Content navigation

Key Takeaways

- The UK consumer is in a stronger position than most realise and are primed to spend

- Brands holding an emotional connection can create a strong competitive advantage for companies

![]()

The UK Consumer

Is the UK consumer ready to get spending? The cost-of-living crisis has certainly placed a significant strain on UK households, but after a challenging period, the situation seems to be improving. Inflation has been reined in, allowing for the return of real wage growth, and despite a dip during the peak inflation period, savings levels are still higher than 30-year averages. With a new government potentially heralding political stability and expected rate cuts, it's no surprise that consumer confidence is rebounding sharply. While UK consumers may not be rushing to open their wallets, it's 2024 after all, they do seem ready to tap their cards, tap their mobiles and are primed for more online purchases.

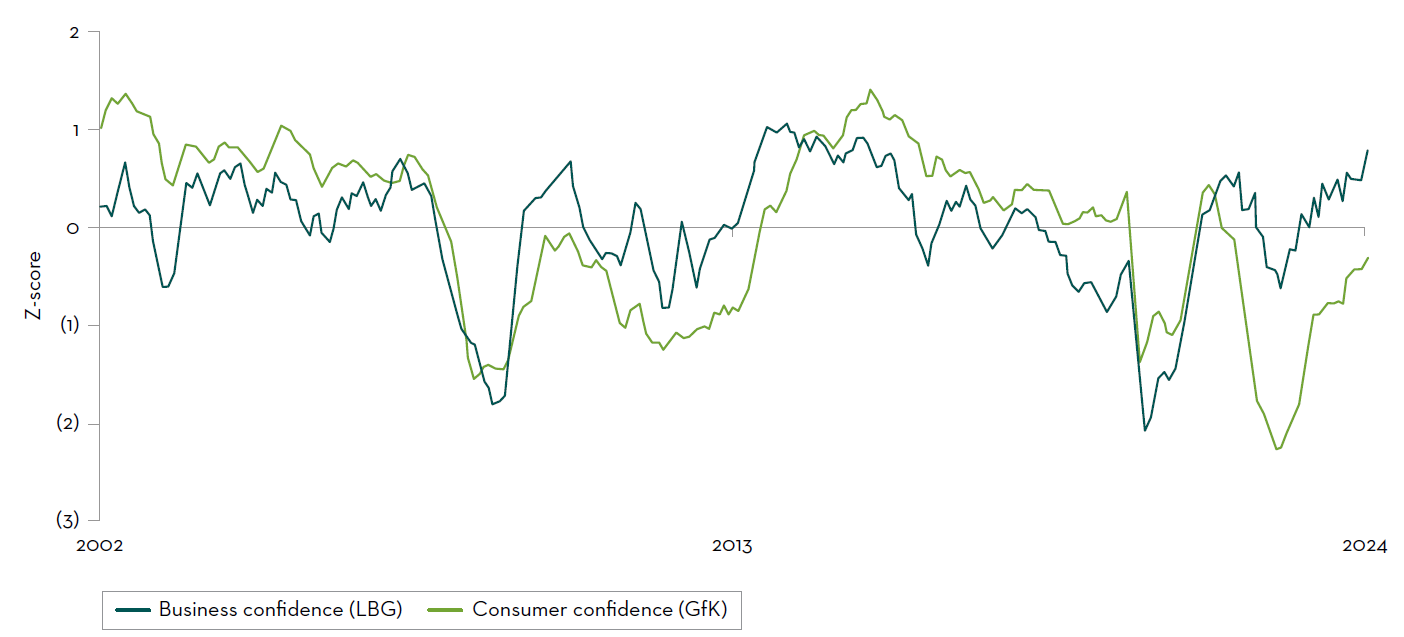

UK economy - confidence on the up

Source: Panmure, as of 31 May 2024.

-

With a new government potentially heralding political stability and the Bank of England beginning to cut rates, it's no surprise that consumer confidence is rebounding sharply.

Brands are big business

The importance of branding is undeniable. Collectively, the world's top hundred brands hold an incredible value of $8.3 trillion1. While it might seem easy to overlook something that isn't physically tangible, a company's commitment to nurturing its brand can greatly influence its success.

A brand earns its worth from the emotional bond it develops with consumers, which could range from trust and familiarity to aspiration. The true measure of a brand's value lies in the rapport it has established. Data shows that 89% of consumers stay loyal to brands that share their values, while 77% are more likely to buy from a brand they follow on social media2. When a brand successfully connects with consumers, it gains a significant edge over competitors, creating a powerful advantage, one that a business must carefully maintain and can harness to its benefit.

Our analysis has pinpointed a number of UK small cap companies that exemplify our investment theme in consumer brands.

Resilient business models earn customer loyalty

Package holiday operator Jet2 has become the number one provider in the UK market, overtaking TUI in recent years with a licence covering 6.7 million holidays versus TUI on 5.9 million3. The firm continues its rapid growth having sold 2.27 million packages in 2017 and more than doubling those figures six years later4. Additionally, the company has been ranked the highest-package holiday provider and airline company according to the most recent UK Consumer Satisfaction Index and recently won travel brand of the year at this year’s Which? awards. This continues their streak of three consecutive wins5.

