 and FTSE 250 (ex-Investment Trust) shown. Performance in £.

Mid-caps have led in the recovery

After the dust settles, what is next?

What happened in the year after these rate cuts had ended? UK equities made positive returns. The post GFC wild ride saw increases of 60% + for all the indices, but mid-caps were once again the winner with a 71% total return.

Life was a little more sedate in 2003-04 when the FTSE 100 rose by 13%. But again the more growth orientated FTSE 250, consisting companies with greater exposure to the domestic economy was arguably better positioned into the recovery: and it returned 23%.

30 years ago, in 1994-95 is the only time when the FTSE 250 does not keep its crown despite returning a respectable 7.5%. The FTSE 100 produced its only gold medal finish, a podium topping return of 21%.

Active management can help navigate volatility

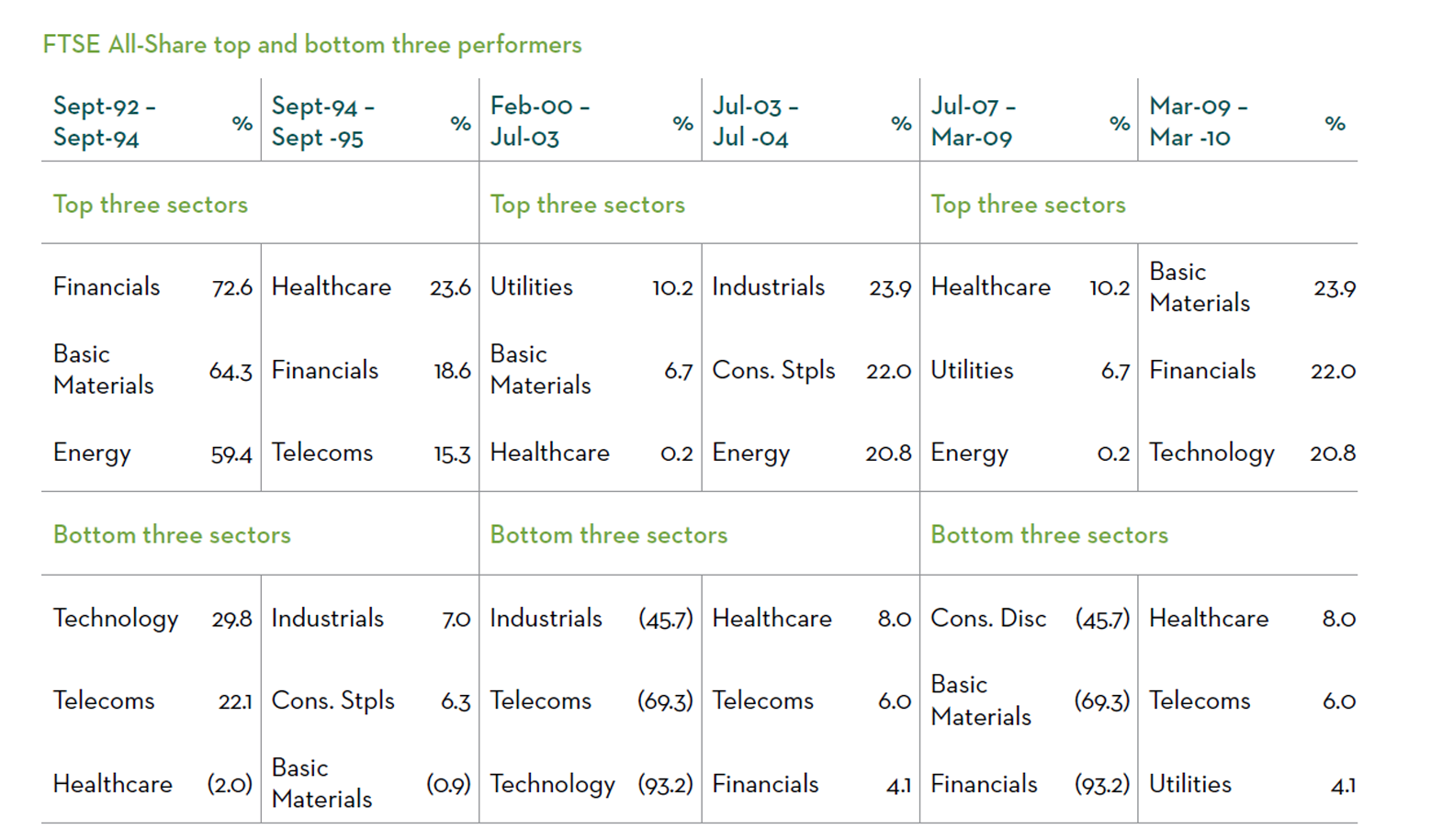

We’ve made the case that when BoE is cutting rates is the time to consider investing in UK mid-caps, but investors need to be aware of significant sector rotations and volatility.

It is during these periods of strain and volatility when active management can help.

For example, in the 1992-94 period, healthcare went from worst to best in the subsequent recovery. The opposite was true for basic materials. In wake of the ‘dot.bust’, industrials went from being from one of the weakest sectors to leaders. Likewise, in the GFC, Healthcare and Utilities were relatively the strongest, but became the worst performers in the recovery, while financials and basic materials powered back to the top (please see appendix).

When economic conditions change, it can lead to a changeable market backdrop. An active approach focused on the companies themselves can capture the potential of the mid-cap space – and limit exposure to weaker performing areas to help navigate the volatility. While limiting exposure to weaker performing areas to help navigate the volatility.

When economic conditions change, it can lead to a changeable market backdrop. An active approach focused on the companies themselves can capture the potential of the mid-cap space. While limiting exposure to weaker performing areas to help navigate the volatility.

Is there a sea change coming for UK Equities as we enter a period of sustained rate decreases? Mid-caps have been overlooked, so is this time to consider looking at the FTSE 250?

Appendix

All change at the top

Source: Morningstar over periods shown. Performance of FTSE All-Share sectors shown. Performance in £.

Source: Morningstar over periods shown. Performance of FTSE All-Share sectors shown. Performance in £.

Sources

1Source: Bloomberg as at September 2022. An inverted yield curve shows that long-term interest rates are less than short-term interest rates. Sometimes referred to as a negative yield curve, the inverted curve has proven in the past to be a reliable indicator of a recession.

2Source: Morningstar. Periods shown are 17/09/1992 - 16/09/1994, 10/02/2000 - 10/07/2003 and 05/07/2009 - 05/03/2009.

*References to FTSE 250 throughout the remainder of the document is to the ex- Investment Trust index.

3Source: Morningstar, 17/06/1994 – 16/09/1995, 11/07/2003 – 10/07/2004 and 06/03/2009 – 05/03/2010. Performance of FTSE 100, FTSE All-Share, FTSE 250 (ex-Investment Trust) shown.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.’