Content navigation

German elections this weekend will be an important focal point for markets. We do not expect any major surprises, and would expect a coalition government to be formed, made up of the Christian Democrat Union/Christian Social Union (CDU/CSU) and Social Democratic Party of Germany (SPD) parties, with Friedrich Merz as Chancellor.

The critical aspect to watch out for is the momentum of the far-right Alternative for Germany (AfD) party, although we do not expect that party to be welcome into any coalition talk. It might take weeks to form a coalition government, which is customary in German elections. The more important aspect will be to assess how the new Chancellor will be tackling the various challenges, both domestically, and internationally.

Domestically, the new government will be facing an economy in recession or quasi-recession since 2023. With industrial production growth contracting for four years in a row, a business climate Institute for Economic Research (IFO) survey at lower levels than during the Covid crisis, and at levels last seen during the Global Financial Crisis of 2008-09.

Internationally, the challenges of an uncertain dynamic on tariffs, growing trade tensions, ongoing geopolitical risks inside Europe and outside. Not to mention an important ceasefire negotiation between Ukraine and Russia on which Europe is not actively involved, the question of increased defence spending, and securing stable access to energy supplies, will all be on the radar to tackle rapidly.

The elections could however lift yet another geopolitical uncertainty for Europe, which could further shed light on the relative attraction of European equities, even if other uncertainties will still linger, notably related to tariffs and trade tensions with the US.

-

Depending on the results, the coalition might have to be made up of more than two parties, to get over the 50% mark, with additional smaller parties potentially playing an important role.

Coalition of centre-right most likely, with Friedrich Merz as Chancellor

German snap federal elections on 23 February will be another important focal point for investors and for Europe, even if it is not gathering much attention with investors and the market, who have been too busy grappling with the ongoing policy announcements of US President Donald Trump’s new administration. Germany, in a similar manner to other countries in Europe, is likely to shift slightly to the right. Even if it is unlikely that the AfD extreme right party, which is now second in polls, will be invited to join a coalition, as mainstream parties will likely refuse to do so.

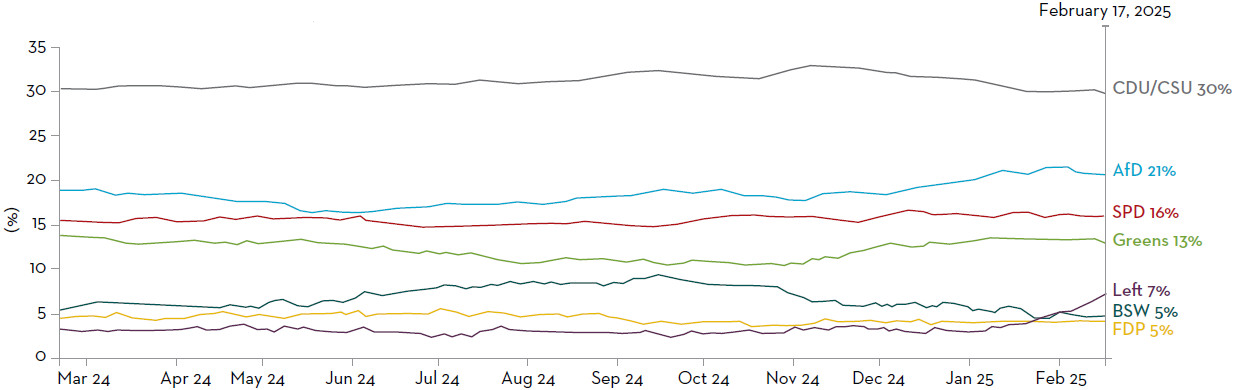

We will likely be left with a CDU/CSU-led coalition with the SPD, most likely headed by leader of the CDU/CSU and ex-BlackRock employee Friedrich Merz as Chancellor, which might be supportive for European equities. The centre-right CDU/CSU party is leading in the polls, with c.29% of voting intentions, whilst AfD is second with 21% of voting intentions, and centre-left SPD is third at 16%, leaving the Green Party in fourth position with 13% of voting intentions.