The brand equity has been built over many years but was enhanced during the Covid-19 pandemic when a conservative balance sheet (stemming from the ethos of the business as well as the owner/operator structure with recently retired Chairman Phillip Meeson owning over 17% of the company) enabled Jet2 to quickly process customer refunds. Over £1 billion in advance deposits for cancelled and delayed holidays were quickly and efficiently refunded to customers6, unlike many of its peers.

The company’s ‘customer first’ strategy has earned the Jet2 brand a degree of customer trust, especially in times of uncertainty. We believe that customers partner with the operators they know they can trust and who offer them the best value for money in such times. A holiday is a significant expense and an experience that customers value; when looking for their next booking they will remember the companies that treated them well and those that did not. This brand loyalty and operational excellence supports our belief that Jet2 will take further market share and enhance its competitive position.

Local community focus proves national success

Loungers is a substantial and growing operator in the UK hospitality sector. Founded in Bristol in 2002, the group operates from 262 sites as of May 2024 under three distinct brands of “Lounge” bars, “Cosy Club” and “Brightside”. While each of the 226 “Lounge” bars has a different name and look on the outside to feel like an independent operation, those that have visited the neighbourhood café-bar in the past will recognise the nationwide menu and familiar décor once inside. The business provides great value-for-money with an all-day operating model where the coffee and breakfast offer is just as strong as the dinner menu and evening cocktails list. The company has created a concept and local brand that differentiates from competition and appeals to a wide range of customers regardless of age, demographic or gender.

If there isn’t a Lounge near you, there may be one soon as the company plans to open 30 more this financial year and believes there is potential for over 600 sites, giving a long runway to growth. The groups other brands are “Cosy Club” which is a more city centre and evening focus offering while the recently launched third brand “Brightside” is in trial phase and provides a nostalgic roadside restaurant experience. New sites have proven to generate excellent cash returns which fuel the investment into the rollout of new sites with the existing estate consistently out-performing the sector with like for like sales averaging over 5% from 2015-2023.7

Brand power in fast-moving consumer goods

PZ Cussons is a fast-moving consumer goods (FMCG) business which owns well-loved brands in the UK such as Carex, Child’s Farm, Original Source and St. Tropez. PZ Cussons is also active in international markets with brands such as Morning Fresh, Premier and Cussons Baby. The company had faced severe headwinds in recent years due to rampant cost inflation and the devaluation of the Nigerian Naira which is a large market for the group. A new management team joined three years ago, and the business is maintaining a focus on the health, beauty and baby categories whilst disposing of other product groups and non-core business activities. There is still further to go here to unlock value for shareholders, but by focussing on its much-loved brands, PZ Cussons has been able to navigate the material increase in costs driven by inflation in raw materials, freight and wage costs with some success. Despite material cost input inflation, gross margins have grown over the past few years driven by pricing and mix benefits and demonstrating impressive pricing power.

Management’s existing strategy is boosting brand investment which has dampened profitability in the short term, but we believe will be key to driving longer-term returns. This is also evidenced by the significant ESG progress made in terms of plastic reduction, palm oil sourcing and a target to achieve B-Corporation* status by 2026. The investment in the brands should see the company improve its operating margins towards larger listed FMCG peers after many years of under-investment.

Putting consumer first

Our investment process is focussed on researching and identifying the most promising businesses in the UK smaller companies investment universe. Our overarching philosophy is centred on quality with respect to a company’s business model, management team, financials, and competitive position. We believe that a strong consumer brand helps a company to stay ahead of the competition, protect pricing and margins, and fuels growth which can contribute to significant total shareholder returns over a long-term investment horizon.

*Certified B Corporations are businesses that meet the highest standards of verified social and environmental performance, public transparency and legal accountability to balance profit and purpose.

-

UK's economic recovery gathers momentum

UK economic conditions are in good health, supported by lower inflation, rate cuts, and a stable political environment. Find out more in our UK quarterly Macro update.

Sources

1 Source: Kantar & Statista as at June 2024.

2 Source: Renderforest as at 21 February 2024.

3 Source: Travel Weekly as at 2 October 2023. Jet2holidays continues Atol growth as September renewals confirmed. https://travelweekly.co.uk/news/tour-operators/jet2holidays-continues-atol-growth-as-september-renewals-confirmed

4 Source: The Telegraph as at 19 February 2023. The unstoppable rise of Jet2, from tiny airline to Britains’s biggest tour operator.

5 Source: Manchester Evening News at at 22 May 2024. Jet2.com and Jet2hoildats named Travel Brand of the Year by Which?.

6 Source: Travel Weekly as at 7 December 2020. Jet2 refunds £1 billion since start of pandemic in March

7 Source: Loungers as at 9 July 2024 unless otherwise stated. https://loungers.co.uk/

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.’