Content navigation

Reflections on 2024

The past year has been a positive one for global equities. US markets continued their leadership, while emerging markets outpaced developed international markets.

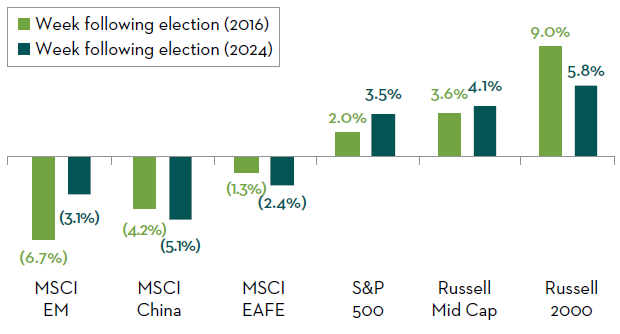

For most of the year, EM was among the best performing asset classes – driven positively by information technology (IT) stocks and China, which rallied following coordinated stimulus announcements. However, in the fourth quarter, EM faced headwinds coinciding with the election of Donald Trump as the next US president. Investors braced for import tariffs, US tax cuts, and other policies that are expected to favour domestic-oriented US companies. As a result, bond yields rose, the US dollar strengthened, US small-cap stocks rallied, and non-US equities declined.

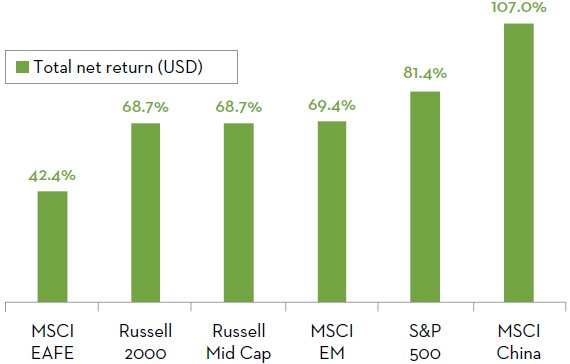

The market’s initial reaction appears strikingly similar to the period following Trump’s 2016 win (see chart below). It’s important to note though that many of these trends reversed course during Trump’s first term – bond yields fell, the US dollar weakened, and US large-cap bested small-cap. Importantly, EM performed strongly, and China outperformed the US with a total return of over 100% during that time (versus the S&P’s return of 81%).

Performance of global equities following US election (2016 and 2024)

Source: Morningstar as at 9 December 2024. Market returns for Donald Trump’s presidency: 20 January 2017 to 19 January 2021.

Performance during Trump Presidency

Source: Morningstar as at 22 November 2024.

While we acknowledge that the political conditions and economic cycle are different this term, we also do not expect the market’s recent pessimism to persist. In fact, we believe that EM is well positioned to benefit in both the near and long term, as we discuss in this piece. As we look to 2025 and beyond, we believe long-term, structural opportunities persist in EM especially within China, India, and the IT sector.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be

issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.