Content navigation

Key Takeaways

- The rise of influencers and content creators has led to a seismic shift in brand and advertiser behaviour

- Owning the intellectual property (IP) of strong book franchises can ensure repeat business through TV and film series additions

- Advertisers are increasingly partnering with digital media firms to better engage with more diverse demographics

![]()

Digital infrastructure is shifting content consumption

Speed of access to information through digital infrastructure has resulted in content being increasingly important in our economic and social activities. Indeed, it feels difficult to walk down the street these days without being bumped into by someone staring at their mobile phone, transfixed by a screen.

The way that we access news and content has evolved significantly over the last two decades. Once considered the principal medium for accessing facts, opinions and analysis, newspapers have been subjected to a shift in consumer habits, culminating in a dramatic reduction in readers. With their declining numbers of customers, advertising spend has shifted to other mediums.

The growth of influencers and content creators

In 2007, news media advertising – magazines and newspapers combined – was worth £7.1 billion in the UK, or 39% of the £17 billion total UK advertising spend. In 2022, all national, regional and magazine titles combined made around £2 billion in advertising revenues (print and online) out of the total £35 billion UK advertising spend. This was less than a fifth of what they received in 2007. They’ve gone from taking 39% to a 6% share of the total1.

Brands are needing to adapt to changing media consumption habits like the rise of content creators and influencers. According to Influencer Marketing Hub, the influencer marketing industry is expected to grow to over £17 billion in 2023, with TikTok being the most popular influencer channel2.

With the rise in influencers and vloggers it is estimated there are now over 40 million people globally that regularly create content for social media platforms and look to monetise that content3. To compete in this environment, content producers are increasing their spend on advanced recording equipment to create and monetise unique content.

-

Content creators are now adopting unprecedented techniques to expand their reach and penetrate the emerging generation of media consumers.