The Left is polling at 7%, with Sahra Wagenknecht Alliance (BSW) at 5% and Free Democratic Party (FDP) at 4%, with the latter two parties being uncertain to enter parliament, if they do not reach the 5% minimum share of votes.

Voting intentions - German polls

Source: Politico as at 17 February 2025.

Depending on the results, the coalition might have to be made up of more than two parties, to get over the 50% mark, with additional smaller parties potentially playing an important role. This could lead to a more difficult situation in terms of agreeing and driving policy initiatives for the new upcoming German government, once it is formed. Depending on the negotiation dynamics between various parties, forming a coalition government might take weeks, although this would be considered a normal part of the process for German elections, and therefore is unlikely to be a worrisome matter for markets, in our view. The Bloomberg analysis below shows that on average, since the 1990 elections, Germany has taken c.60+ days to form a coalition government, although this has taken longer with the last three elections.

Length of time to form German coalition governments since 1990

Source: Bloomberg as at 31 January 2025.

Wild card of an AfD-backed government is unlikely

European political elections have got us used to surprise outcomes. In this instance, the surprise outcome would be a strong enough showing by extreme-right party AfD, and a coalition government that would have that party within it. This is a very low probability event, based on the current polls, and would lead to a negative market reaction, on the basis that the market would question the long-term political future of the EU. It would be a further significant shift towards the far-right for yet another key EU member country.

Plenty to tackle for the next Chancellor both domestically and internationally

The new Chancellor will be taking over in a difficult economic environment, with the German economy being in recession for the past two years (2023 and 2024, with -0.3% and -0.2% GDP growth respectively), and expected to barely grow this year, with a consensus expectation of +0.3% GDP growth in 2025. The all-important industrial production has been contracting every year since 2022, and is expected to continue to contract in 2025, with a consensus forecast of -0.3% growth1.

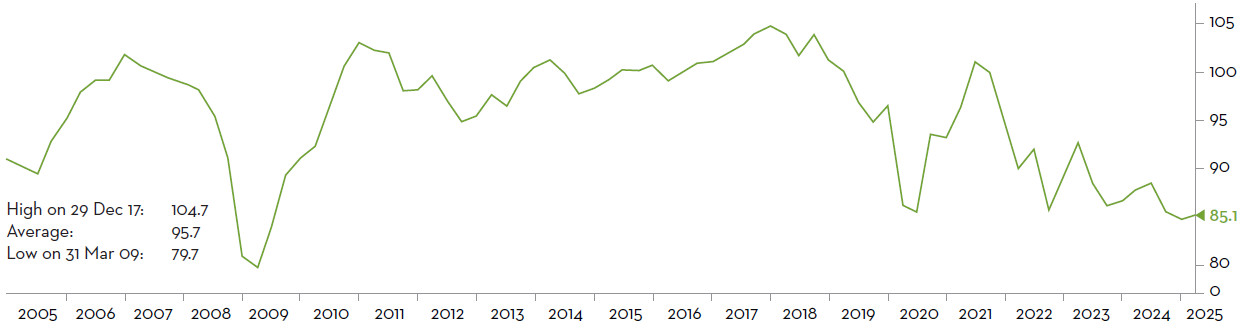

Business sentiment is also weak in Germany, with the German IFO Business Climate index reaching weaker levels than during the Covid crisis, and at levels last seen during the GFC.

IFO German business climate survey

Source: Bloomberg and IFO as at 20 February 2025.

The new German government will have plenty to tackle on the international scene, with Trump policies continuing to come through, and an ongoing backdrop of increased trade tensions. The geopolitical scene will likely also be important to tackle, with both the Ukraine/Russia ceasefire progress, the need for the EU to get involved in the negotiations to ensure the right outcome for the economic bloc, and the ongoing need to tackle energy supplies, to ensure reliable and predictable access to energy.