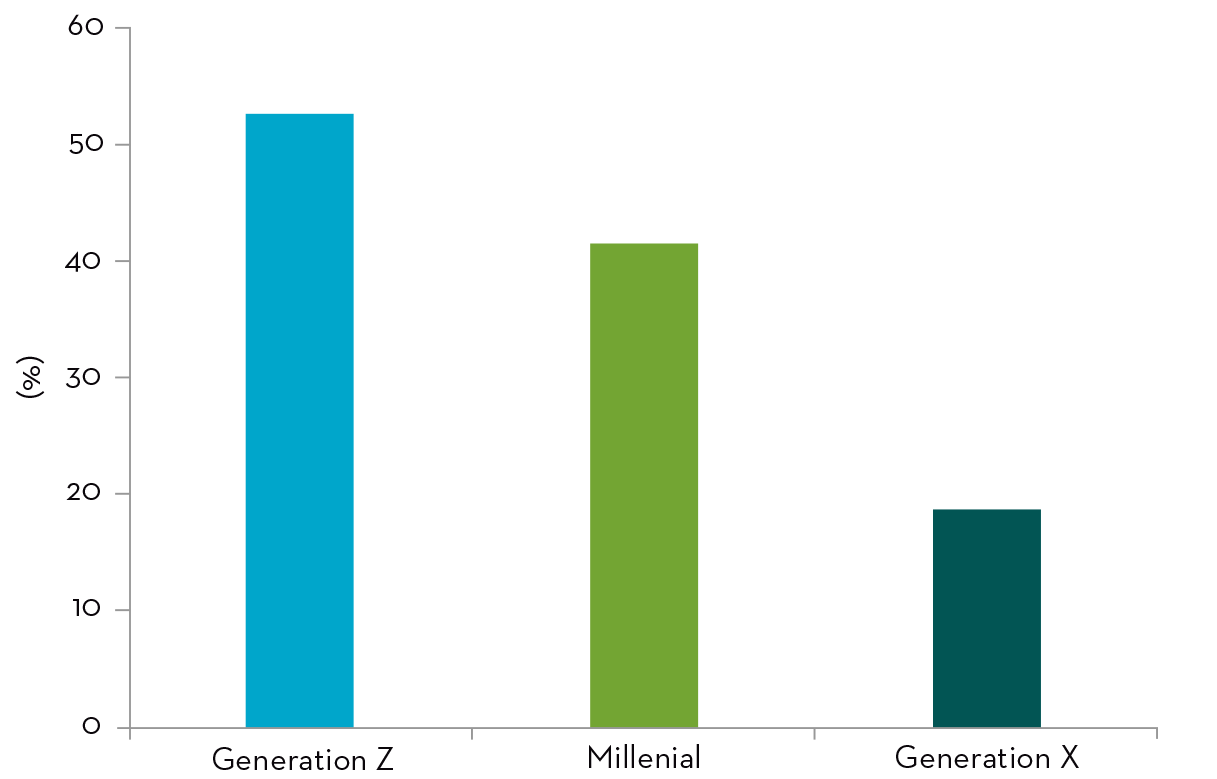

Share of consumers whose buying decisions were influenced by social media influencers in the UK in 2022, by generational cohort

Brands are needing to adapt to changing media consumption habits like the rise of content creators and influencers.

Source: Statista and Deloitte, November 2022.

Media companies around the world are also spending more on content as they look to compete for subscribers. Ten years ago, Netflix spent US$3 billion on content, this year it will spend US$17 billion4. With competition from Disney+, Amazon Prime, Apple TV, Hulu, Peacock, HBO Max etc., the total amount being spent on content is increasing each year and media companies are looking to bring popular intellectual property to the screen.

For instance, despite Harry Potter being first published over 20 years ago, HBO Max and Discovery+ have announced that a decade long series is being produced diving deep into the stories from the original books.

Below we highlight some portfolio companies which are benefitting from this shift in media consumption.

Enduring Intellectual Property

Bloomsbury Publishing is home to very strong IP. These include the publishing rights to Harry Potter, which still features in the top ten sellers of children books, and bestselling ‘romantasy’ author, Sarah J. Maas.

Bloomsbury has published 16 of Maas’s novels since 2012 and has six more under contract. Sales grew by 51% in the last financial year and hashtag views on TikTok relating to her name stand at over 11.5 billion5.

The subculture of “BookTok” on TikTok has allowed followers to find numerous book recommendations, reviews, reactions, and other fan content. With Maas being a particularly popular author.

When her latest book was released in January 2024, some bookstores opened at midnight to facilitate the demand for the new book. In its first week on sale, the book went to number one globally on Amazon (inc. US, UK, Australia, France, Sweden and Spain).

Other books by the author occupied five of the top 10 best sellers slots and she had nine books in the top 20 – the books continue to sell, but the latest release has triggered readers to buy the back catalogue.

TV series and films driving repeat business

Bloomsbury’s authors demonstrate the enduring quality of their IP, driving repeat customers year after year with new audiences discovering the back catalogue of titles and engaging in new formats such as e-book or audiobooks.

TV series and films based on their author’s work inevitably drive higher book sales as seen through the life of the Harry Potter franchise. The company has announced that another author, Cixin Liu, is soon to have a Netflix release based on his “Three Body Problem” series and there have been reports that streaming service Hulu has signed a deal to make a series based on Maas’s work.

The company has also expanded to distribute content through new mediums in recent years. For example, the Bloomsbury Digital Resources division, which sells access to digital content from academic institutions and schools globally in areas such as Fashion and Drama. This provides annual subscription revenues and is higher margin than traditional publishing.

Equipping content creators

Videndum (formerly Vitec Group) is a provider of equipment and services that enable the creation of innovative and unique content. Videndum manufactures and distributes equipment such as filming and monitoring apparatus, tripods, batteries, lighting panels, audio kits, camera accessories and streaming solutions.

The online content creation market is thriving, driven by the growth in e-commerce and need for better product presentation. This shift in consumer habits backed by expanded advertising on social media platforms has resulted in a surge in vlogger and influencer activity.

Therefore, the requirement for sophisticated and professional equipment to produce content is becoming increasingly evident. Videndum also benefits from the growth of other areas such as subscription television, driven by large budgets from the likes of Netflix, Amazon, and Disney.

The company had a very challenging 2023 with the unprecedented length of the Hollywood actors and writers strikes effectively shutting down one of its largest end markets.

As we look to 2024, we believe there will be an element of catch-up spend from delayed projects in 2023. This, combined with the US Presidential elections and the Olympics, provides a solid backdrop for Videndum in 2024.

Expanding reach to target demographic

LBG Media is a leading multi-channel digital content youth publisher operating under ten different brands. These include LadBible, UniLad, SportBible, Gaming Bible, Tyla and FoodBible.

With 410 million followers across its social media channels, the company is established as the industry leader with respect to reaching the 18-to 34-year-old demographic in the UK and increasingly internationally6

The cultural and societal shift in recent decades has rendered traditional advertising methods less effective. A more viable marketing solution now is to collaborate with digital partners like LBG Media, which operate in the fastest growing segments of social video and content marketing.

The scale and importance of its reach was reinforced by UK Prime Minister Rishi Sunak exclusively launching new Government policy on banning disposable vapes on LadBible with a 45 second video.

Accessibility and demand for content increases

Amongst teenagers, the most popular source for news is Instagram, followed by YouTube and TikTok. LBG Media taps into this trend by creating and distributing over 250 pieces of content per day across its channels.

The company analyses audience engagement with the content in real time7. This ensures that the content is relevant, entertaining, and engaging on specific topics of interest. This prompted its audience to view published content 67 billion times in the first six months of 20236.

The company is also looking to drive growth in the largest advertising market in the world, North America, with the recent acquisition of Betches Media. This acquisition adds 32 million highly engaged followers of which about 86% are women8.

LBG Media is considered an established route for brand owners and marketing agencies to interact with end customers. Audiences are constantly demanding new content and the adoption of 5G networks will only add to the accessibility and demand for video content. As users are equipped to download more video content swiftly and efficiently, we believe that growth will continue.

Emerging trends impacting the success of business models

Structural societal forces are incredibly powerful and often irreversible. Whilst we continue to construct our portfolio on a bottom-up and fundamental basis, we must acknowledge that emerging trends will benefit certain business models. By identifying influential themes such as the growth of content creation and value of strong IP, we can identify businesses that could benefit from these structural tailwinds over the long term.

Sources

1Source: Press Gazette as at 15 February 2024. Colossal decline of UK regional media since 2007 revealed. https://pressgazette.co.uk/publishers/regional-newspapers/colossal-decline-of-uk-regional-media-since-2007-revealed/

2Source: BBC as at 19 October 2023. Are influencer partnerships the inevitable future of business? https://www.bbc.com/worklife/article/20231013-are-influencer-partnerships-the-inevitable-future-of-business

3Source: Videndum company presentationas at December 2022. Enabling the capture and sharing of exceptional content. https://videndum.com/media/3905/videndum-introduction-december-2022.pdf

4Source: Redshark as at 10 February 2024. Streaming wars: Content is king, but kings cost money. https://www.redsharknews.com/streaming-wars-content-is-king-but-kings-cost-money

5Source: The Guardian as at 4 June 2023. The Guardian view on Bloomsbury’s success: publishing wizardry. https://www.theguardian.com/commentisfree/2023/jun/04/the-guardian-view-on-bloomsburys-success-publishing-wizardry

6Source: LBG Media plc as at 30 June 2023. https://lbgmedia.co.uk/docs/ladbiblelibraries/archive/results/interim-results---june-2023.pdf

7Source: Ofcom as at 20 July 2023. Light-hearted news on social media drawing Gen Z away from traditional sources.https://www.ofcom.org.uk/news-centre/2023/light-hearted-news-social-media-drawing-gen-z#:~:text=Social%20media%20platforms%20dominate%20the,feature%20in%20their%20top%20five

8Source: LBG Media plc as at 18 October 2023. https://lbgmedia.co.uk/docs/ladbiblelibraries/archive/news/october-2023-acquisition-of-betches-media-llc.pdf

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.’