The most critical internal point to tackle for the German economy and for investors will be a more flexible approach to managing government spending, to bring in a better counter-cyclical flexibility. This will be an important focal point for us, as it could trigger further down the line a move towards a more centralised European budgeting, and easing of the tight budget constraints imposed by Brussels on member states.

At the moment, Germany has the lowest government debt to GDP ratio of any of the G7 countries, at c.63%, and a very low budget deficit of -2.2% of GDP in 2024. This is expected to be -2.0% in 2025, as a result of the constitutionally-embedded limitation to overspending2. The current limitations of 0.35% of GDP for structural budget deficits, which act as a debt brake, are likely too stringent, and do not allow Germany to spend on critical long-term spending related to infrastructure upgrades in particular. Merz has in the past mentioned that he would be open to look at reforming the debt brake rule.

A potential political uncertainty lifting, valuation attraction of EU equities could become more apparent

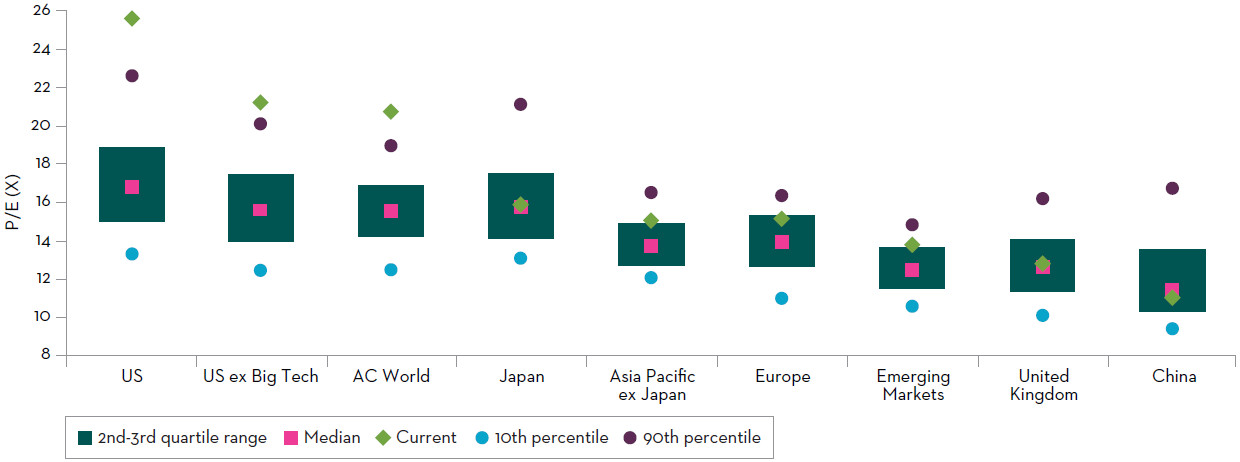

Post the formation of a new coalition government in Germany, it will lift one more political uncertainty for Europe, at least for the time being, which could further bring to the forefront the valuation attraction that European equities are currently sitting on. This is compared to the historic ranges, shown in the chart below.

Forward P/E (FY1) across regions over the last 20 years

Source: FactSet as at 31 January 2025.

This is in sharp contrast to US equity valuations, which are at historically very demanding levels, and which require a positive earnings momentum to justify. We have been arguing recently that, yes, there is US exceptionalism in terms of economic growth prospects and corporates earnings growth differential compared to Europe and emerging markets, but this exceptionalism also translates into a significantly high valuation level.

Further lifting of political and geopolitical uncertainties in Europe and in China in particular, could make these regional equity markets appear more appealing to investors who could see a potentially favourable risk reward.

Sources

1Source: Bloomberg as at 20 February 2025.

2Source: Bloomberg using consensus estimates of GDP as at 20 February 2025.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.